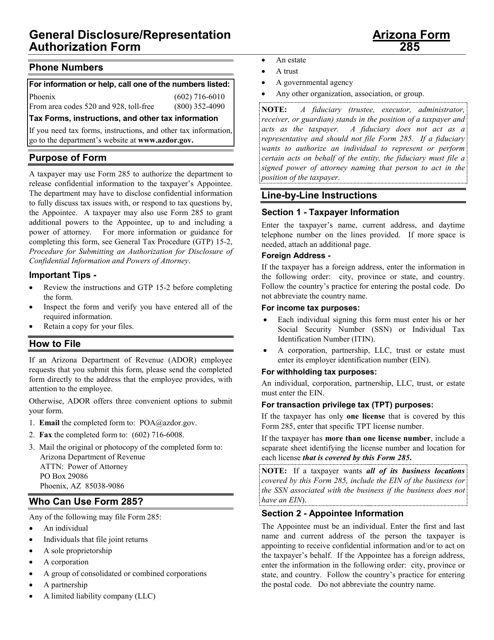

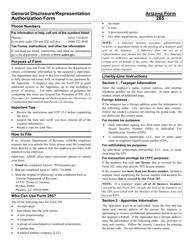

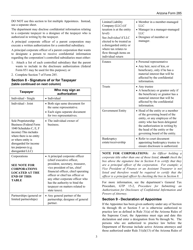

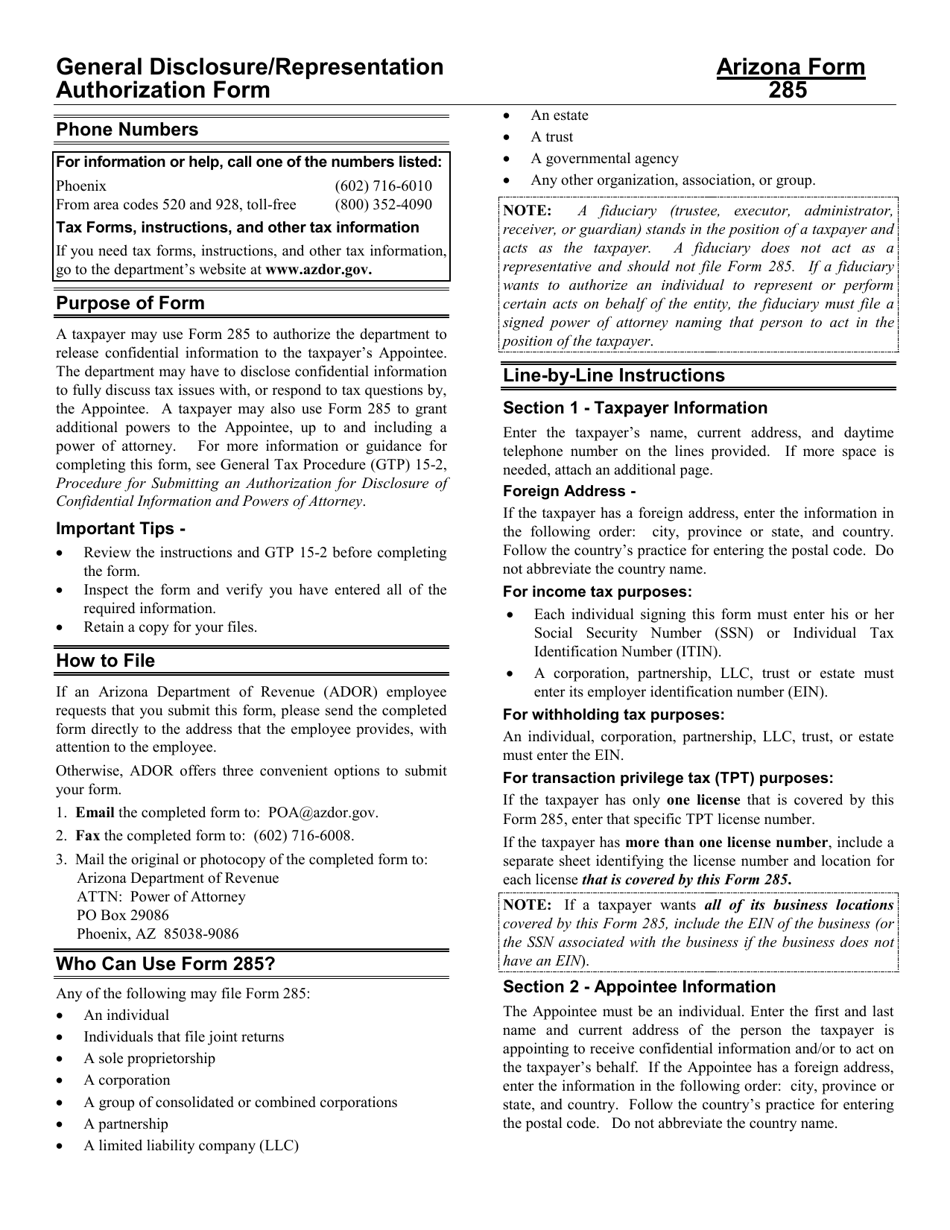

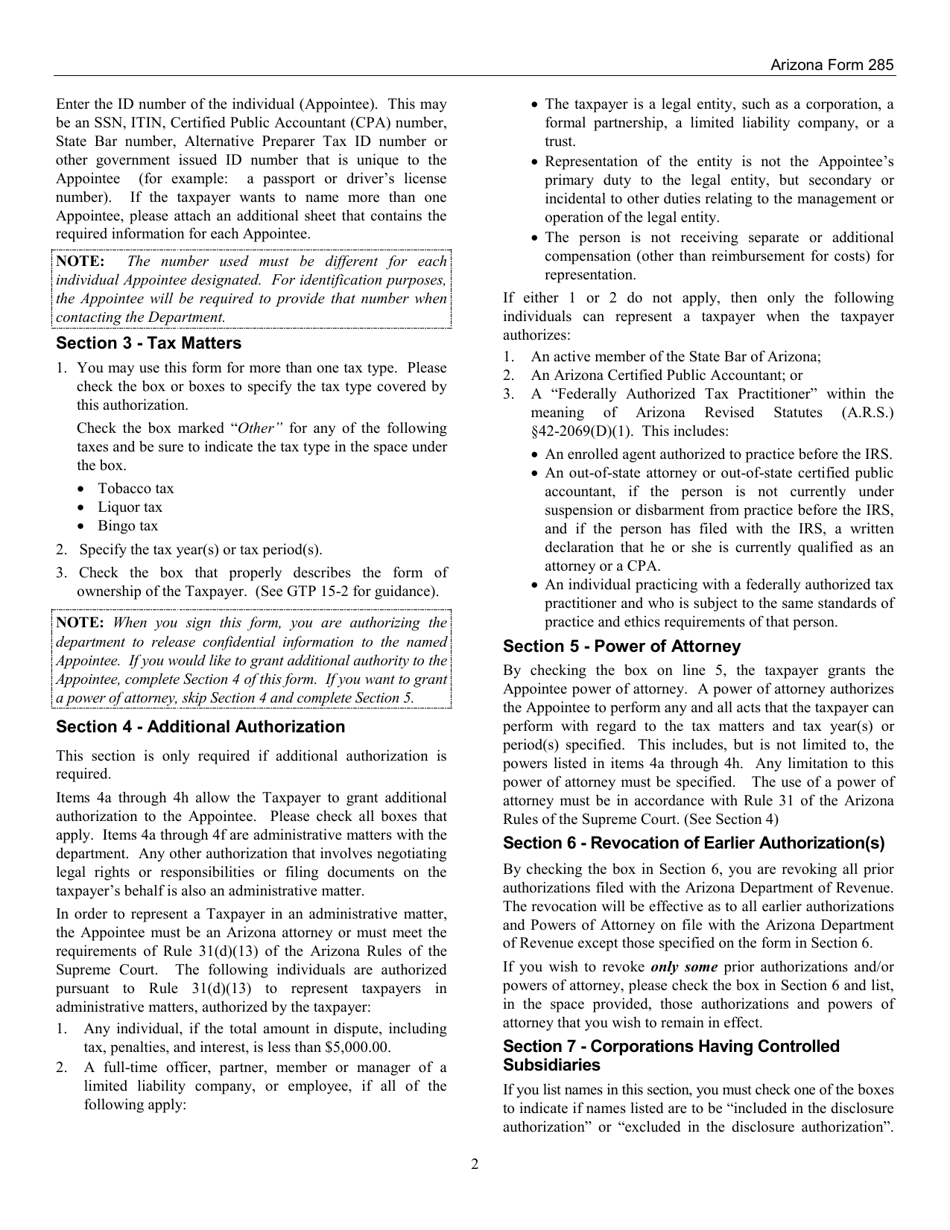

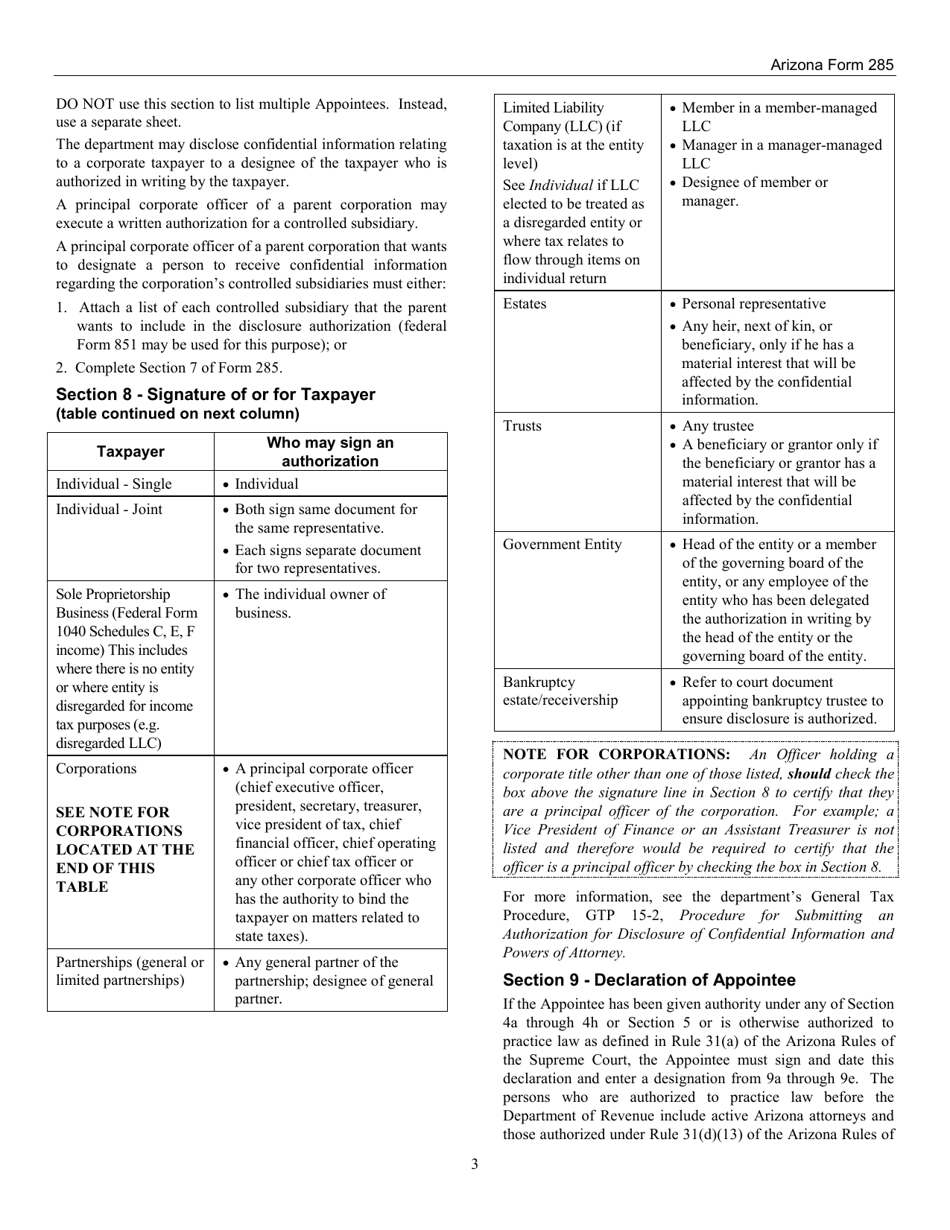

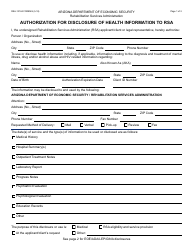

Instructions for Arizona Form 285, ADOR10952 General Disclosure / Representation Authorization Form - Arizona

This document contains official instructions for Arizona Form 285 , and Form ADOR10952 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 285 (ADOR10952) is available for download through this link.

FAQ

Q: What is Arizona Form 285?

A: Arizona Form 285 is the ADOR10952 General Disclosure/Representation Authorization Form for Arizona.

