Arizona Form 845-CIG (ADOR11245) Retailer's Report of Cigarettes Sold - Arizona

What Is Arizona Form 845-CIG (ADOR11245)?

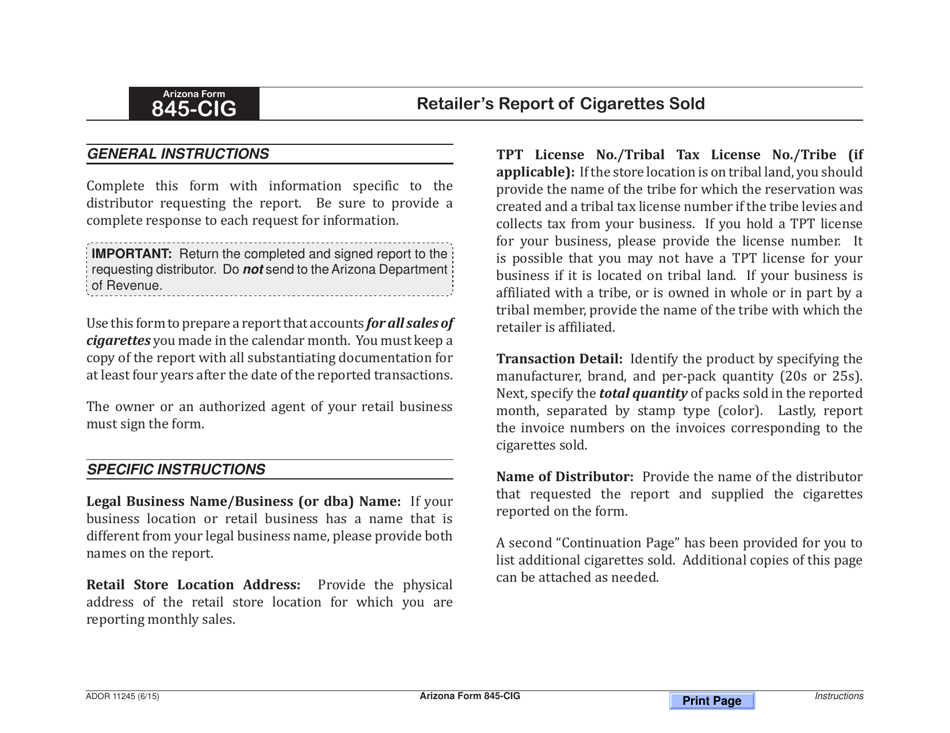

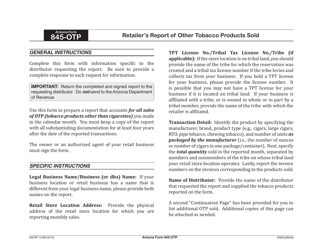

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 845-CIG?

A: Arizona Form 845-CIG is the Retailer's Report of Cigarettes Sold, required by the Arizona Department of Revenue.

Q: Who needs to file Arizona Form 845-CIG?

A: Retailers in Arizona who sell cigarettes need to file Arizona Form 845-CIG.

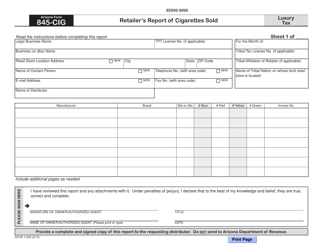

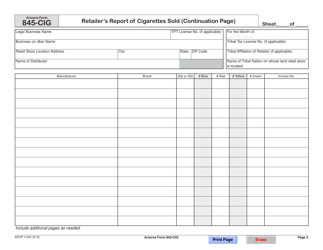

Q: What information is required on Arizona Form 845-CIG?

