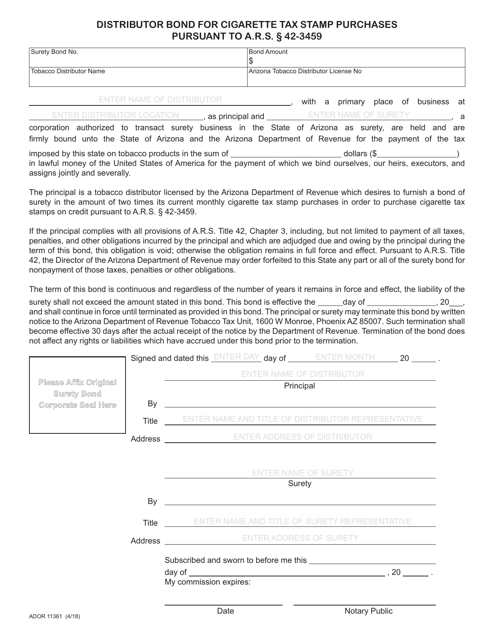

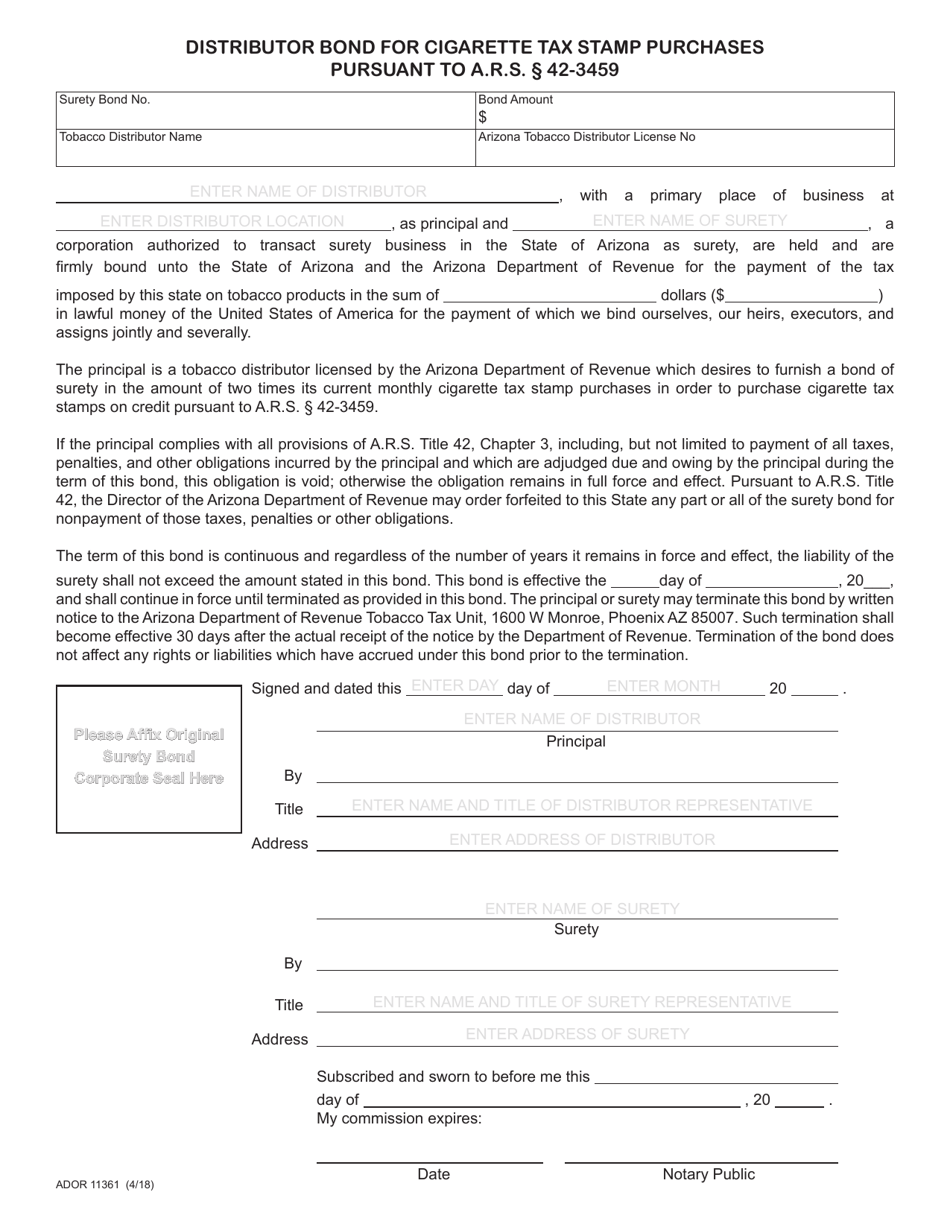

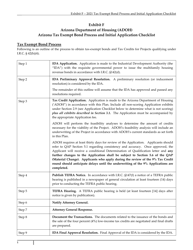

Form ADOR11361 Distributor Bond for Cigarette Tax Stamp Purchases - Arizona

What Is Form ADOR11361?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR11361?

A: Form ADOR11361 is a Distributor Bond used for cigarette tax stamp purchases in Arizona.

Q: Who needs to use Form ADOR11361?

A: Distributors who need to purchase cigarette tax stamps in Arizona need to use Form ADOR11361.

Q: What is the purpose of the Distributor Bond?

A: The Distributor Bond is a financial guarantee that ensures compliance with Arizona's cigarette tax laws.

Q: Are there any fees associated with the Distributor Bond?

A: Yes, there may be fees associated with the Distributor Bond. Please refer to the instructions on the form for more information.

Q: Do I need to submit the Distributor Bond with my cigarette tax stamp purchase?

A: Yes, you need to submit the Distributor Bond along with your cigarette tax stamp purchase.

Q: What happens if I fail to submit the Distributor Bond?

A: Failure to submit the Distributor Bond may result in penalties and enforcement actions by the Arizona Department of Revenue.

Q: Can I cancel the Distributor Bond?

A: Yes, you can cancel the Distributor Bond by submitting a written request to the Arizona Department of Revenue.

Q: How long does the Distributor Bond remain in effect?

A: The Distributor Bond remains in effect until it is cancelled or until the Arizona Department of Revenue releases the bond.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11361 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.