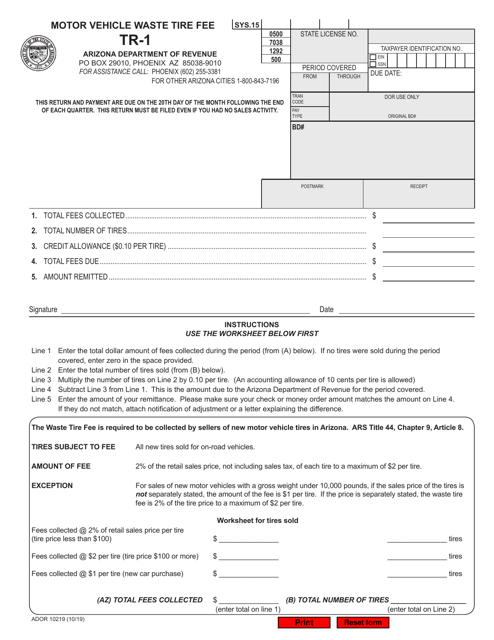

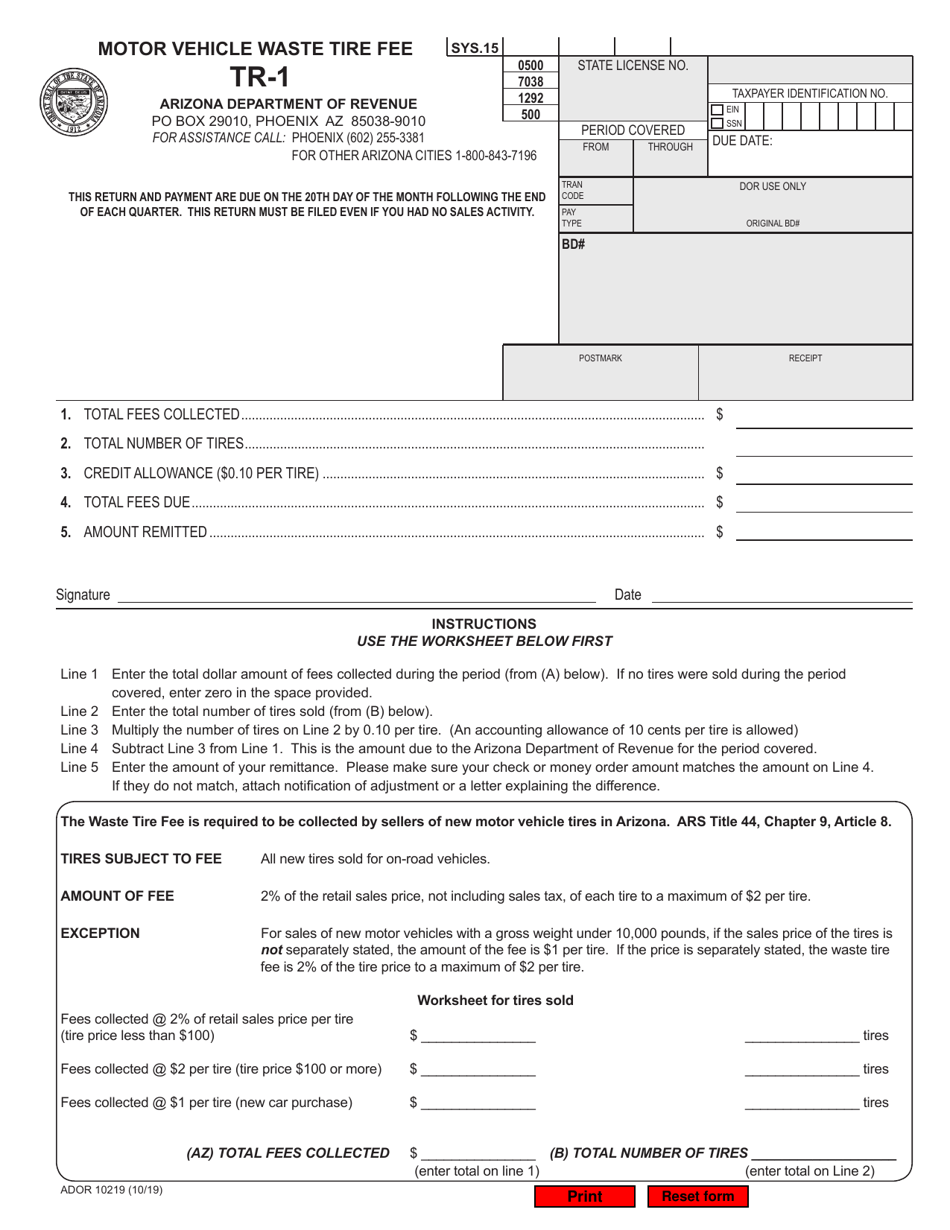

Form TR-1 (ADOR10219) Motor Vehicle Waste Tire Fee - Arizona

What Is Form TR-1 (ADOR10219)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-1 (ADOR10219)?

A: Form TR-1 (ADOR10219) is a form used to report and remit the Motor Vehicle Waste Tire Fee in Arizona.

Q: What is the Motor Vehicle Waste Tire Fee?

A: The Motor Vehicle Waste Tire Fee is a fee imposed on the sale of new tires in Arizona. It is used to fund waste tire clean-up and recycling programs.

Q: Who needs to file Form TR-1 (ADOR10219)?

A: Tire retailers and other businesses that sell new tires in Arizona need to file Form TR-1 (ADOR10219) and remit the Motor Vehicle Waste Tire Fee.

Q: How often is Form TR-1 (ADOR10219) filed?

A: Form TR-1 (ADOR10219) is filed monthly by tire retailers and businesses that sell new tires in Arizona.

Q: What is the deadline for filing Form TR-1 (ADOR10219)?

A: The form and payment for the Motor Vehicle Waste Tire Fee are due by the 20th day of the month following the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance. It is important to file and remit the Motor Vehicle Waste Tire Fee on time to avoid penalties.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-1 (ADOR10219) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.