Q: What is the purpose of Arizona Form 285?

A: The purpose of Arizona Form 285 is to authorize the Arizona Department of Revenue (ADOR) to disclose and discuss your tax information with a designated representative.

Q: Who needs to use Arizona Form 285?

A: Anyone who wants to authorize a representative to discuss their tax information with the Arizona Department of Revenue needs to use Arizona Form 285.

Q: How do I fill out Arizona Form 285?

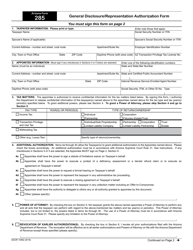

A: To fill out Arizona Form 285, you need to provide your personal information, including your name, address, social security number, and the name of your designated representative.

Q: Is there a fee to submit Arizona Form 285?

A: No, there is no fee to submit Arizona Form 285.

Q: Can I fax or email Arizona Form 285?

A: Yes, you can fax or email Arizona Form 285 to the Arizona Department of Revenue. The contact information is provided on the form.

Q: How long does it take for Arizona Form 285 to be processed?

A: The processing time for Arizona Form 285 may vary, but it typically takes a few weeks for the form to be processed.

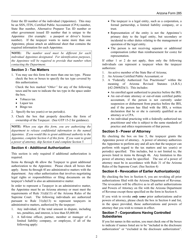

Q: What if I need to revoke or change the authorization on Arizona Form 285?

A: If you need to revoke or change the authorization on Arizona Form 285, you can submit a new form with updated information to the Arizona Department of Revenue.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.