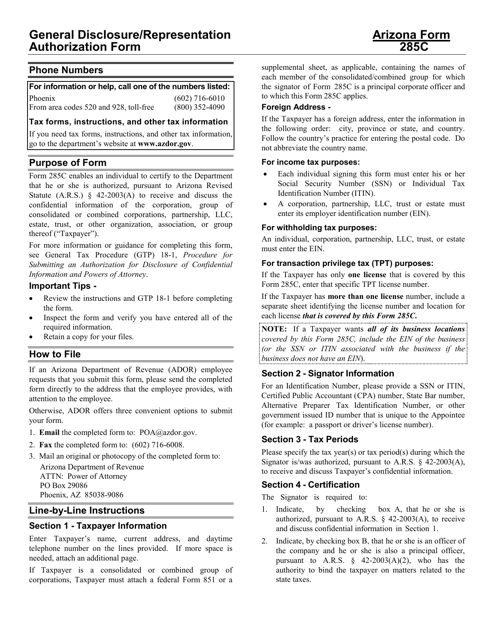

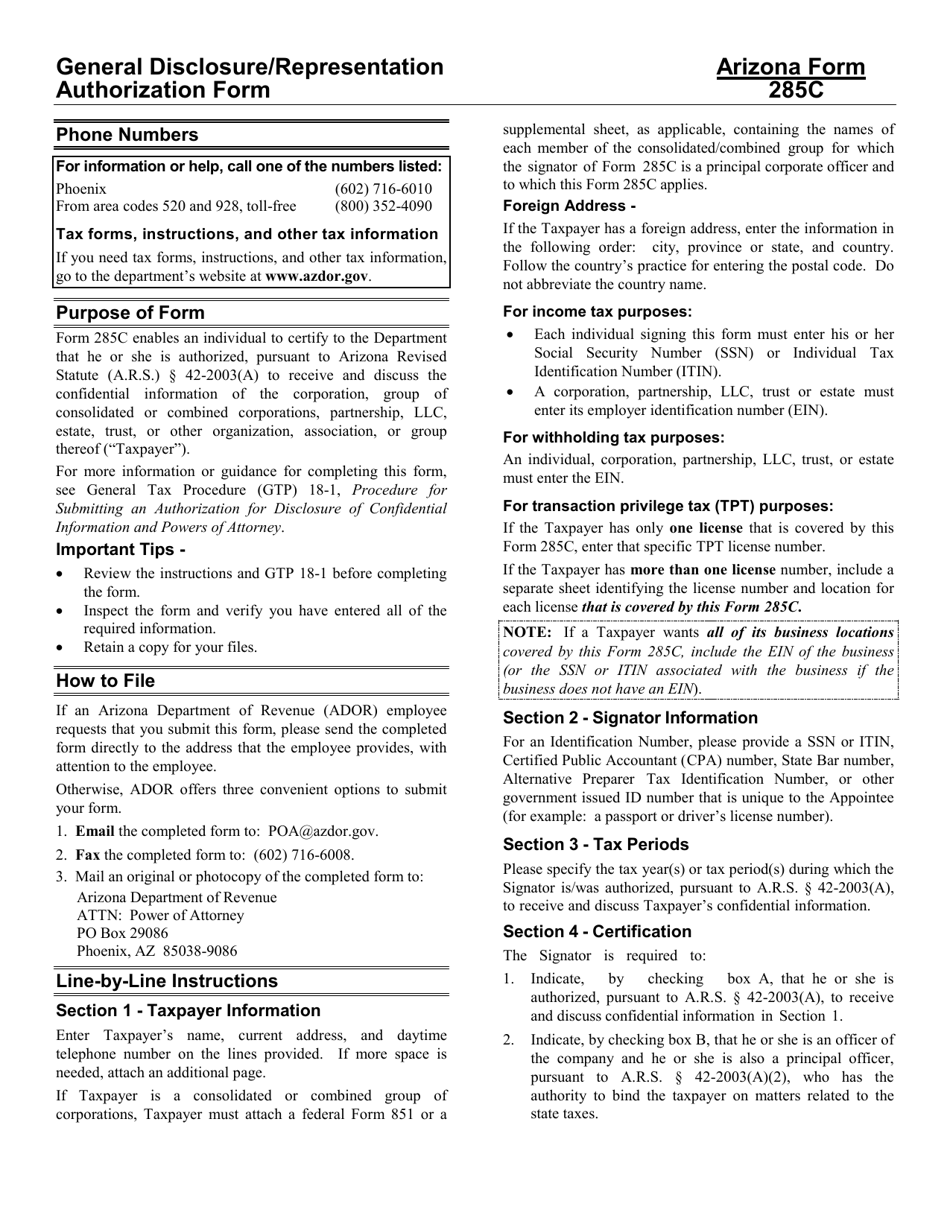

Instructions for Arizona Form 285C, ADOR10954 Disclosure Certification Form - Arizona

This document contains official instructions for Arizona Form 285C , and Form ADOR10954 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 285C (ADOR10954) is available for download through this link.

FAQ

Q: What is Arizona Form 285C?

A: Arizona Form 285C is the ADOR10954 Disclosure Certification Form in Arizona.

Q: What is the purpose of Arizona Form 285C?

A: The purpose of Arizona Form 285C is to certify the accuracy and completeness of financial disclosures.

Q: Who needs to fill out Arizona Form 285C?

A: Individuals or entities who are required to make financial disclosures in Arizona need to fill out this form.

Q: Is Arizona Form 285C mandatory?

A: Yes, if you are required to make financial disclosures in Arizona, filling out Arizona Form 285C is mandatory.

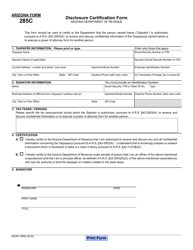

Q: What information do I need to provide on Arizona Form 285C?

A: On Arizona Form 285C, you need to provide accurate and complete financial disclosures, including income, assets, and liabilities.

Q: Is there a deadline for submitting Arizona Form 285C?

A: The deadline for submitting Arizona Form 285C may vary depending on the specific requirements and regulations. It is important to check with the Arizona Department of Revenue (ADOR) or consult a tax professional for the specific deadline.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.