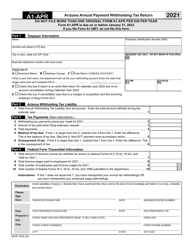

This version of the form is not currently in use and is provided for reference only. Download this version of

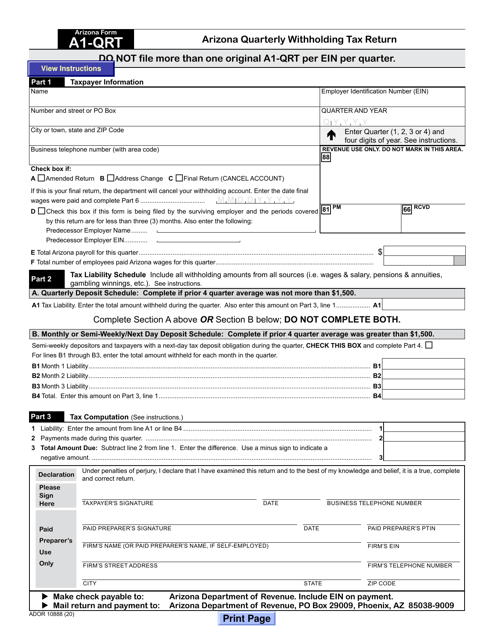

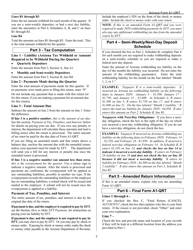

Arizona Form A1-QRT (ADOR10888)

for the current year.

