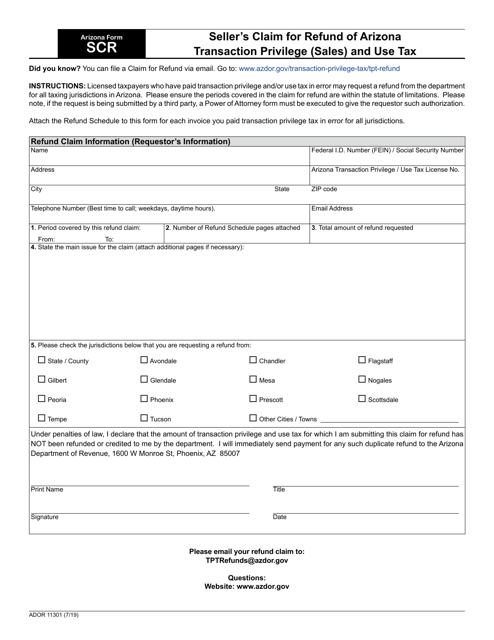

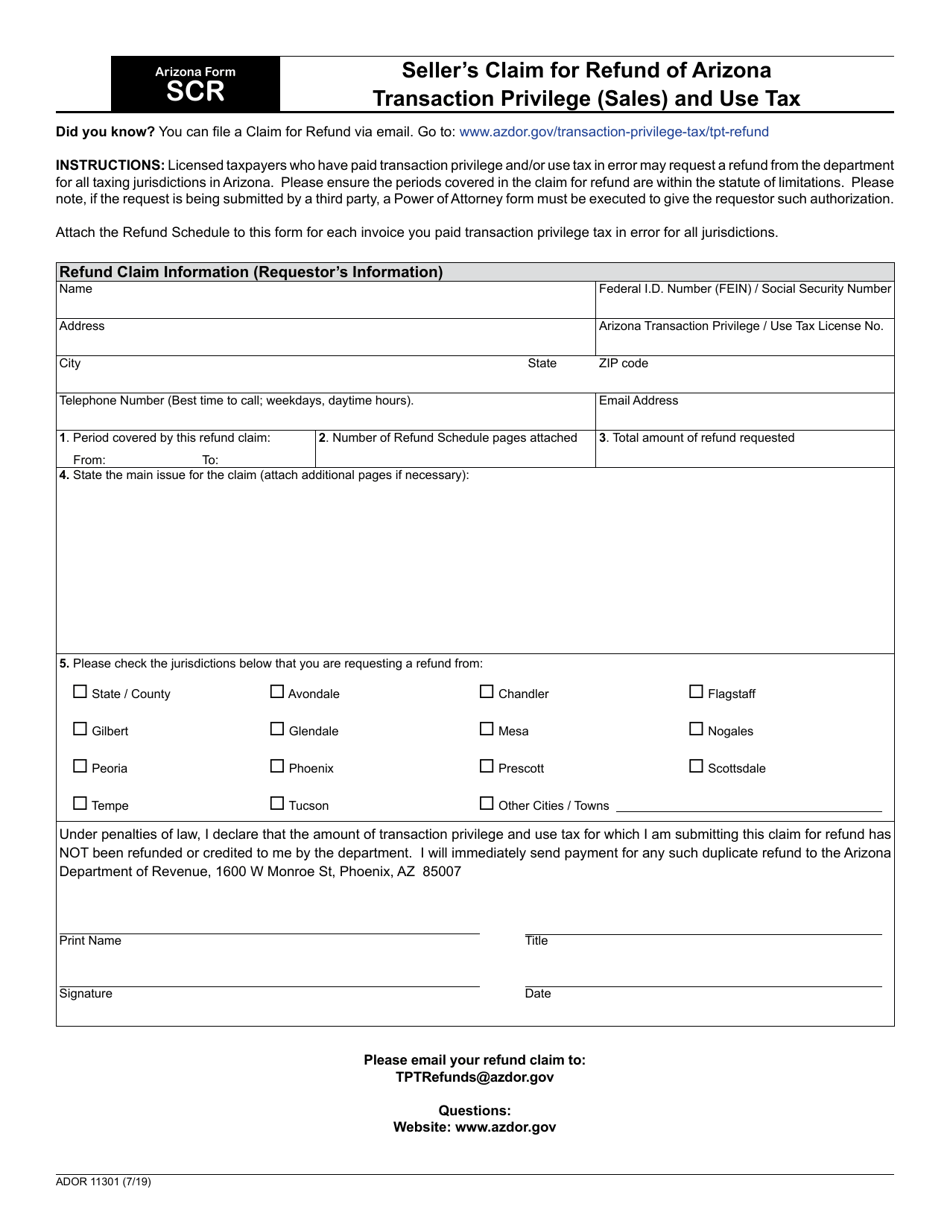

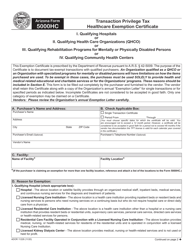

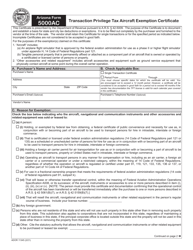

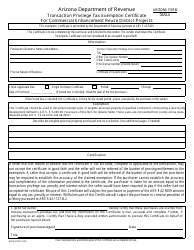

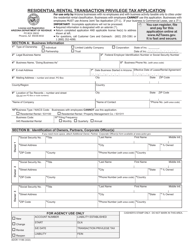

Arizona Form SCR (ADOR11301) Seller's Claim for Refund of Arizona Transaction Privilege (Sales) and Use Tax - Arizona

What Is Arizona Form SCR (ADOR11301)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SCR?

A: Form SCR is Arizona's Seller's Claim for Refund of Arizona Transaction Privilege (Sales) and Use Tax.

Q: Who can use Form SCR?

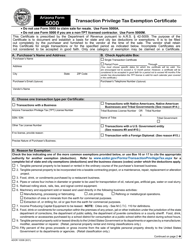

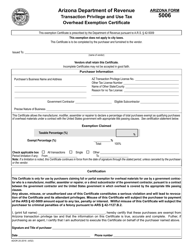

A: Form SCR is used by sellers and vendors in Arizona to claim a refund of transaction privilege (sales) and use tax.

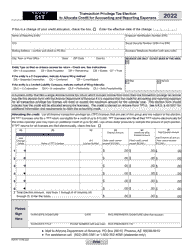

Q: What is transaction privilege tax?

A: Transaction privilege tax is a tax on the privilege of doing business in Arizona. It is commonly referred to as a sales tax.

Q: What is use tax?

A: Use tax is a tax on tangible personal property used in Arizona that was not subject to sales tax.

Q: How can one qualify for a refund using Form SCR?

A: To qualify for a refund using Form SCR, the seller must have overpaid transaction privilege (sales) and/or use tax.

Q: What information is required on Form SCR?

A: Form SCR requires the seller's contact information, tax information, detailed explanation of the refund claim, and supporting documentation.

