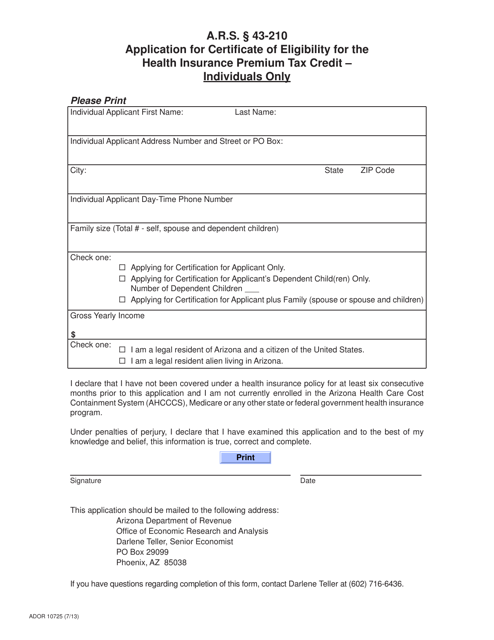

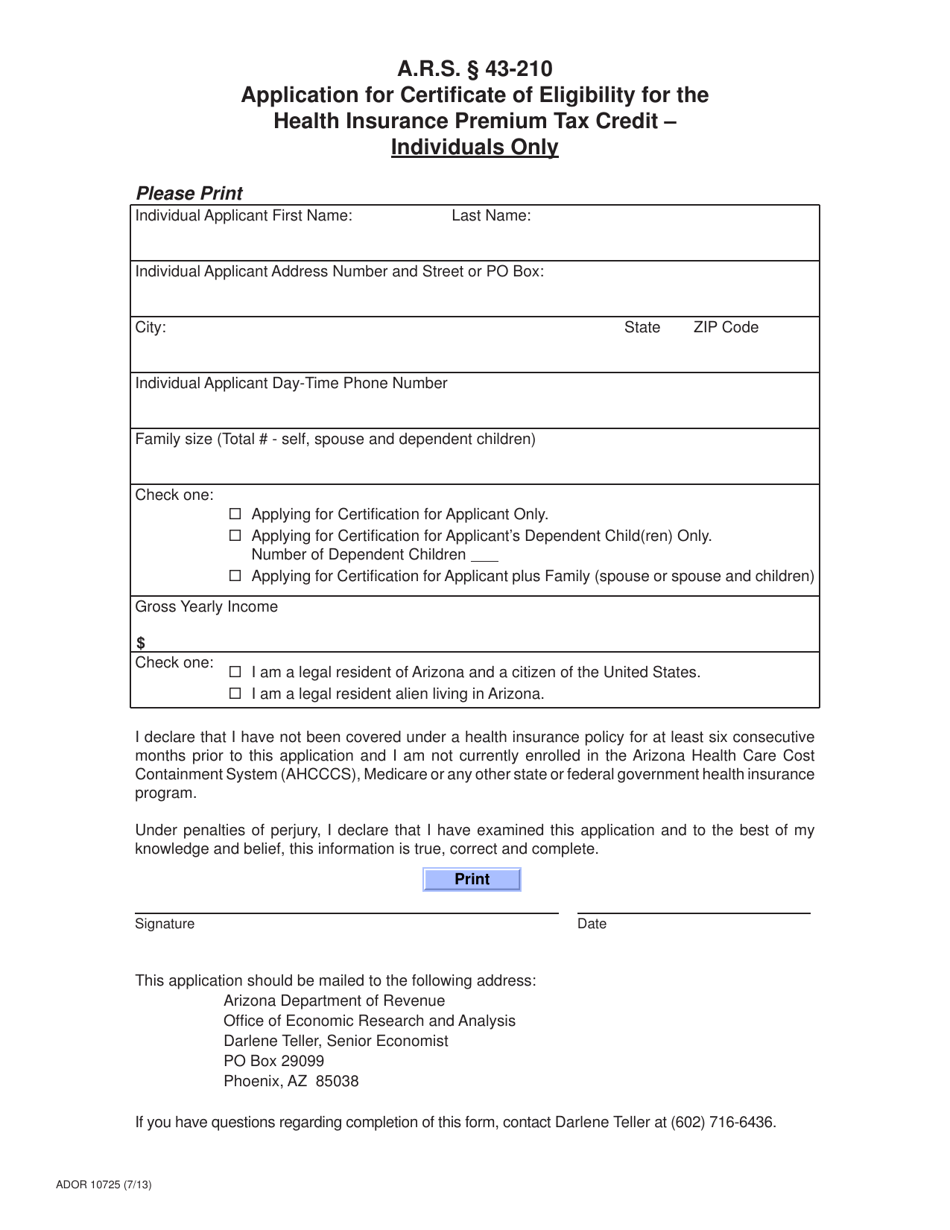

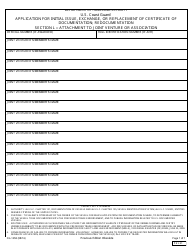

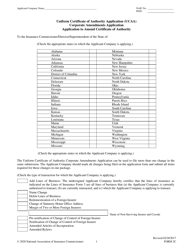

Form ADOR10725 Application for Certificate of Eligibility for the Health Insurance Premium Tax Credit - Individuals Only - Arizona

What Is Form ADOR10725?

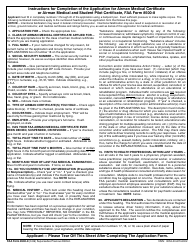

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

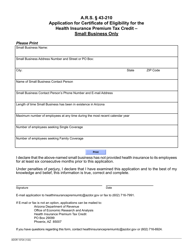

Q: What is ADOR10725?

A: ADOR10725 is the form used to apply for the Health Insurance Premium Tax Credit in Arizona.

Q: Who can use form ADOR10725?

A: Individuals in Arizona who are seeking the Health Insurance Premium Tax Credit can use this form.

Q: What is the purpose of form ADOR10725?

A: The purpose of this form is to apply for the Health Insurance Premium Tax Credit in Arizona.

Q: Is form ADOR10725 only for individuals?

A: Yes, this form is designed for individuals only.

Q: What is the Health Insurance Premium Tax Credit?

A: The Health Insurance Premium Tax Credit is a tax credit that helps individuals afford health insurance premiums.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR10725 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.