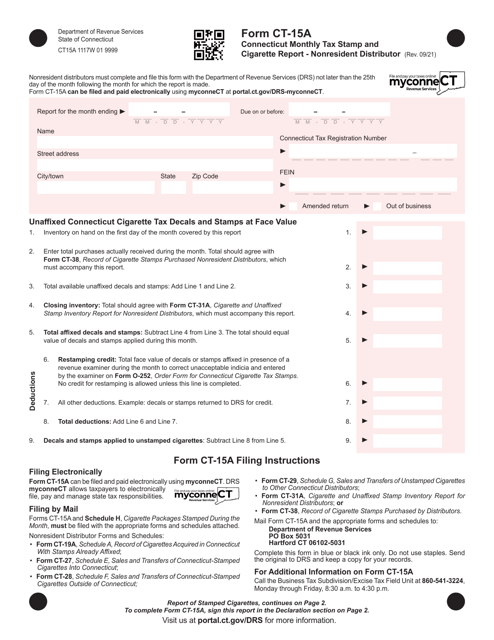

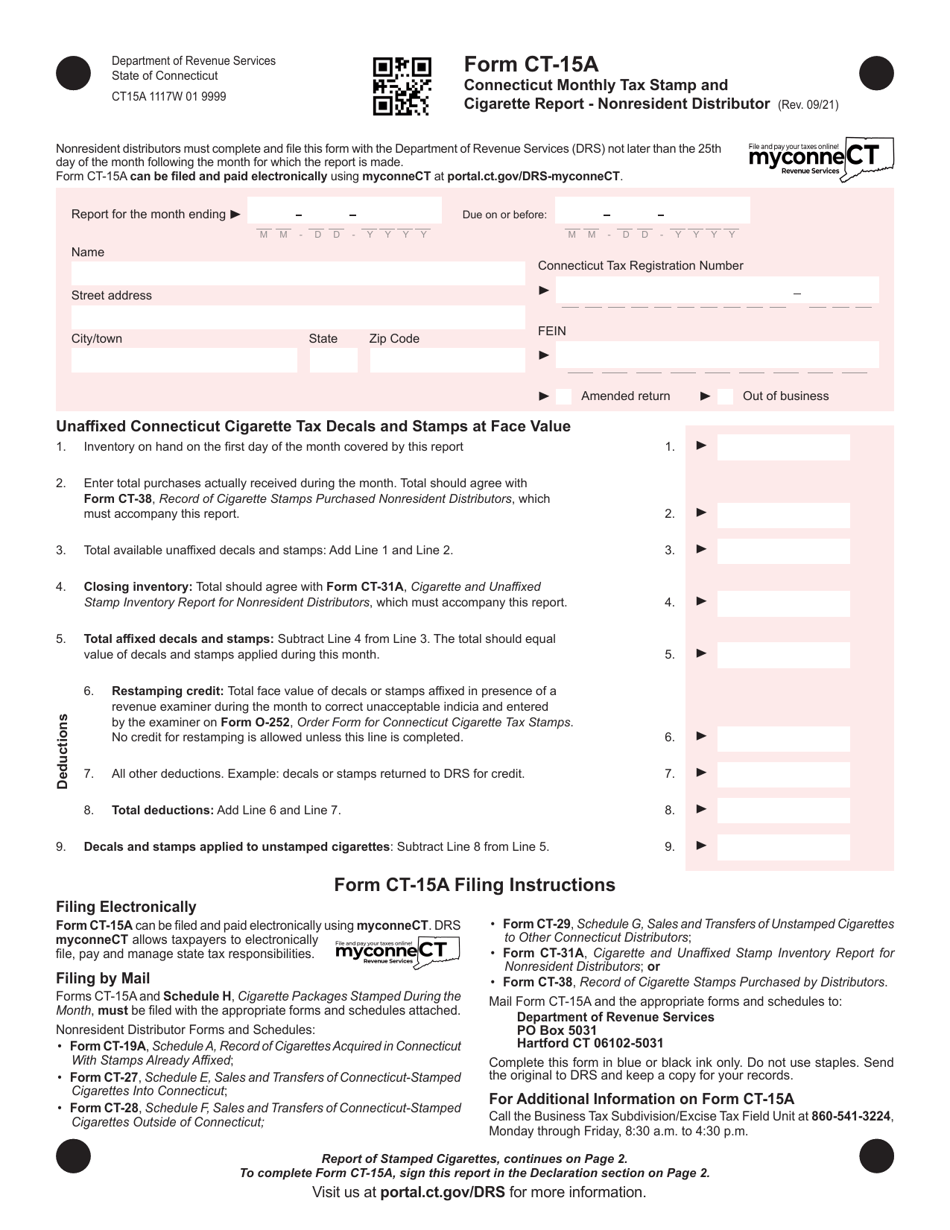

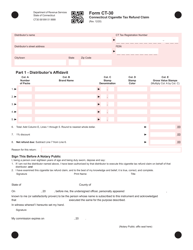

Form CT-15A Connecticut Monthly Tax Stamp and Cigarette Report - Nonresident Distributor - Connecticut

What Is Form CT-15A?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-15A?

A: Form CT-15A is the Connecticut Monthly Tax Stamp and Cigarette Report for Nonresident Distributors in Connecticut.

