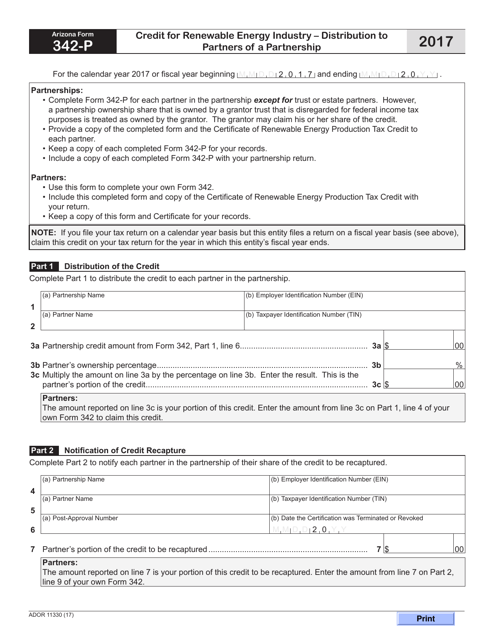

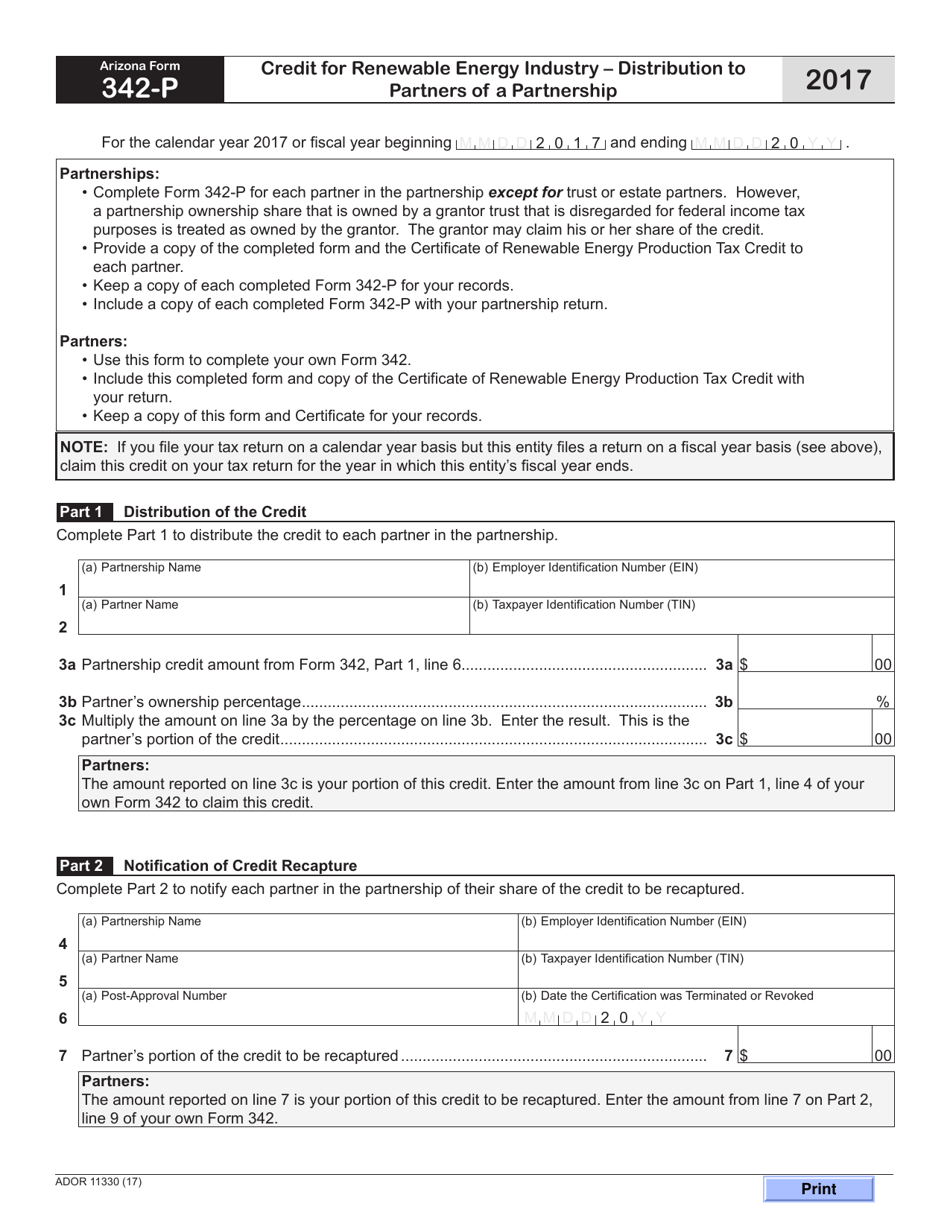

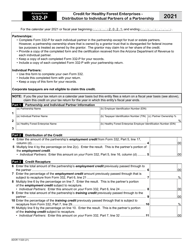

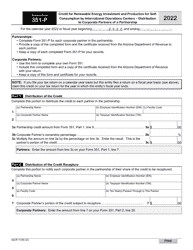

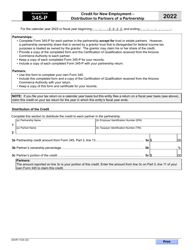

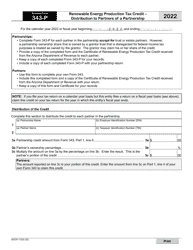

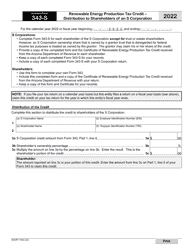

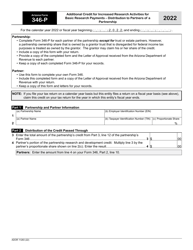

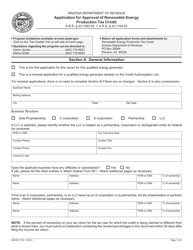

Arizona Form 342-P (ADOR11330) Credit for Renewable Energy Industry - Distribution to Partners of a Partnership - Arizona

What Is Arizona Form 342-P (ADOR11330)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 342-P?

A: Arizona Form 342-P is a tax form used to claim the Credit for Renewable Energy Industry - Distribution to Partners of a Partnership in Arizona.

Q: What is the purpose of Form 342-P?

A: The purpose of Form 342-P is to provide partners of a partnership with a means to claim the Credit for Renewable Energy Industry in Arizona.

Q: Who is eligible to use Form 342-P?

A: Partnerships in Arizona that meet the criteria for the Credit for Renewable Energy Industry can use Form 342-P.

Q: What is the Credit for Renewable Energy Industry?

A: The Credit for Renewable Energy Industry is a tax incentive provided by Arizona for businesses involved in renewable energy production or distribution.

Q: What information is required on Form 342-P?

A: Form 342-P requires partnership information, details of the renewable energy project, and calculation of the credit to be claimed.

Q: Are there any filing deadlines for Form 342-P?

A: Yes, Form 342-P must be filed by the due date for filing the partnership's Arizona income tax return.

Q: Can I claim the credit if I am not a partner in a partnership?

A: No, the Credit for Renewable Energy Industry - Distribution to Partners of a Partnership is specifically for partners of a partnership in Arizona.

Q: What are the benefits of claiming the Credit for Renewable Energy Industry?

A: Claiming the credit can reduce the tax liability of partners in a partnership engaged in renewable energy production or distribution in Arizona.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are limitations and restrictions on the Credit for Renewable Energy Industry. It is important to review the instructions and guidelines provided with Form 342-P.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 342-P (ADOR11330) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.