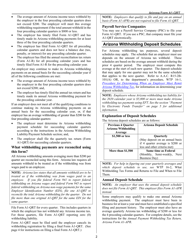

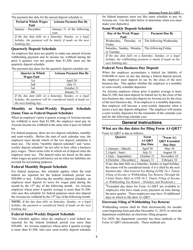

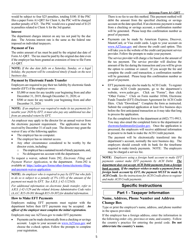

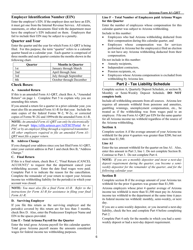

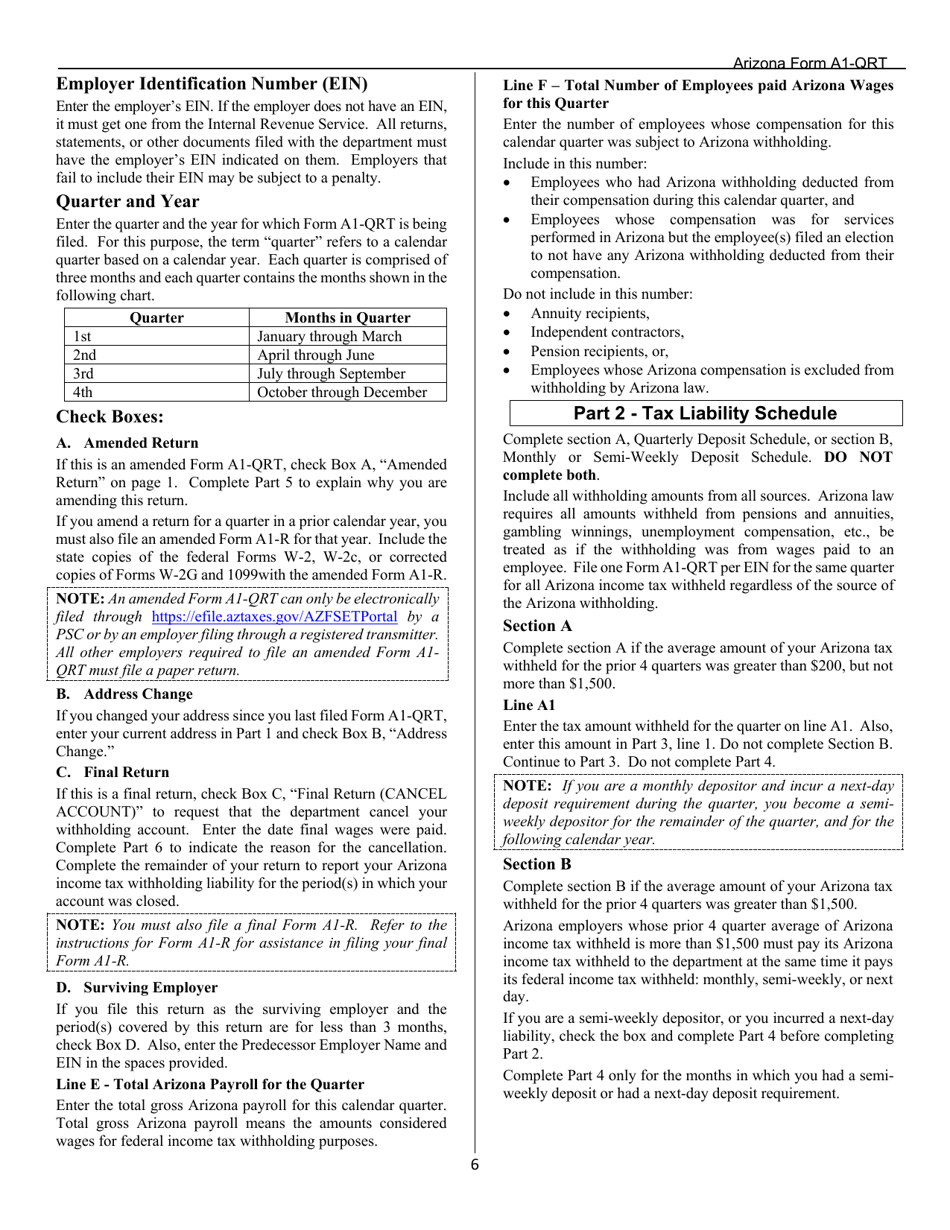

Arizona Form A1-QRT (ADOR10888) Arizona Quarterly Withholding Tax Return - Arizona

What Is Arizona Form A1-QRT (ADOR10888)?