Q: Who needs to file Form CT-15A?

A: Nonresident distributors of cigarettes in Connecticut need to file Form CT-15A.

Q: What is the purpose of Form CT-15A?

A: The purpose of Form CT-15A is to report the monthly tax stamp and cigarette sales for nonresident distributors in Connecticut.

Q: When is Form CT-15A due?

A: Form CT-15A is due by the 10th day of the month following the reporting month.

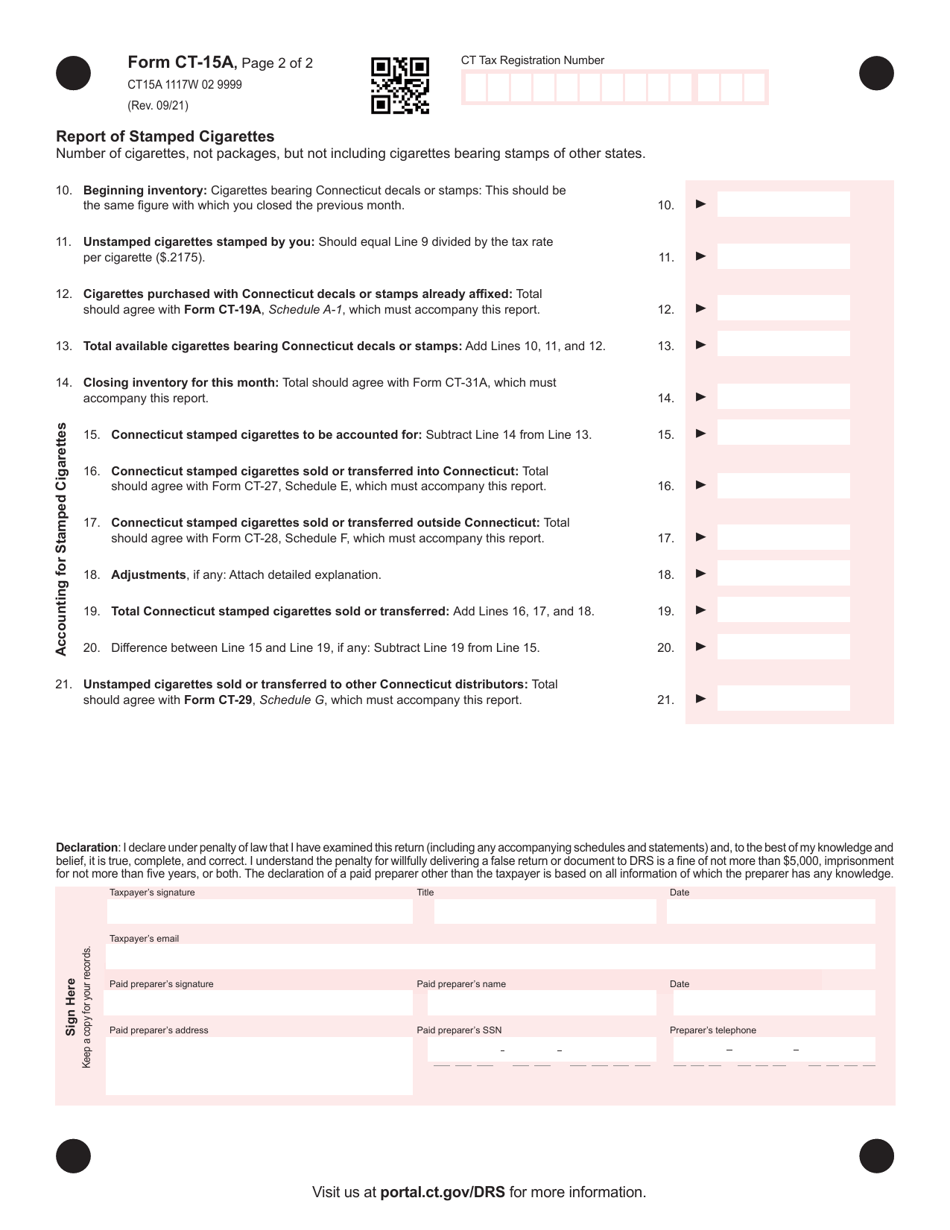

Q: What information is required on Form CT-15A?

A: Form CT-15A requires information such as total cigarette sales, number of tax stamps purchased, and any adjustments or refunds.

Q: How can Form CT-15A be filed?

A: Form CT-15A can be filed electronically through the Connecticut Department of Revenue Services.

Q: Are there any penalties for late filing of Form CT-15A?

A: Yes, there are penalties for late filing of Form CT-15A. The penalty is $100 for the first day of delinquency, and an additional $50 for each subsequent day, up to a maximum of $1,000.

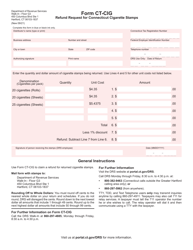

Q: Can a nonresident distributor claim a refund on Form CT-15A?

A: Yes, a nonresident distributor can claim a refund on Form CT-15A if they have overpaid the cigarette tax.

Q: What should I do if I have questions about Form CT-15A?

A: If you have questions about Form CT-15A, you should contact the Connecticut Department of Revenue Services for assistance.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-15A by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.