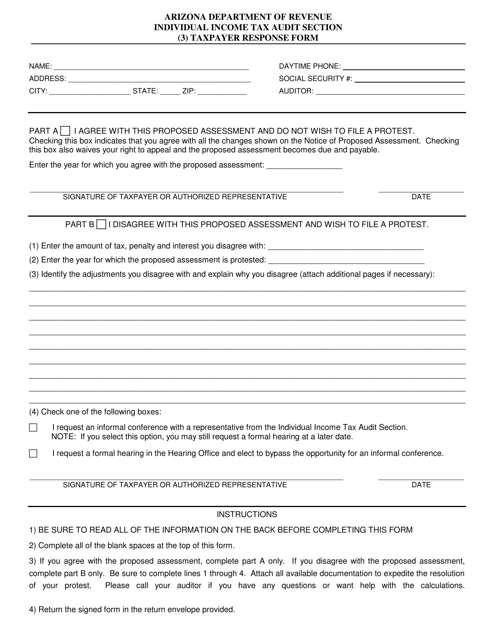

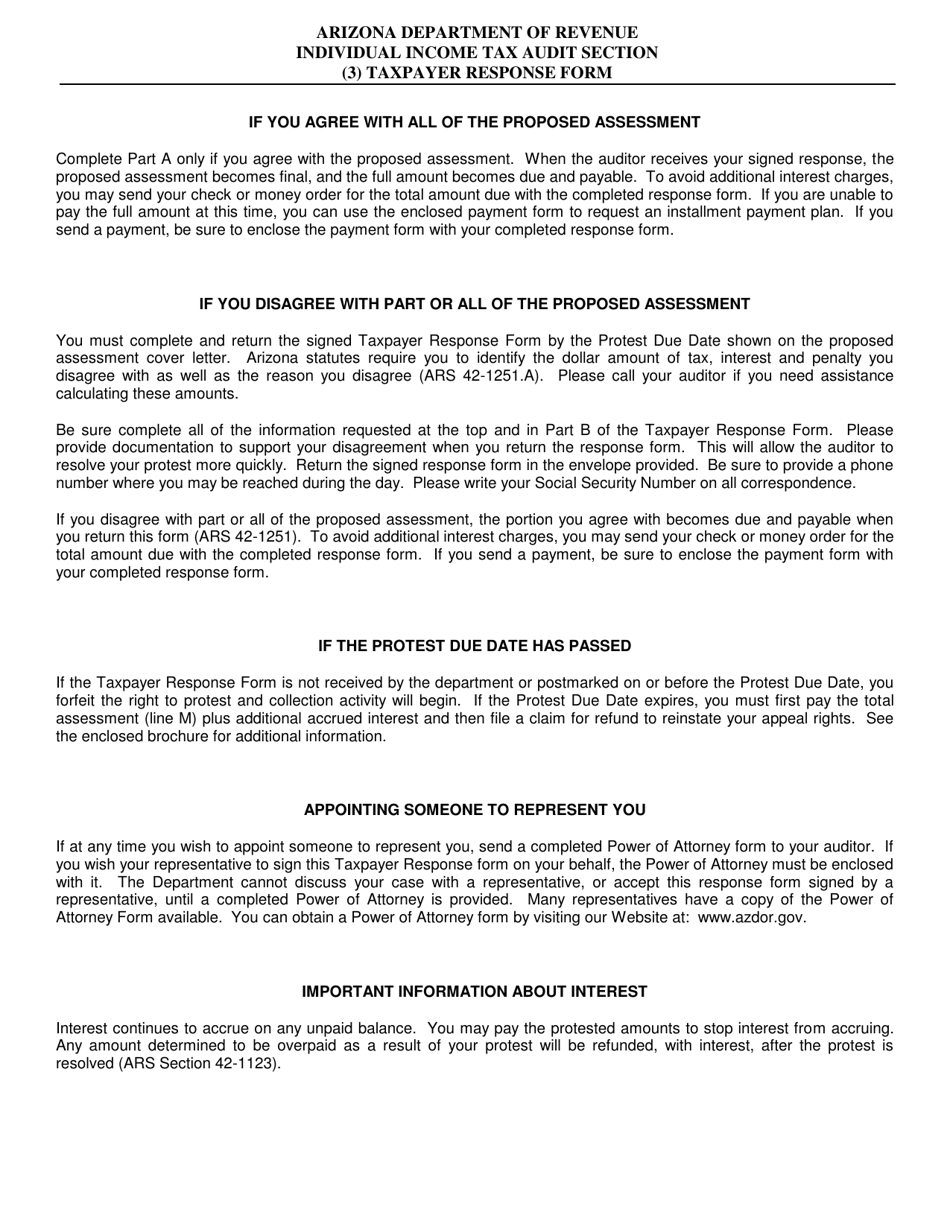

Taxpayer Response Form - Arizona

Taxpayer Response Form is a legal document that was released by the Arizona Department of Revenue - a government authority operating within Arizona.

FAQ

Q: What is the Taxpayer Response Form?