Q: What is the deadline for submitting Form SCR?

A: The deadline for submitting Form SCR is generally three years from the date the tax was due or paid, whichever is later.

Q: What happens after submitting Form SCR?

A: After submitting Form SCR, the Arizona Department of Revenue (ADOR) will review the claim and notify the seller of their decision.

Q: Can I appeal the decision made on my Form SCR?

A: Yes, if a seller disagrees with the department's decision on their Form SCR, they have the right to appeal it.

Q: Are there any fees or costs associated with filing Form SCR?

A: No, there are no fees or costs associated with filing Form SCR.

Q: Is there any assistance available for filling out Form SCR?

A: Yes, sellers can contact the Arizona Department of Revenue (ADOR) for assistance with filling out Form SCR.

Q: Can I claim a refund if I am not a seller or vendor in Arizona?

A: No, Form SCR is specifically for sellers and vendors in Arizona.

Q: Are there any other forms or documents I need to submit along with Form SCR?

A: Yes, sellers may need to submit additional supporting documentation depending on the nature of their refund claim.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

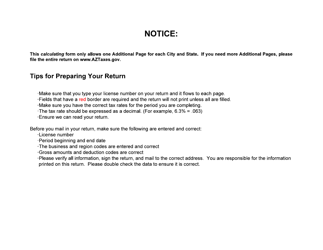

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form SCR (ADOR11301) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.