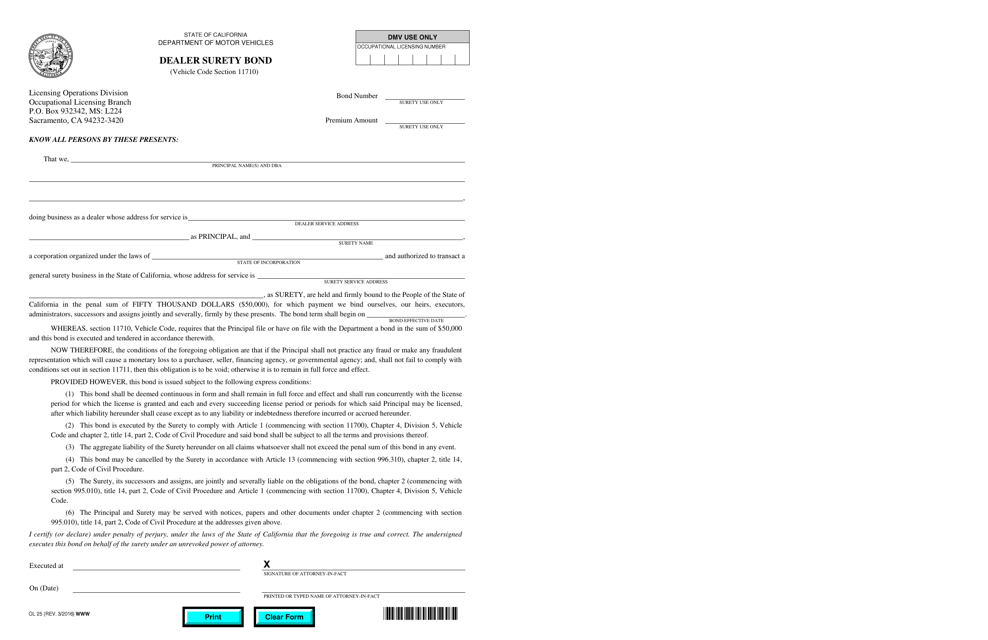

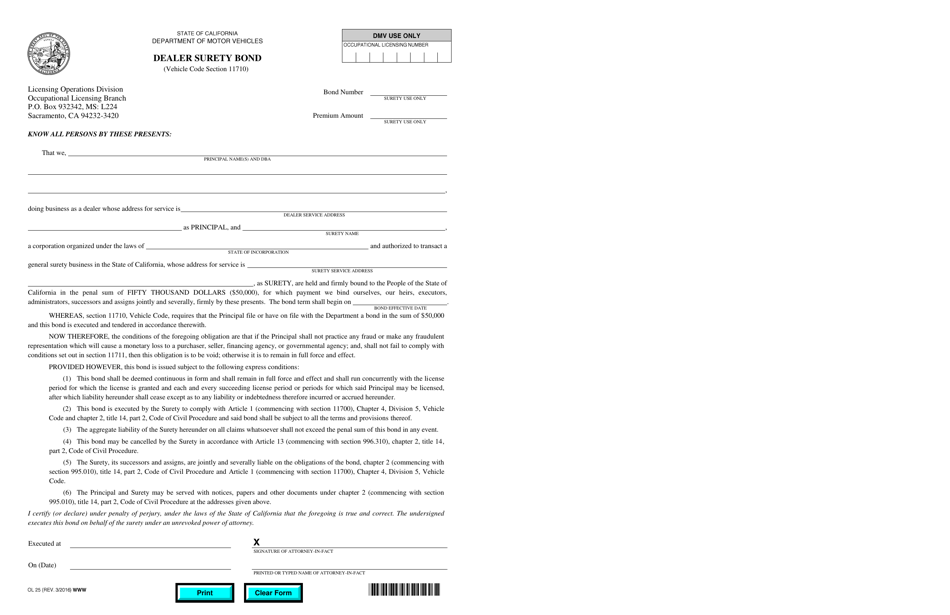

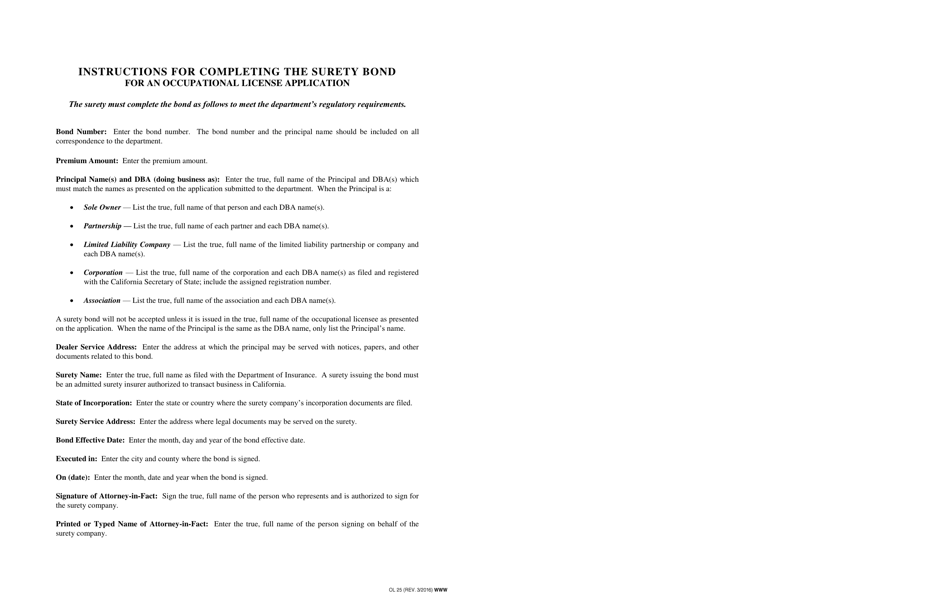

Form OL25 Dealer Surety Bond - California

What Is Form OL25?

This is a legal form that was released by the California Department of Motor Vehicles - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

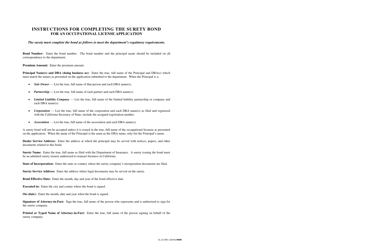

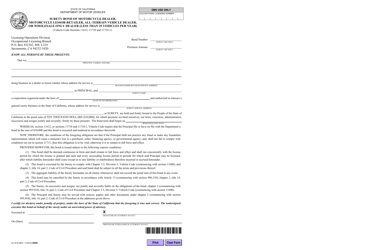

Q: What is an OL25 Dealer Surety Bond?

A: The OL25 Dealer Surety Bond is a type of bond required by the state of California for licensed vehicle dealers.

Q: Who needs to file an OL25 Dealer Surety Bond?

A: Licensed vehicle dealers in the state of California are required to file an OL25 Dealer Surety Bond.

Q: Why do I need an OL25 Dealer Surety Bond?

A: The OL25 Dealer Surety Bond provides a guarantee that the dealer will comply with all applicable laws and regulations.

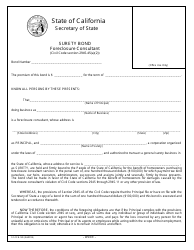

Q: How much does an OL25 Dealer Surety Bond cost?

A: The cost of an OL25 Dealer Surety Bond can vary depending on factors such as the dealer's credit history and the bond amount required.

Q: Can I get an OL25 Dealer Surety Bond with bad credit?

A: Yes, it is possible to obtain an OL25 Dealer Surety Bond with bad credit, but it may be more difficult and the cost could be higher.

Q: How long does an OL25 Dealer Surety Bond last?

A: The OL25 Dealer Surety Bond is typically valid for one year from the date of issuance.

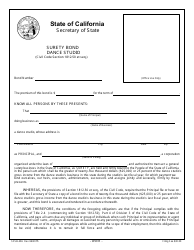

Q: What happens if I don't have an OL25 Dealer Surety Bond?

A: If you are a licensed vehicle dealer in California and do not have an OL25 Dealer Surety Bond, your license may be revoked or suspended.

Q: Can I cancel an OL25 Dealer Surety Bond?

A: Yes, an OL25 Dealer Surety Bond can be canceled, but there may be penalties or fees associated with the cancellation.

Q: How do I file an OL25 Dealer Surety Bond?

A: You can file an OL25 Dealer Surety Bond by submitting the required documents and payment to the appropriate state agency.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the California Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OL25 by clicking the link below or browse more documents and templates provided by the California Department of Motor Vehicles.