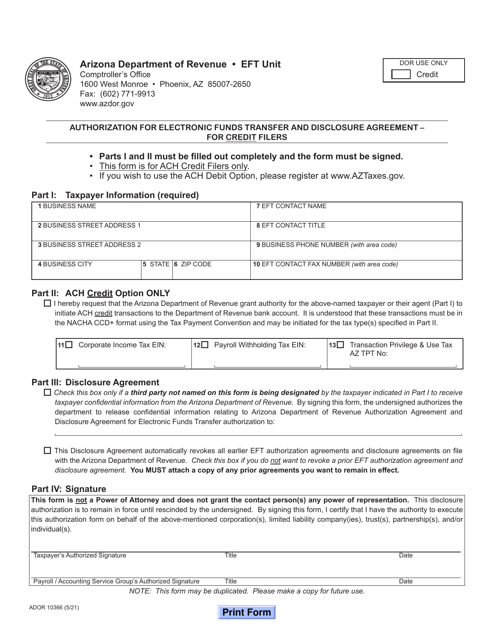

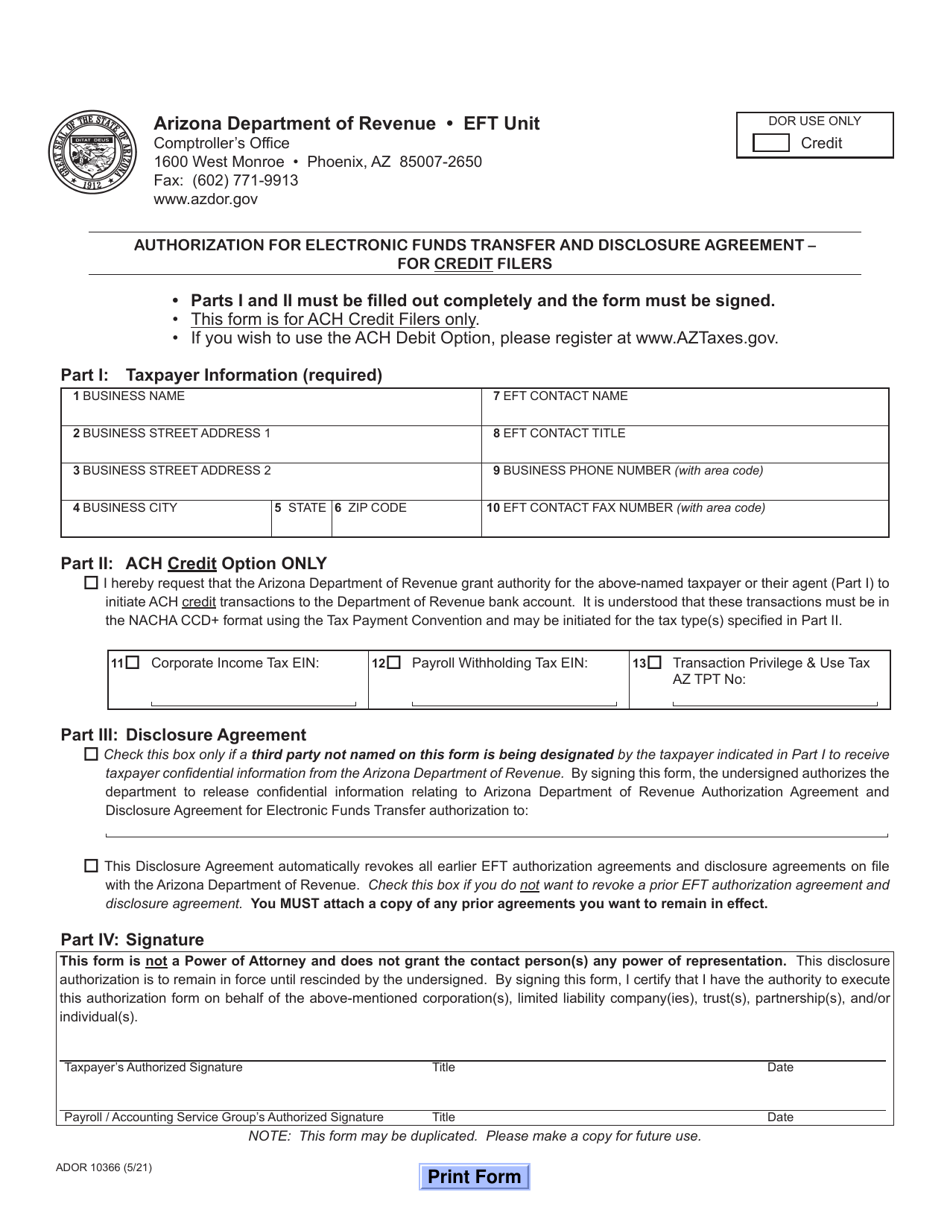

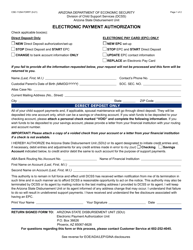

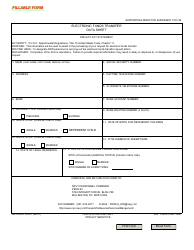

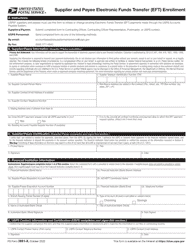

Form ADOR10366 Authorization for Electronic Funds Transfer and Disclosure Agreement - for Credit Filers - Arizona

What Is Form ADOR10366?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ADOR10366?

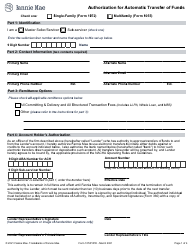

A: ADOR10366 is the form for Authorization for Electronic Funds Transfer and Disclosure Agreement specifically for credit filers in Arizona.

Q: Who needs to fill out this form?

A: Credit filers in Arizona who want to authorize electronic funds transfer and agree to the disclosure terms need to fill out this form.

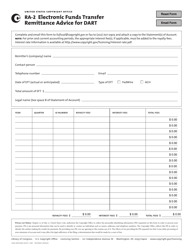

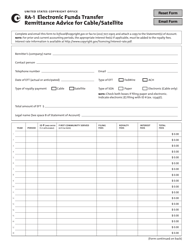

Q: What is the purpose of this form?

A: The purpose of this form is to authorize electronic funds transfer for credit filers and agree to the disclosure terms set by the Arizona Department of Revenue.

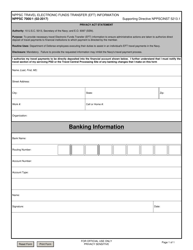

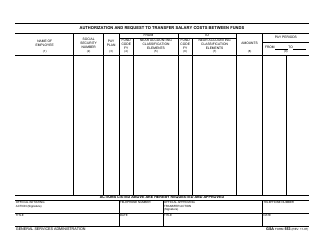

Q: Are there any fees associated with electronic funds transfer?

A: There may be fees associated with electronic funds transfer, and these fees will be disclosed in the agreement.

Q: What information is required in the form?

A: The form will require information such as the filer's name, business name, address, bank account details, and a signature.

Q: Can I cancel the electronic funds transfer authorization?

A: Yes, you can cancel the authorization by submitting a written request to the Arizona Department of Revenue.

Q: What are the consequences of not filling out this form?

A: If you do not fill out this form, you may not be able to authorize electronic funds transfer and may not be in compliance with the Arizona Department of Revenue's requirements for credit filers.

Q: What should I do if I have questions or need assistance with this form?

A: If you have any questions or need assistance with the ADOR10366 form, you should contact the Arizona Department of Revenue directly.

Form Details:

- Released on May 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR10366 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.