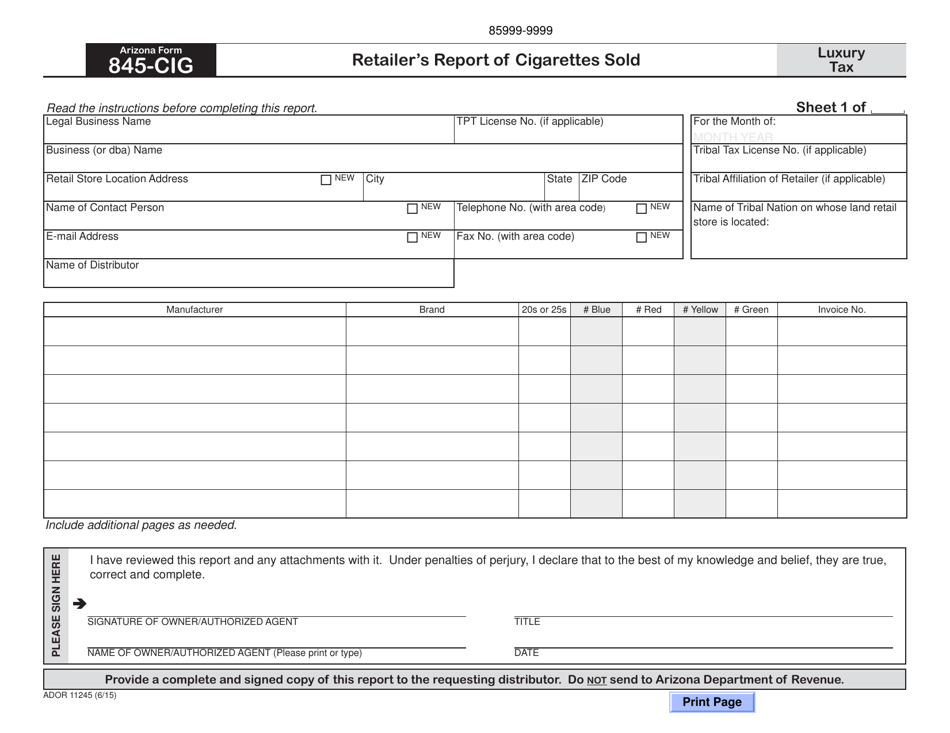

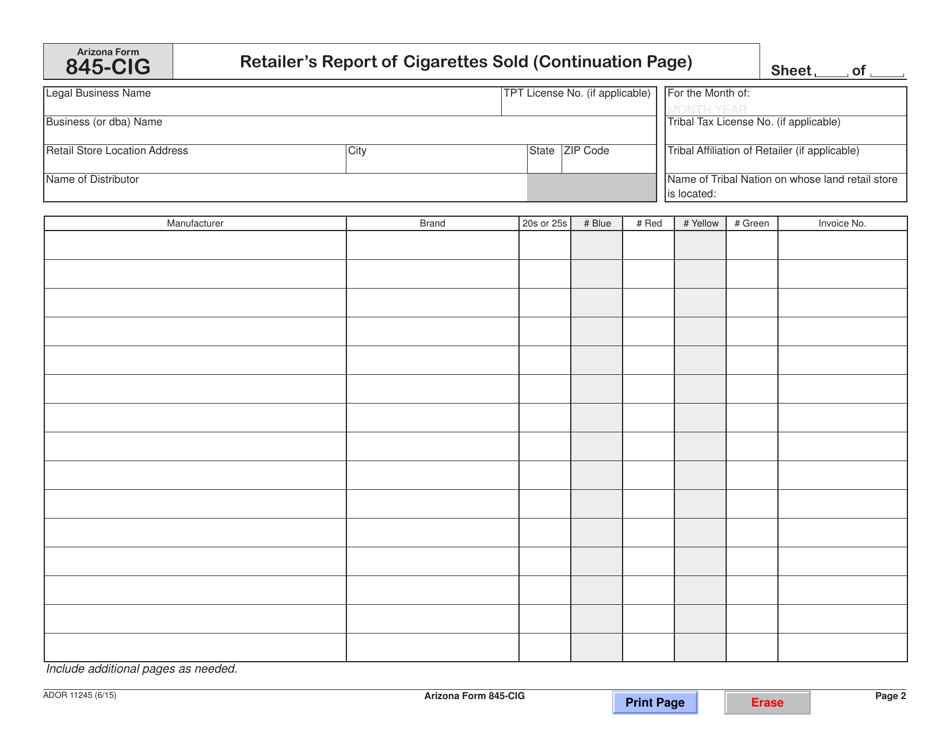

A: Arizona Form 845-CIG requires retailers to provide information about the quantity of cigarettes sold and any other required details, such as the retailer's name and address.

Q: When is the deadline for filing Arizona Form 845-CIG?

A: The deadline for filing Arizona Form 845-CIG is typically on a monthly basis by the 20th day of the following month.

Q: What happens if I fail to file Arizona Form 845-CIG?

A: Failing to file Arizona Form 845-CIG or providing false information may result in penalties or other legal consequences.

Q: Is Arizona Form 845-CIG applicable for all retailers in Arizona?

A: No, Arizona Form 845-CIG is specifically for retailers who sell cigarettes in Arizona.

Q: Are there any exemptions or exceptions to filing Arizona Form 845-CIG?

A: Exemptions or exceptions to filing Arizona Form 845-CIG may apply in certain situations, such as for retailers who do not sell cigarettes or who qualify for specific exemptions according to Arizona state laws.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 845-CIG (ADOR11245) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.