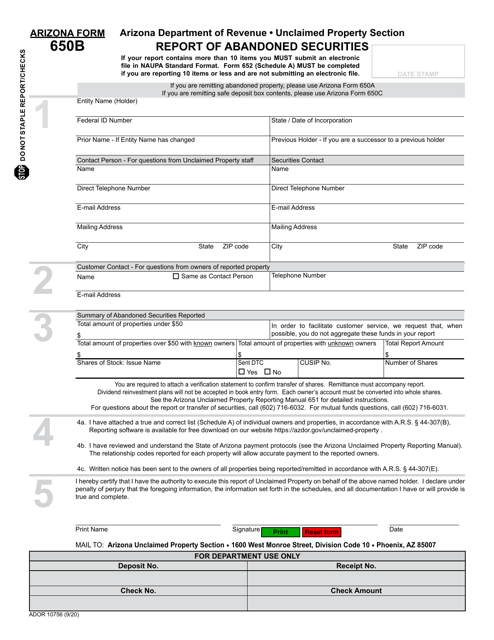

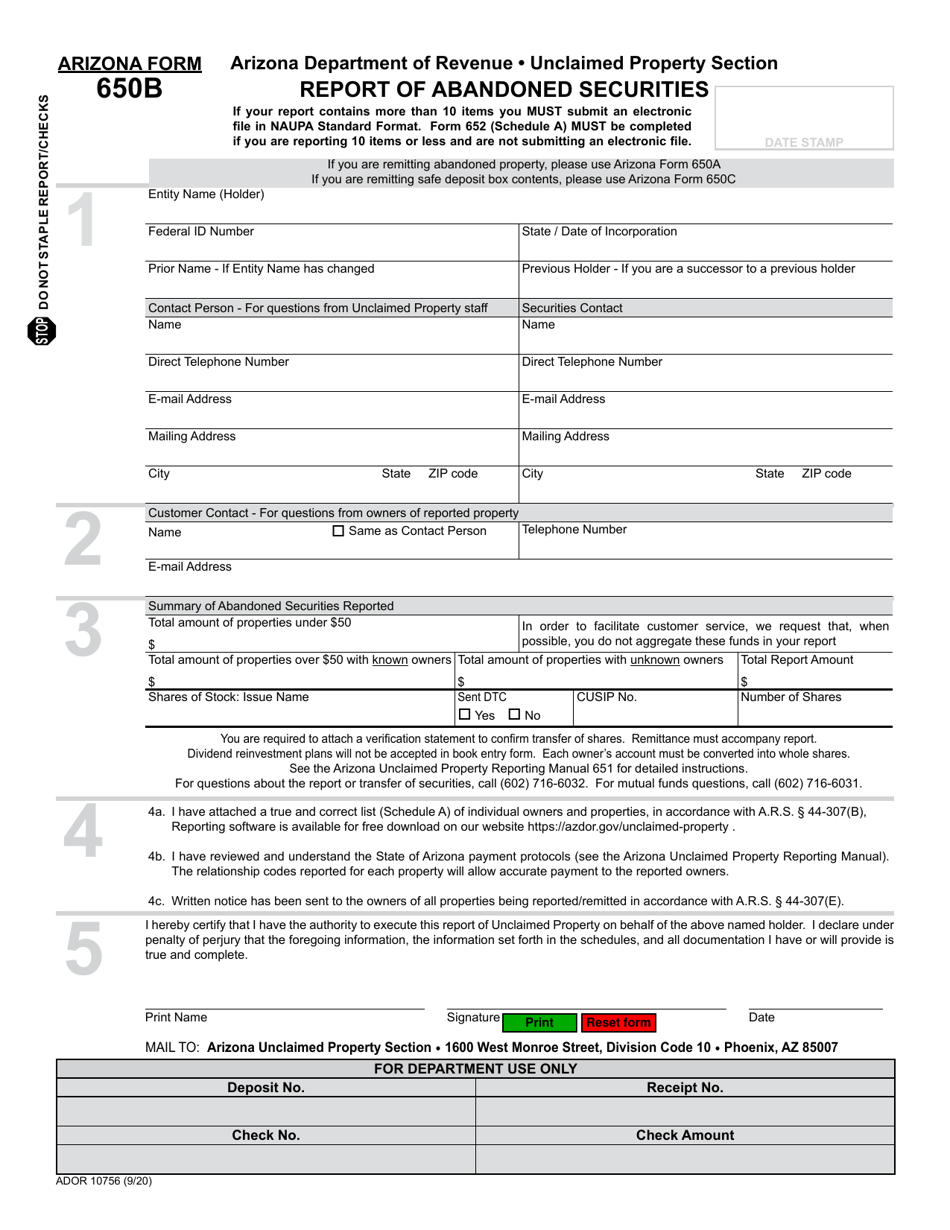

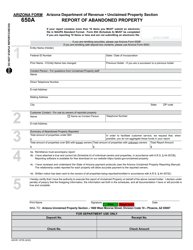

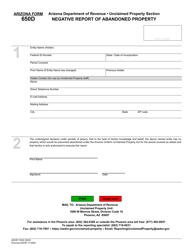

Arizona Form 650B (ADOR10756) Report of Abandoned Securities - Arizona

What Is Arizona Form 650B (ADOR10756)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 650B?

A: Arizona Form 650B is a report used to declare abandoned securities in the state of Arizona.

Q: Who needs to file Arizona Form 650B?

A: Individuals or entities holding abandoned securities in Arizona need to file Arizona Form 650B.

Q: What are abandoned securities?

A: Abandoned securities are securities that have been unclaimed or untouched for a certain period of time.

Q: When is Arizona Form 650B due?

A: Arizona Form 650B is generally due by November 1st of each year.

Q: What information is required on Arizona Form 650B?

A: Arizona Form 650B requires information about the abandoned securities, including the name and address of the owner, description of the securities, and any attempts to locate the owner.

Q: Are there any penalties for not filing Arizona Form 650B?

A: Yes, failure to file Arizona Form 650B can result in penalties and interest.

Q: Can I file Arizona Form 650B if I don't have any abandoned securities?

A: No, you are only required to file Arizona Form 650B if you have abandoned securities to report.

Q: Is Arizona Form 650B specific to Arizona residents only?

A: No, Arizona Form 650B applies to anyone holding abandoned securities in Arizona, regardless of residency.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 650B (ADOR10756) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.