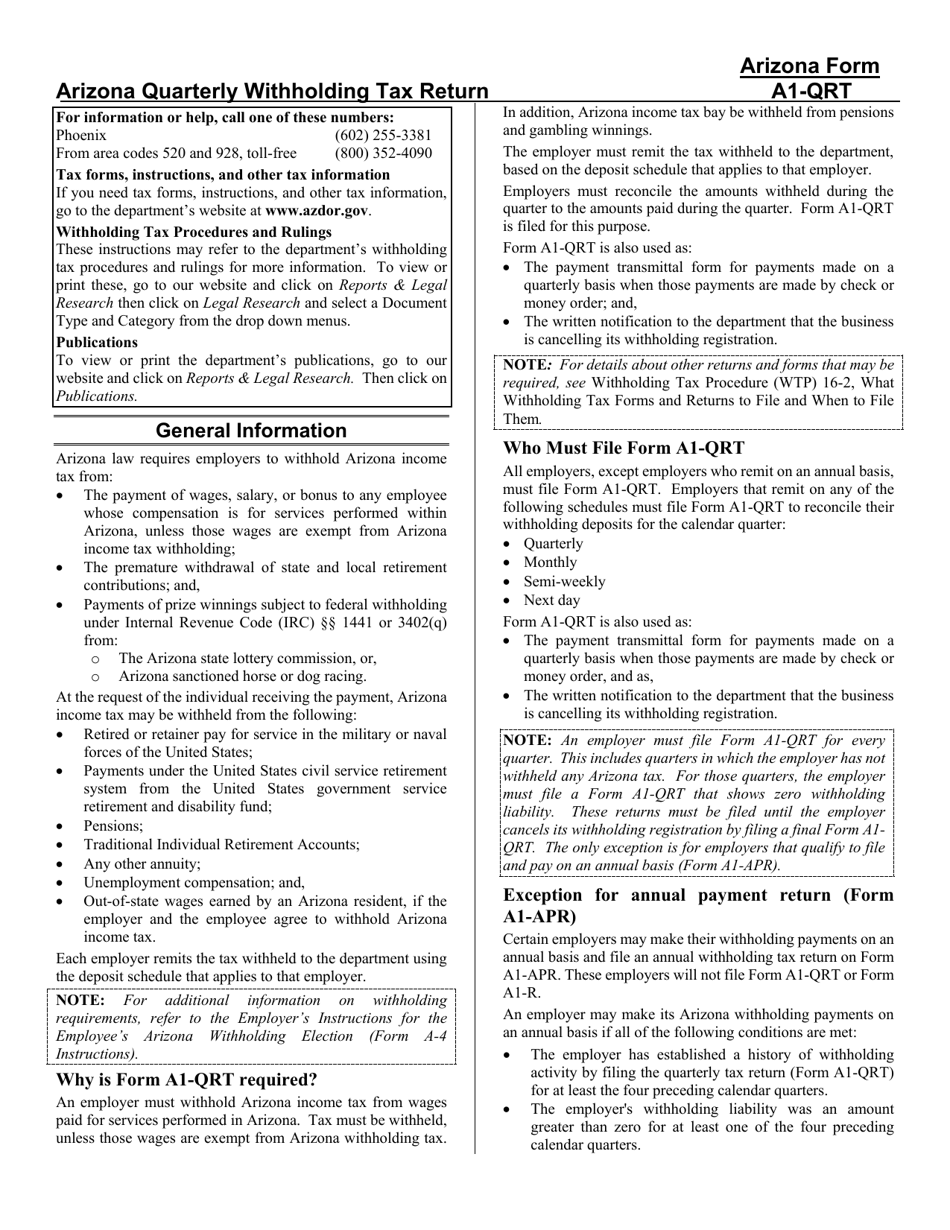

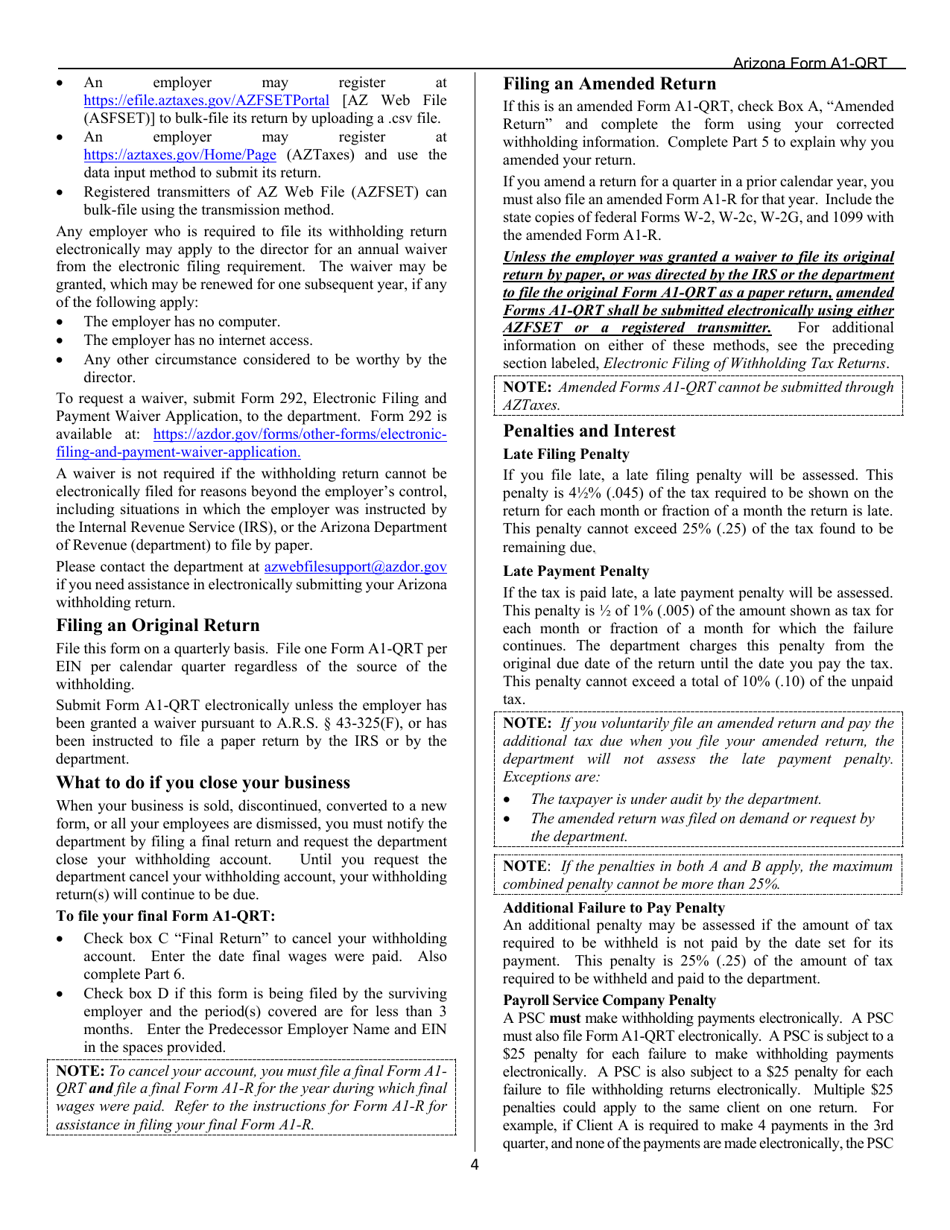

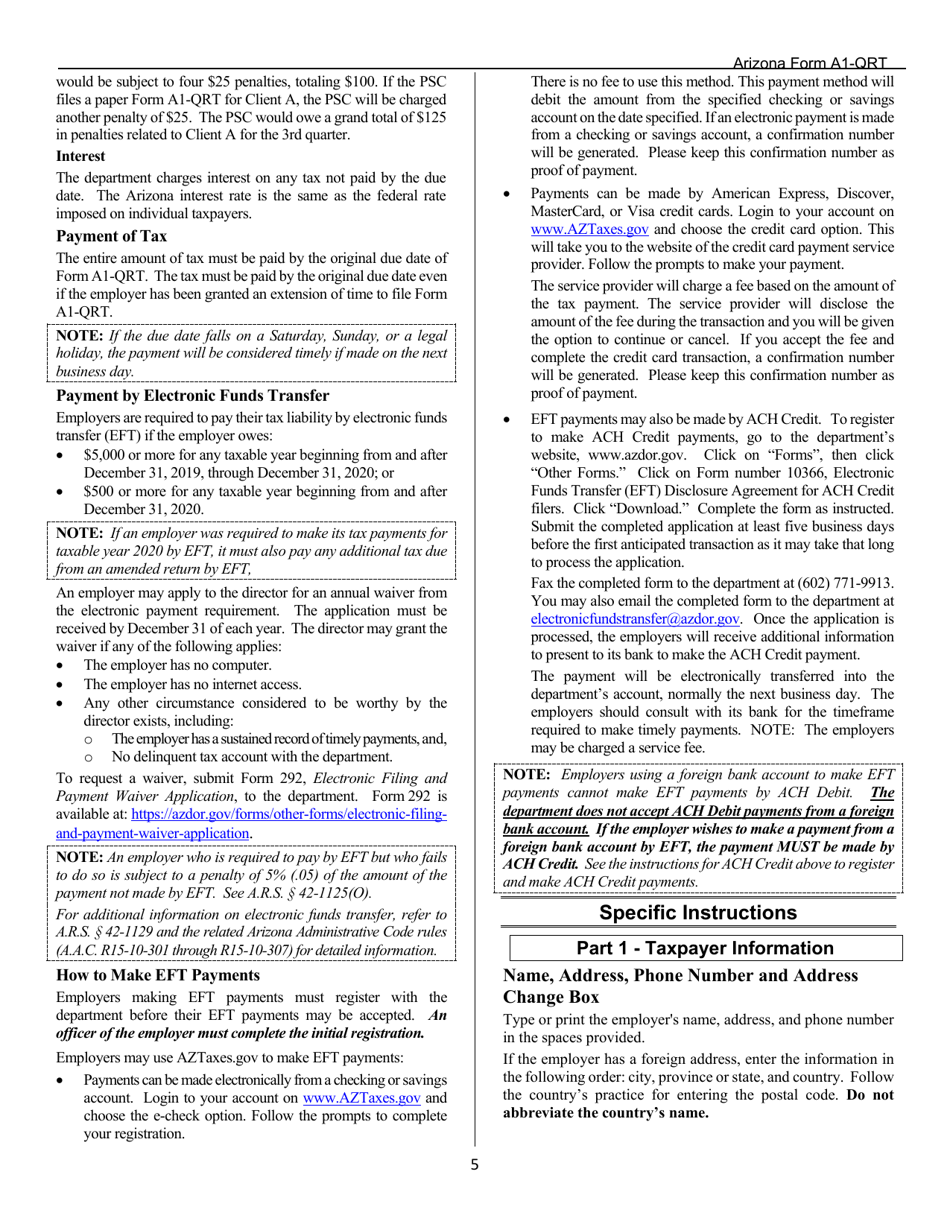

