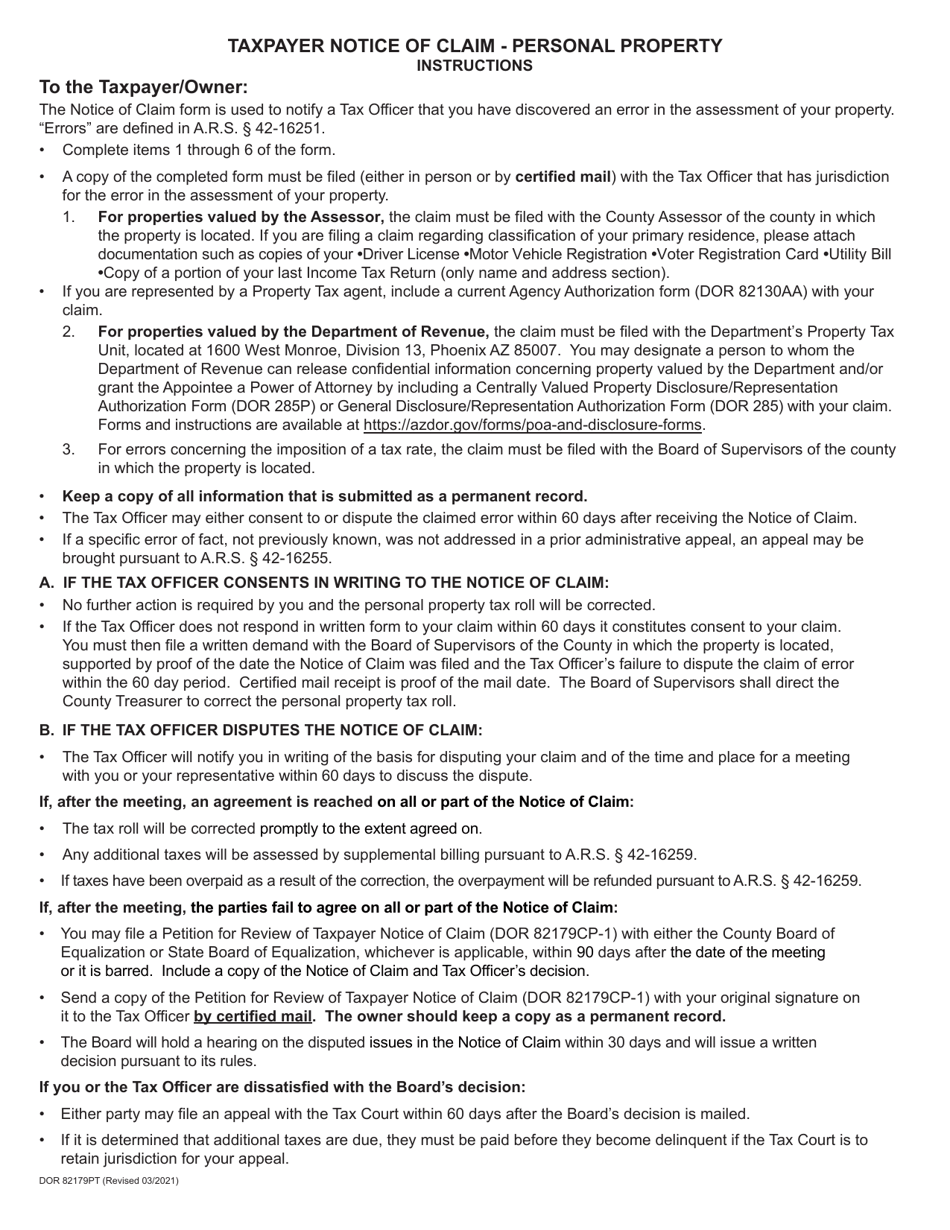

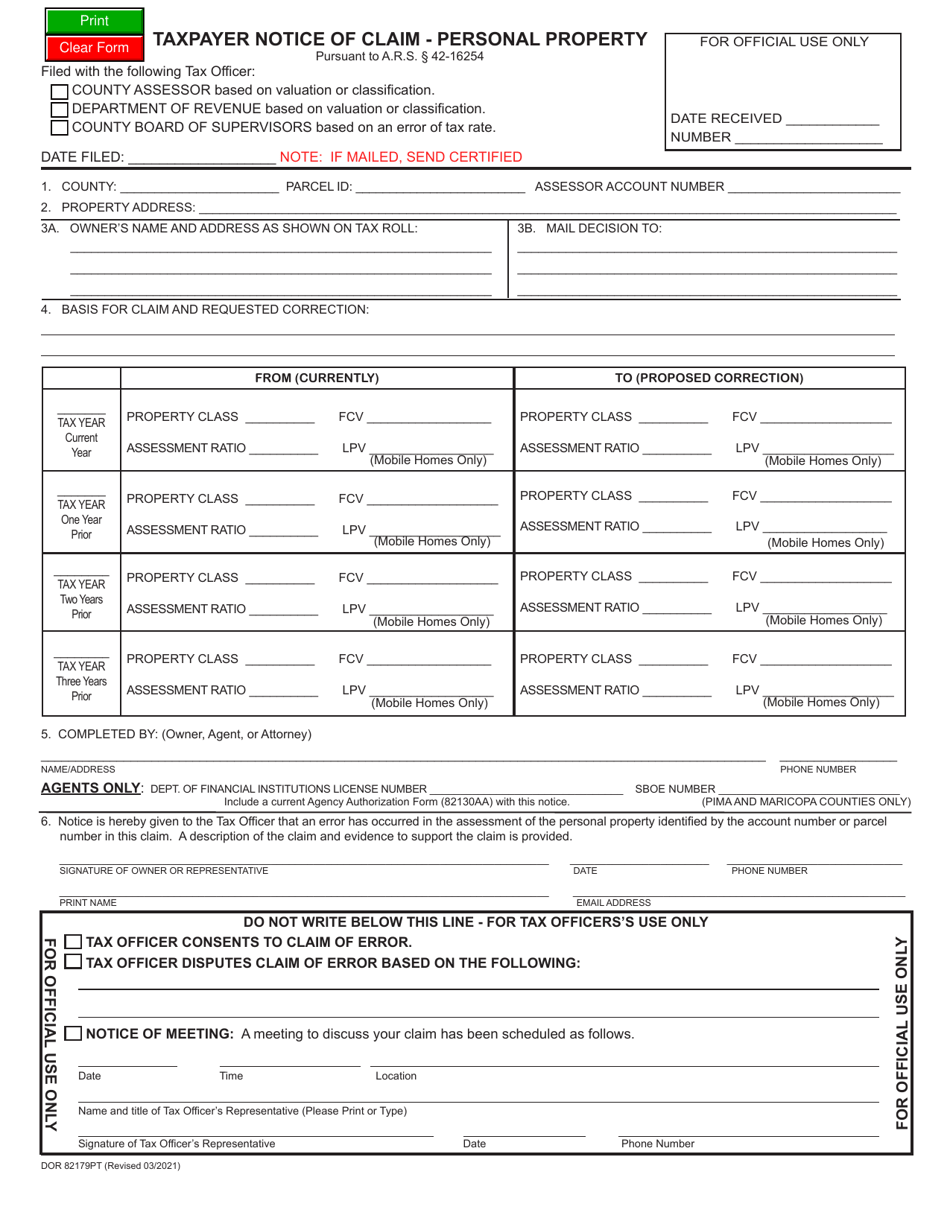

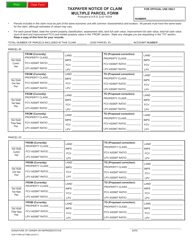

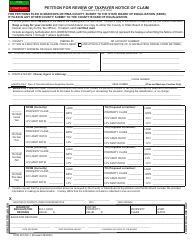

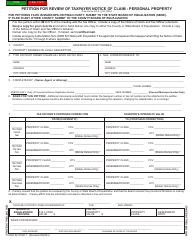

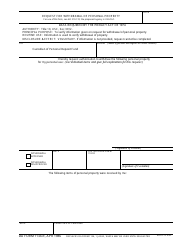

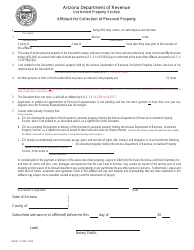

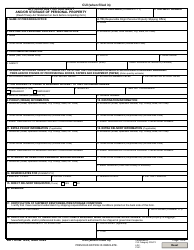

Form DOR82179PT Taxpayer Notice of Claim - Personal Property - Arizona

What Is Form DOR82179PT?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82179PT?

A: Form DOR82179PT is a Taxpayer Notice of Claim for Personal Property in Arizona.

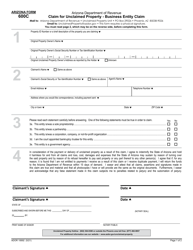

Q: Who can use Form DOR82179PT?

A: This form can be used by taxpayers in Arizona who want to file a claim for personal property.

Q: What is the purpose of Form DOR82179PT?

A: The purpose of this form is to allow taxpayers to claim a reduction in their personal property tax liability or to challenge the valuation of their property.

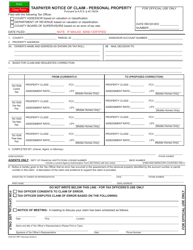

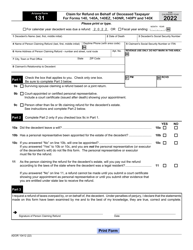

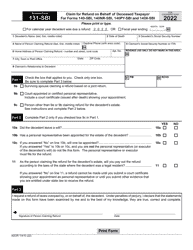

Q: What information is required on Form DOR82179PT?

A: The form requires information such as the taxpayer's name, address, description of the property, and the reason for the claim.

Q: When is the deadline to file Form DOR82179PT?

A: The deadline to file this form is typically within 60 days from the date of the valuation notice or tax bill.

Q: Is there a fee to file Form DOR82179PT?

A: No, there is no fee to file this form.

Q: What should I do if I have questions about Form DOR82179PT?

A: If you have any questions, you can contact the Arizona Department of Revenue for assistance.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82179PT by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.