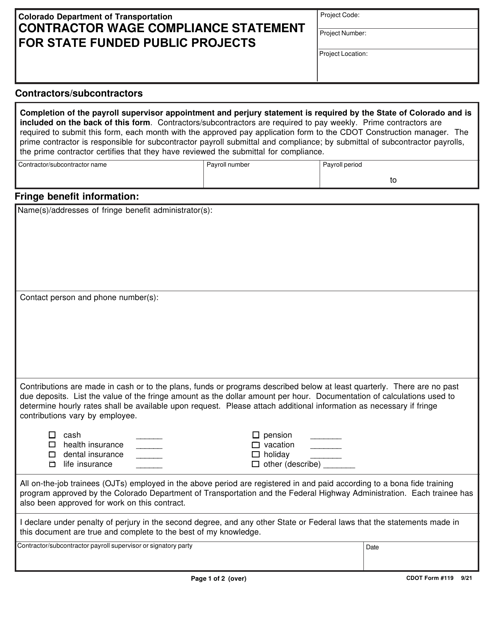

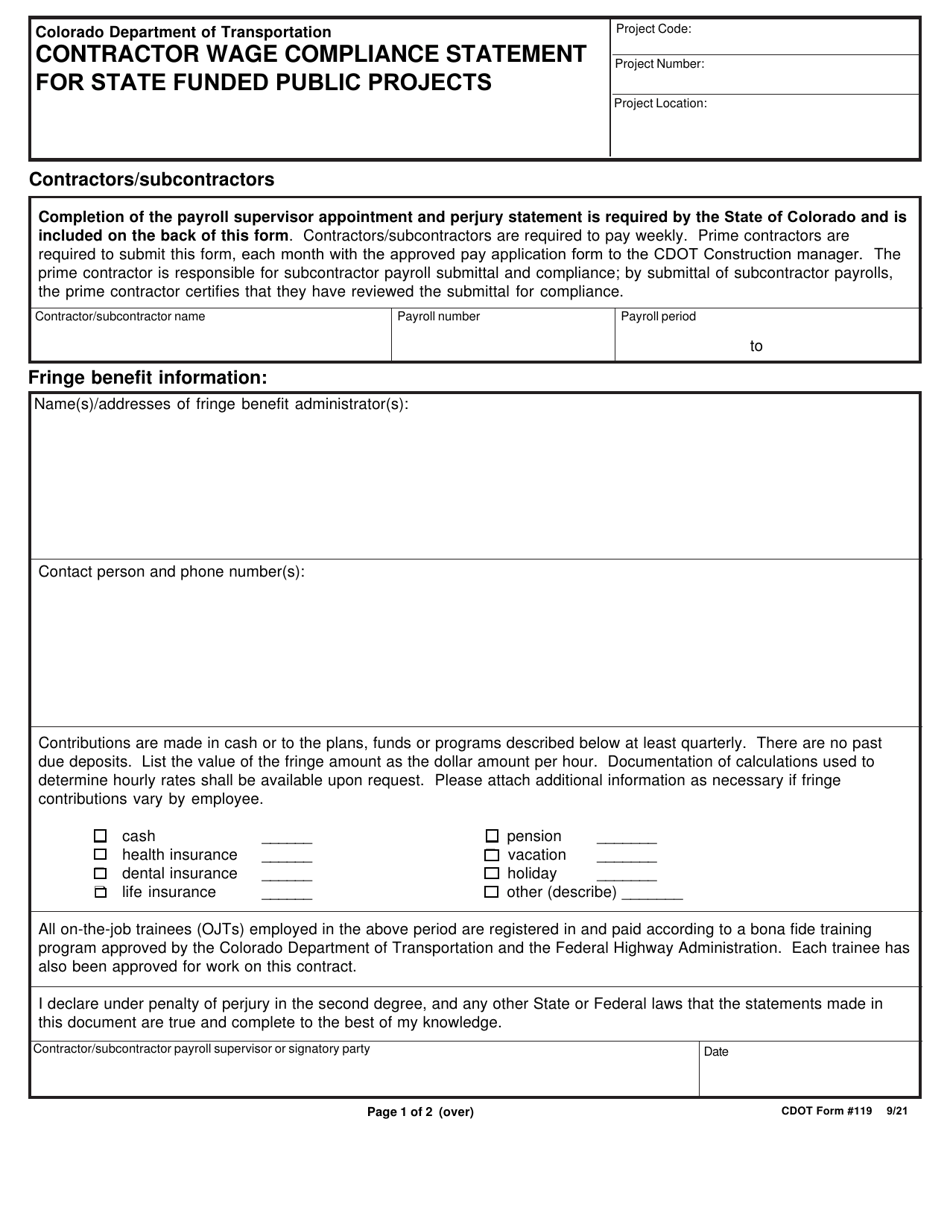

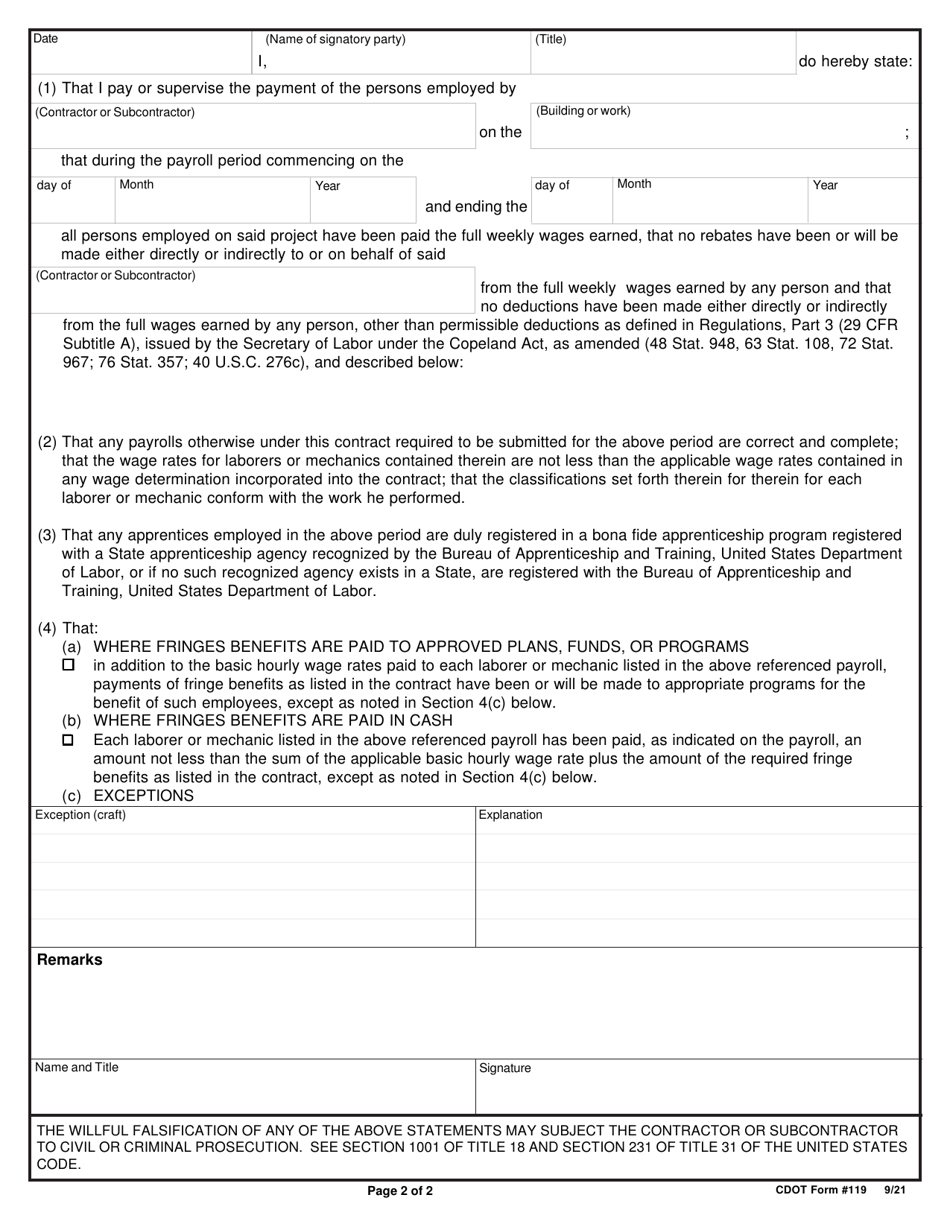

CDOT Form 119 Contractor Wage Compliance Statement for State Funded Public Projects - Colorado

What Is CDOT Form 119?

This is a legal form that was released by the Colorado Department of Transportation - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDOT Form 119?

A: CDOT Form 119 is the Contractor Wage Compliance Statement for State Funded Public Projects in Colorado.

Q: Who needs to fill out CDOT Form 119?

A: Contractors working on state fundedpublic projects in Colorado need to fill out CDOT Form 119.

Q: What is the purpose of CDOT Form 119?

A: The purpose of CDOT Form 119 is to ensure compliance with wage requirements on state funded public projects in Colorado.

Q: When should CDOT Form 119 be submitted?

A: CDOT Form 119 should be submitted prior to the commencement of work on a state funded public project in Colorado.

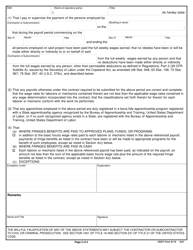

Q: What information is required on CDOT Form 119?

A: CDOT Form 119 requires information about the contractor, including their address, contact information, and compliance with wage requirements.

Q: Are there any penalties for non-compliance with CDOT Form 119?

A: Yes, there can be penalties for non-compliance with CDOT Form 119, including possible withholding of payments on the project.

Q: Can subcontractors also be required to fill out CDOT Form 119?

A: Yes, subcontractors working on state funded public projects in Colorado may also be required to fill out CDOT Form 119.

Q: Is CDOT Form 119 specific to Colorado?

A: Yes, CDOT Form 119 is specifically for state funded public projects in Colorado.

Q: Is CDOT Form 119 applicable to private projects?

A: No, CDOT Form 119 is only applicable to state funded public projects in Colorado.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Colorado Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of CDOT Form 119 by clicking the link below or browse more documents and templates provided by the Colorado Department of Transportation.