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

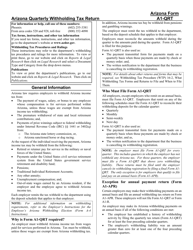

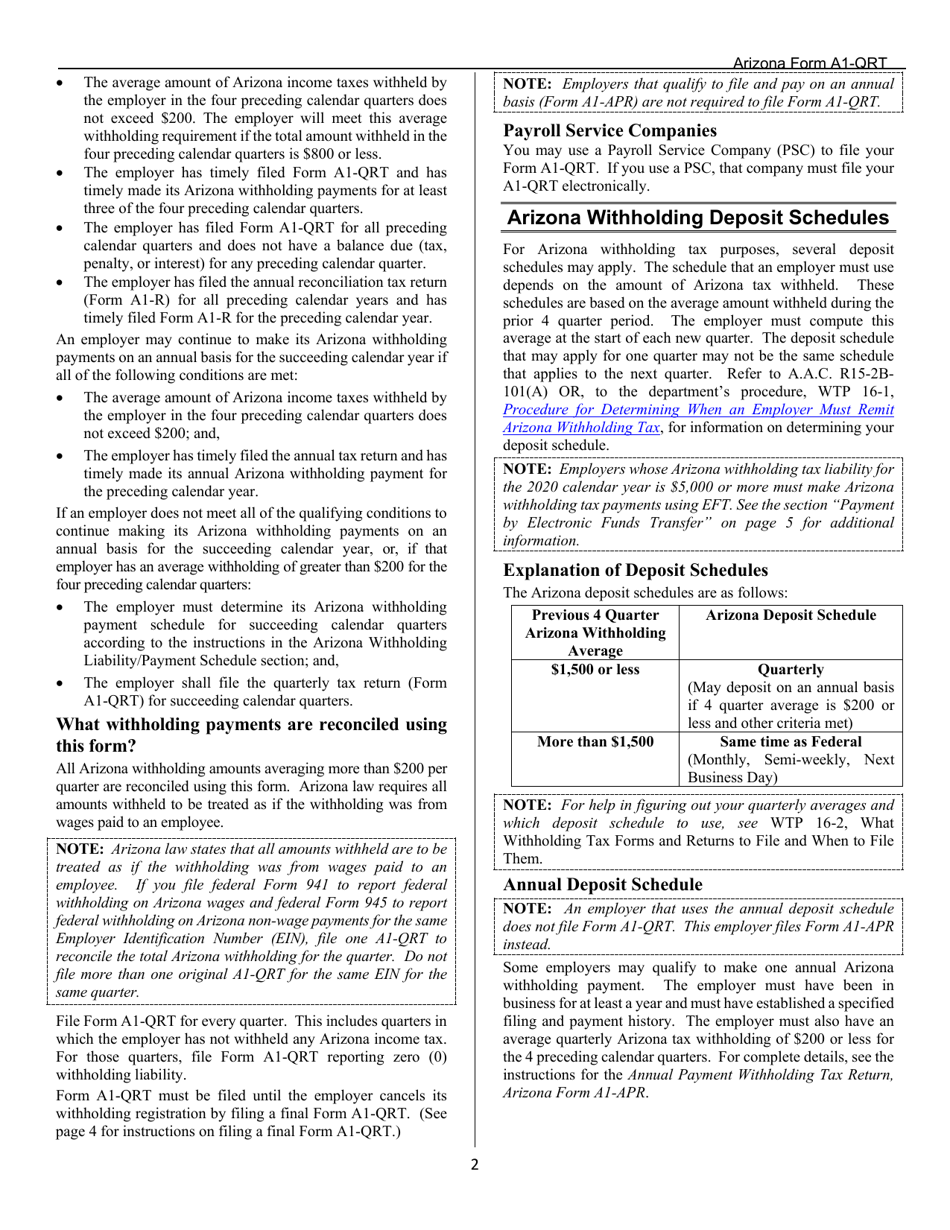

Q: What is the Arizona Form A1-QRT?

A: The Arizona Form A1-QRT is the Quarterly Withholding Tax Return used in Arizona.

Q: Who needs to file the Arizona Form A1-QRT?

