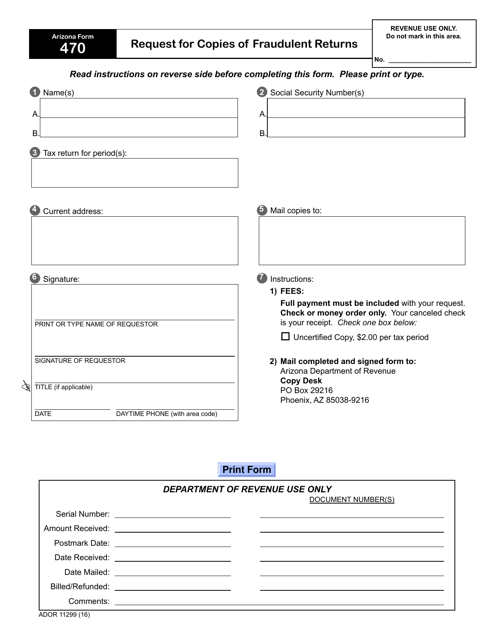

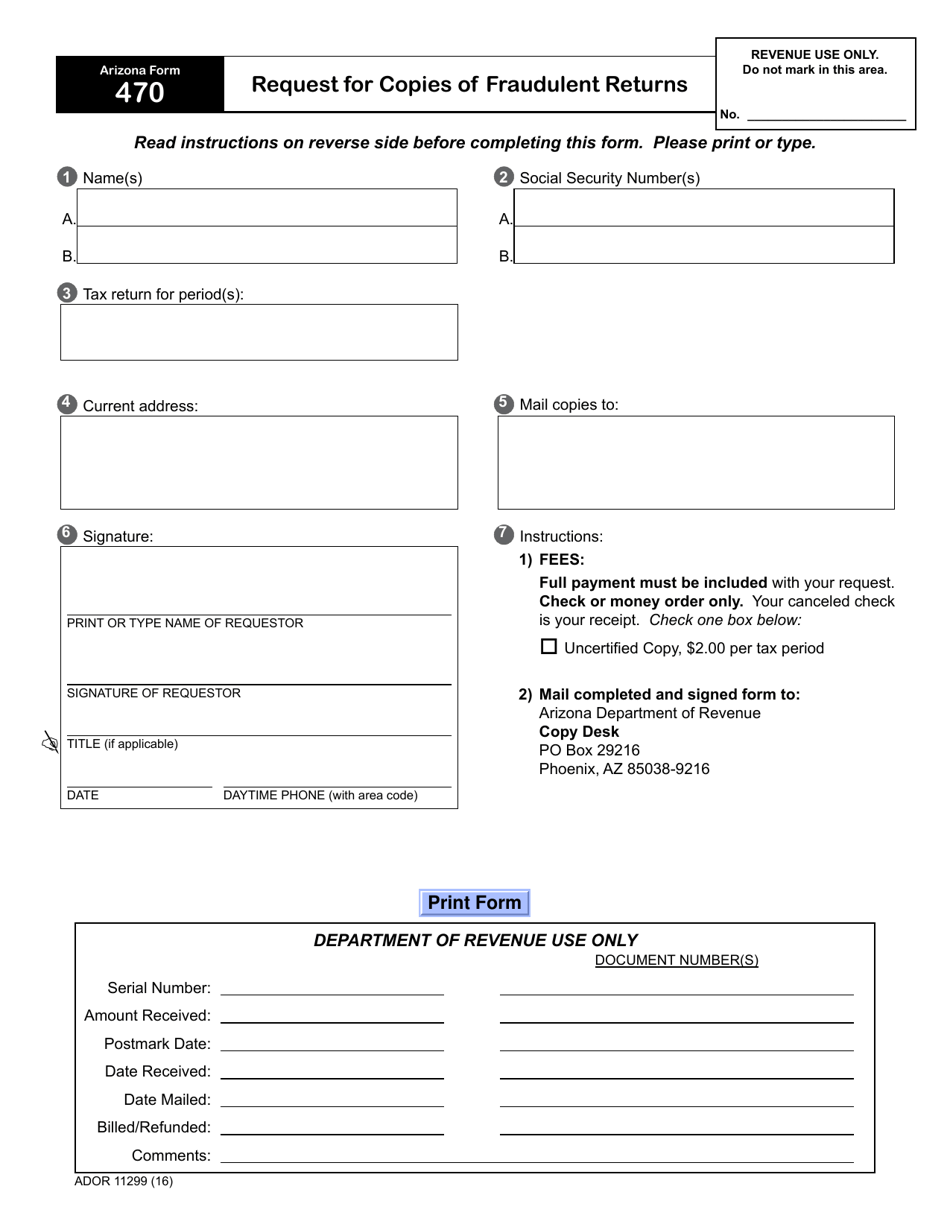

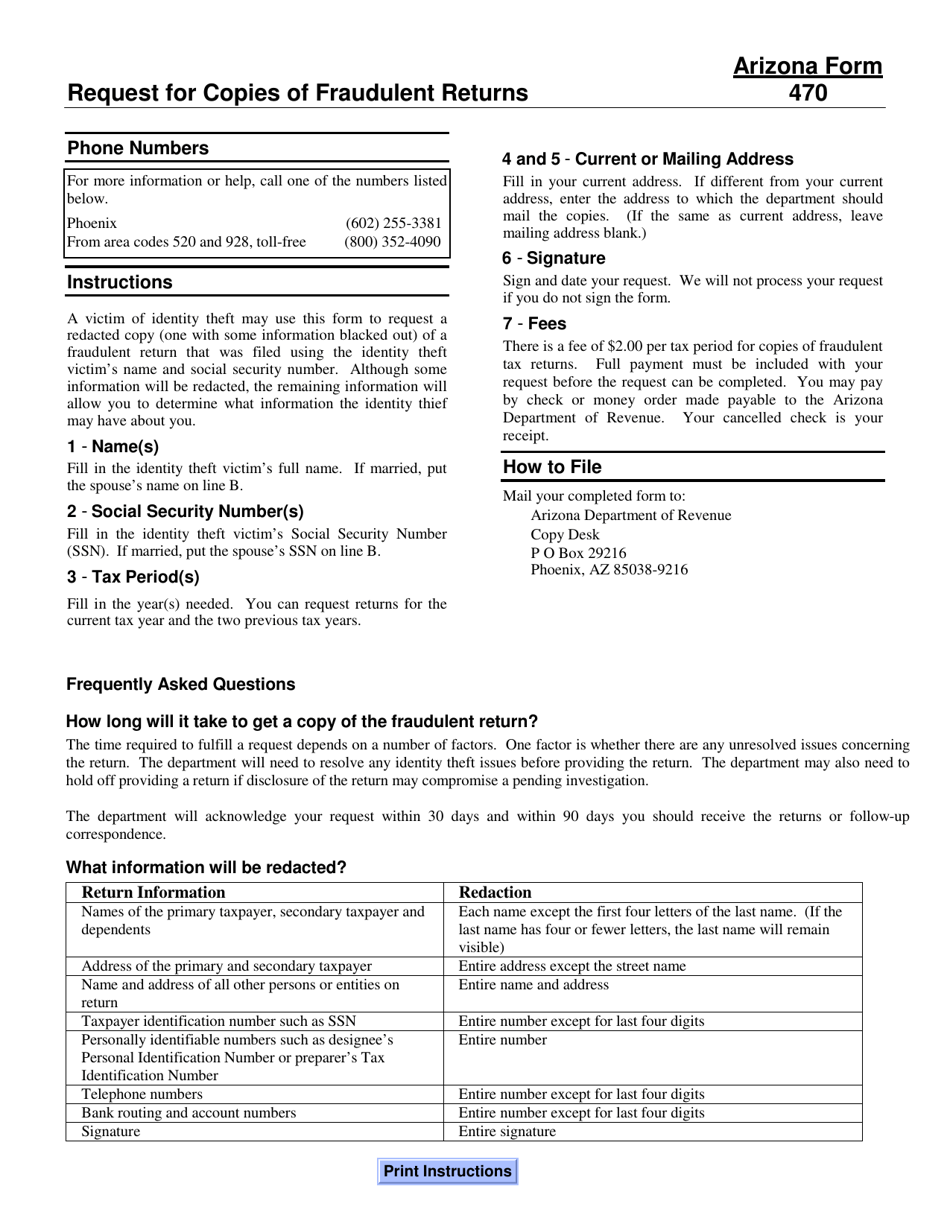

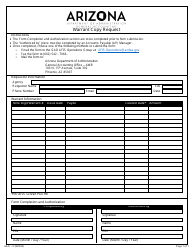

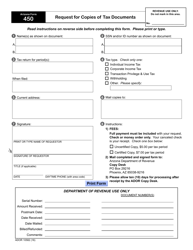

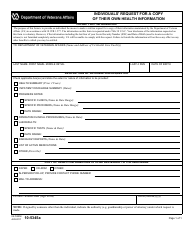

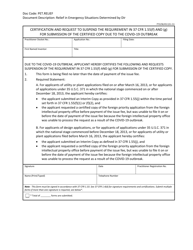

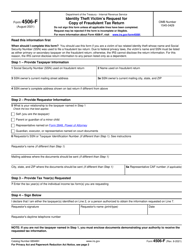

Arizona Form 470 (ADOR11299) Request for Copies of Fraudulent Returns - Arizona

What Is Arizona Form 470 (ADOR11299)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 470?

A: Arizona Form 470 is a request form used to request copies of fraudulent tax returns filed in the state of Arizona.

Q: What is the purpose of Arizona Form 470?

A: The purpose of Arizona Form 470 is to request copies of fraudulent tax returns to aid in the investigation of tax fraud.

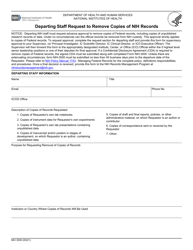

Q: Who can request copies of fraudulent returns using Arizona Form 470?

A: Only authorized law enforcement officers or authorized Department of Revenue personnel can request copies of fraudulent returns using Arizona Form 470.

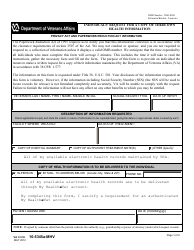

Q: What information is required on Arizona Form 470?

A: Arizona Form 470 requires information such as the requester's name, agency or department, contact information, and the specific tax year and taxpayer information for the requested fraudulent returns.

Q: Is there a fee for requesting copies of fraudulent returns using Arizona Form 470?

A: Yes, there is a fee associated with requesting copies of fraudulent returns using Arizona Form 470. The fee is outlined in the instructions for the form and must be included with the request.

Q: How long does it take to process a request for copies of fraudulent returns using Arizona Form 470?

A: The processing time for a request for copies of fraudulent returns using Arizona Form 470 varies depending on the volume of requests received. It is best to contact the Arizona Department of Revenue for an estimate on processing time.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 470 (ADOR11299) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.