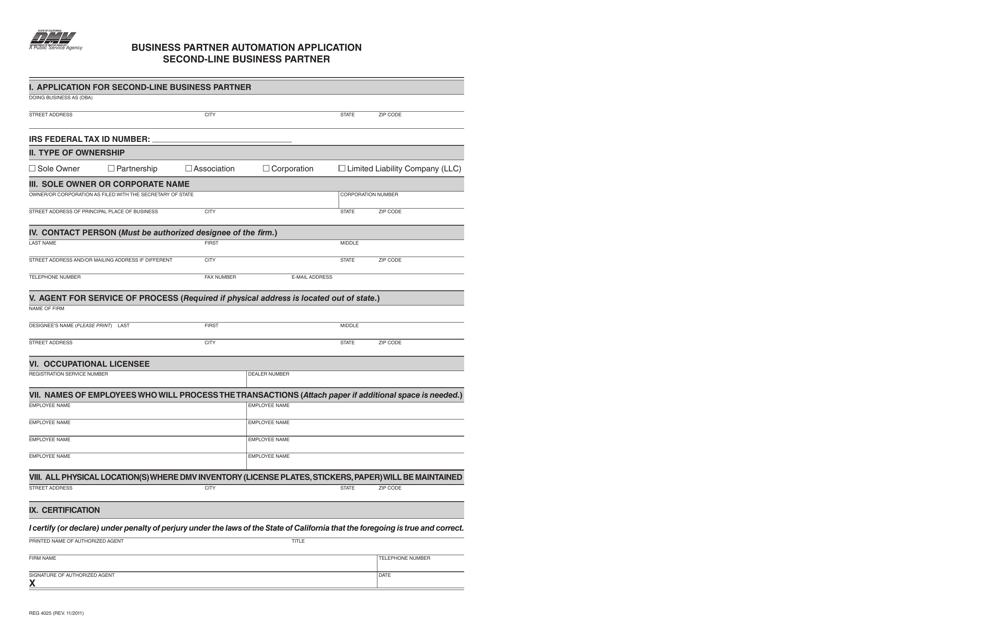

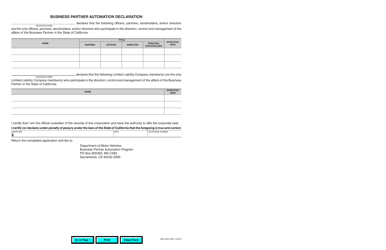

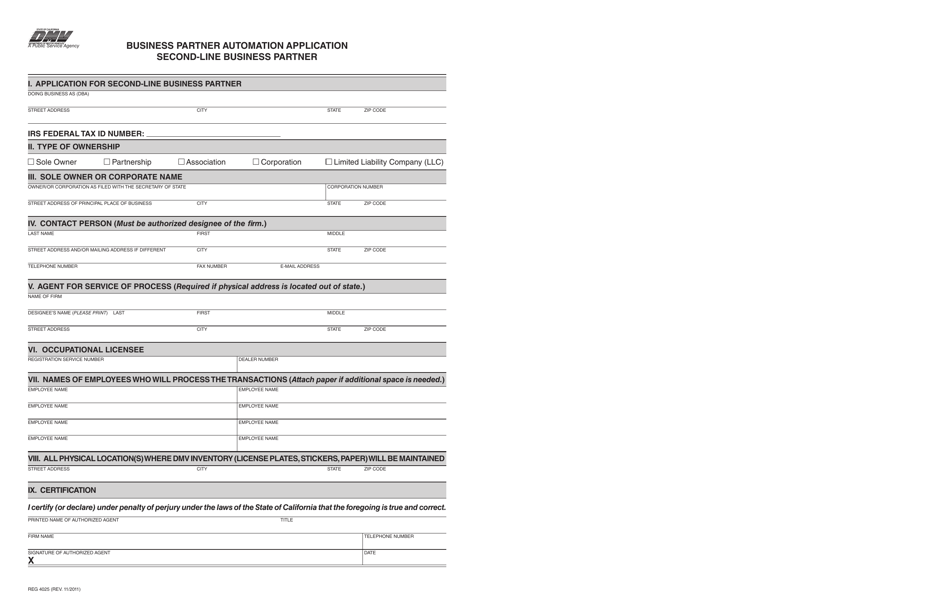

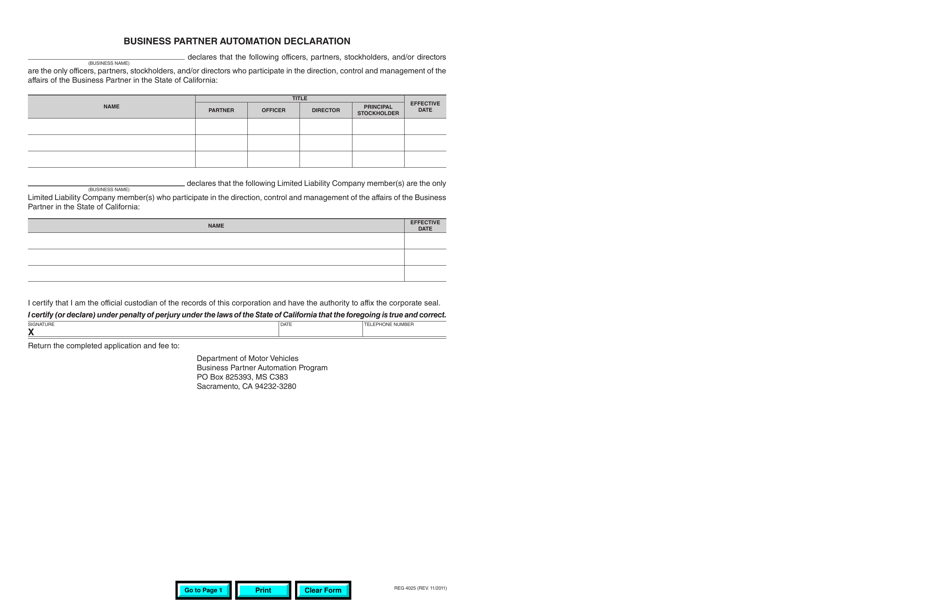

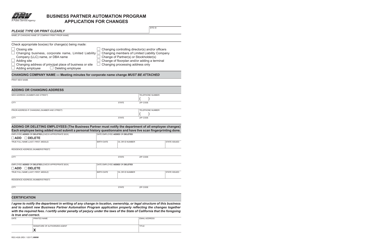

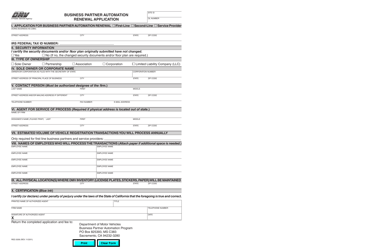

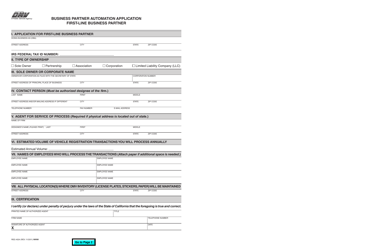

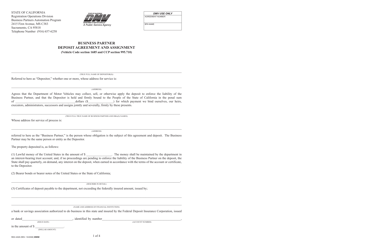

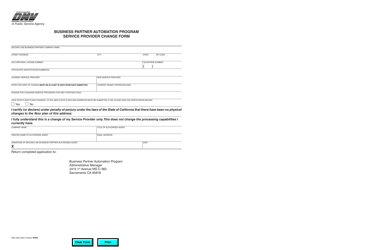

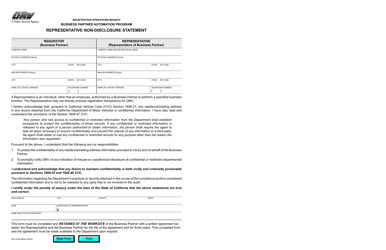

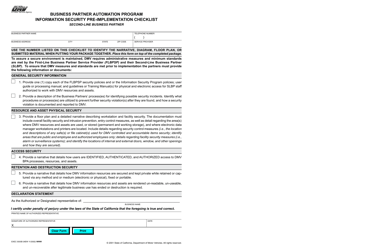

Form REG4025 Business Partner Automation Application - Second-Line Business Partner - California

What Is Form REG4025?

This is a legal form that was released by the California Department of Motor Vehicles - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG4025?

A: Form REG4025 is the Business Partner Automation Application for Second-Line Business Partner in California.

Q: What is a Second-Line Business Partner?

A: A Second-Line Business Partner is a business partner who operates under a First-Line Business Partner, typically in a distributor or franchise relationship.

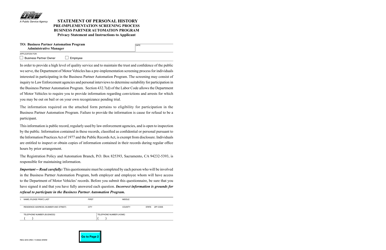

Q: Who is required to file Form REG4025?

A: Second-Line Business Partners in California are required to file Form REG4025.

Q: What is the purpose of filing Form REG4025?

A: The purpose of filing Form REG4025 is to establish and maintain accurate records of Second-Line Business Partners in California.

Q: Are there any fees associated with filing Form REG4025?

A: There are no fees associated with filing Form REG4025.

Q: When is Form REG4025 due?

A: Form REG4025 is due within 30 days of becoming a Second-Line Business Partner in California.

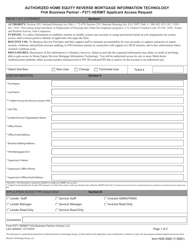

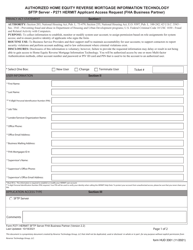

Q: What information is required on Form REG4025?

A: Form REG4025 requires information such as business name, address, taxpayer identification number, and relationship with the First-Line Business Partner.

Q: Can Form REG4025 be filed by mail?

A: Yes, Form REG4025 can be filed by mail to the address provided on the form.

Form Details:

- Released on November 1, 2011;

- The latest edition provided by the California Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG4025 by clicking the link below or browse more documents and templates provided by the California Department of Motor Vehicles.