A: Employers in Arizona who have employees subject to withholding tax need to file the Arizona Form A1-QRT.

Q: What is the purpose of the Arizona Form A1-QRT?

A: The purpose of the Arizona Form A1-QRT is to report the amount of income tax withheld from employees' wages and remit the withheld taxes to the Arizona Department of Revenue.

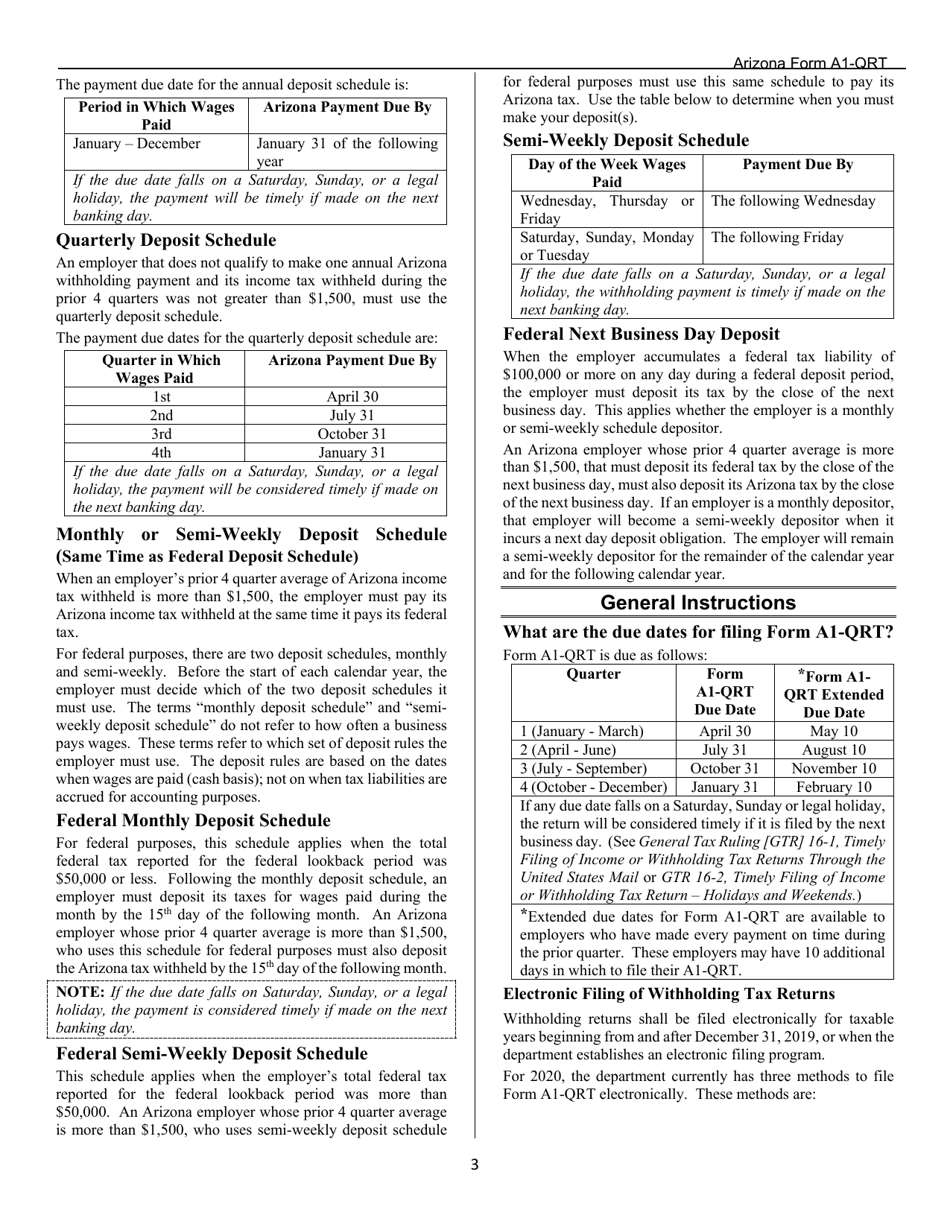

Q: When is the due date for filing the Arizona Form A1-QRT?

A: The due date for filing the Arizona Form A1-QRT is the last day of the month following the end of the quarter.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form A1-QRT (ADOR10888) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.