A: The Taxpayer Response Form is a document used by taxpayers in Arizona to respond to notices from the Department of Revenue.

Q: When do I need to use the Taxpayer Response Form?

A: You need to use the Taxpayer Response Form when you receive a notice from the Arizona Department of Revenue and need to respond to it.

Q: What information do I need to provide on the Taxpayer Response Form?

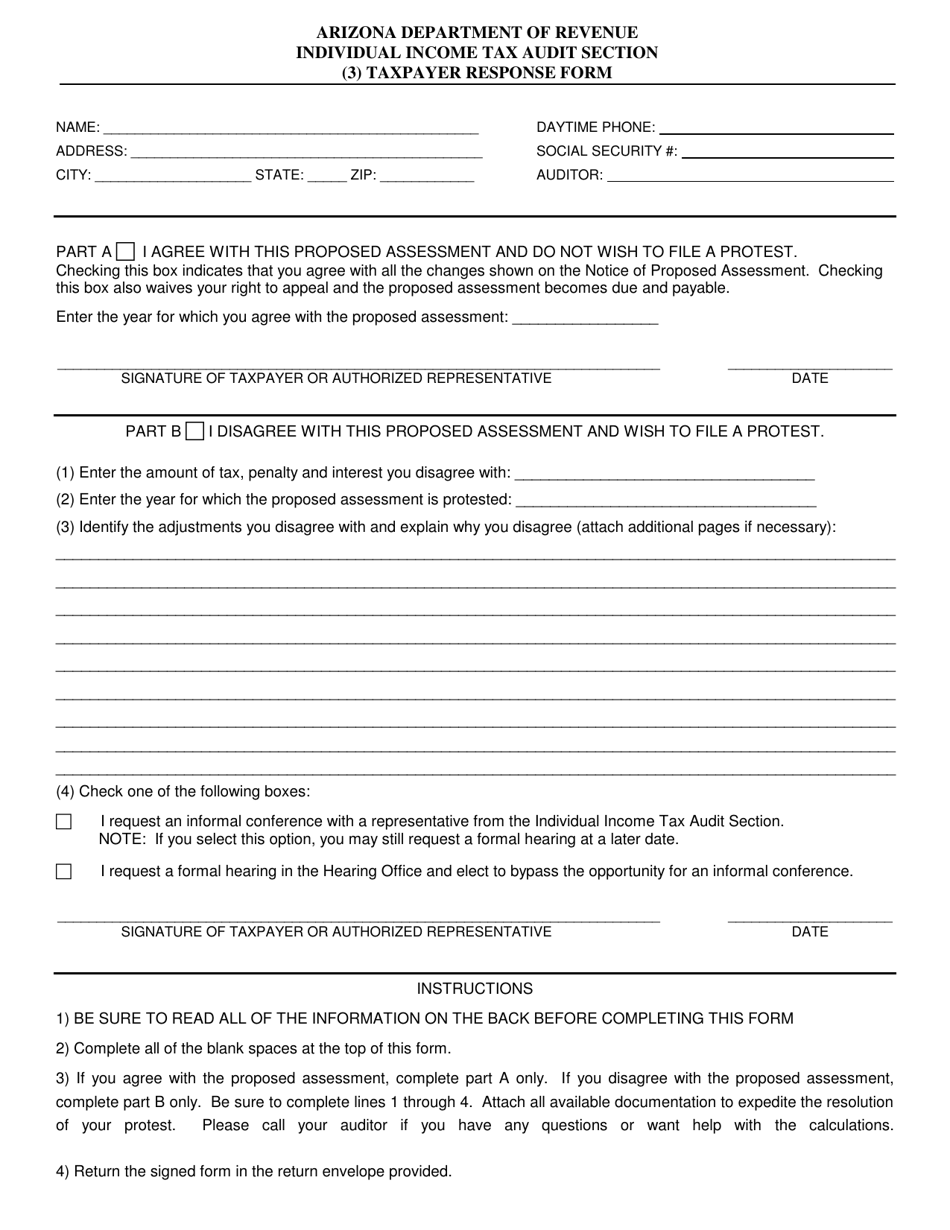

A: You will need to provide your personal information, the notice number, and details about your response or dispute.

Q: What happens after I submit the Taxpayer Response Form?

A: After you submit the Taxpayer Response Form, the Arizona Department of Revenue will review your response and take appropriate action.

Q: Is there a deadline for submitting the Taxpayer Response Form?

A: Yes, the deadline for submitting the Taxpayer Response Form is usually specified on the notice you received from the Arizona Department of Revenue.

Q: What should I do if I have questions or need assistance with the Taxpayer Response Form?

A: If you have questions or need assistance with the Taxpayer Response Form, you can contact the Arizona Department of Revenue's helpline or visit their office for help.

Q: Can I appeal a decision made based on my Taxpayer Response Form?

A: Yes, if you disagree with the decision made based on your Taxpayer Response Form, you can appeal it through the established appeals process.

Form Details:

- The latest edition currently provided by the Arizona Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.