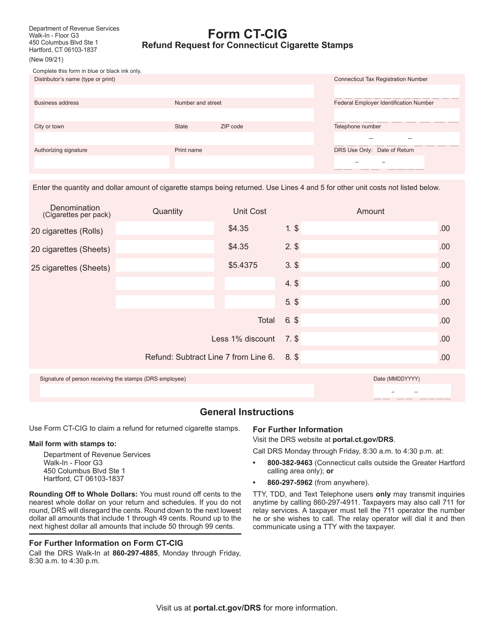

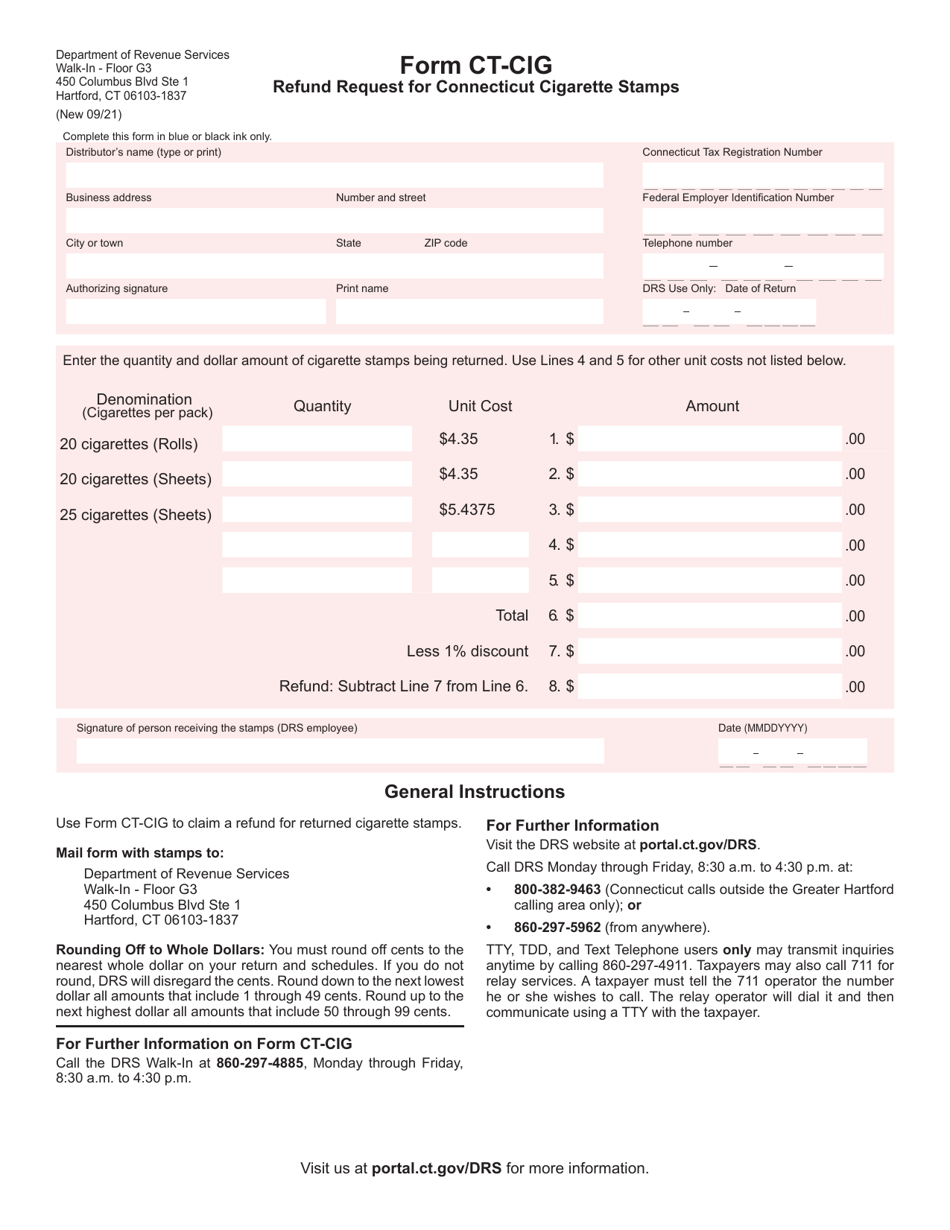

Form CT-CIG Refund Request for Connecticut Cigarette Stamps - Connecticut

What Is Form CT-CIG?

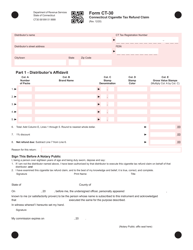

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-CIG Refund Request?

A: Form CT-CIG Refund Request is a form used to request a refund for Connecticut cigarette stamps.

Q: Who can use Form CT-CIG Refund Request?

A: Anyone who has purchased Connecticut cigarette stamps and wishes to request a refund can use this form.

Q: What information is required on Form CT-CIG Refund Request?

A: You will need to provide information such as your name, address, contact information, quantity of stamps, and reason for the refund.

Q: What is the deadline for submitting Form CT-CIG Refund Request?

A: The form should be submitted within 60 days from the date of purchase of the stamps.

Q: How long does it take to receive a refund after submitting Form CT-CIG Refund Request?

A: It may take up to 90 days to receive a refund after submitting the form.

Q: Are there any fees associated with submitting Form CT-CIG Refund Request?

A: No, there are no fees associated with submitting the form.

Q: What if I have additional questions about Form CT-CIG Refund Request?

A: If you have additional questions, you can contact the Connecticut Department of Revenue Services (DRS) for assistance.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-CIG by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.