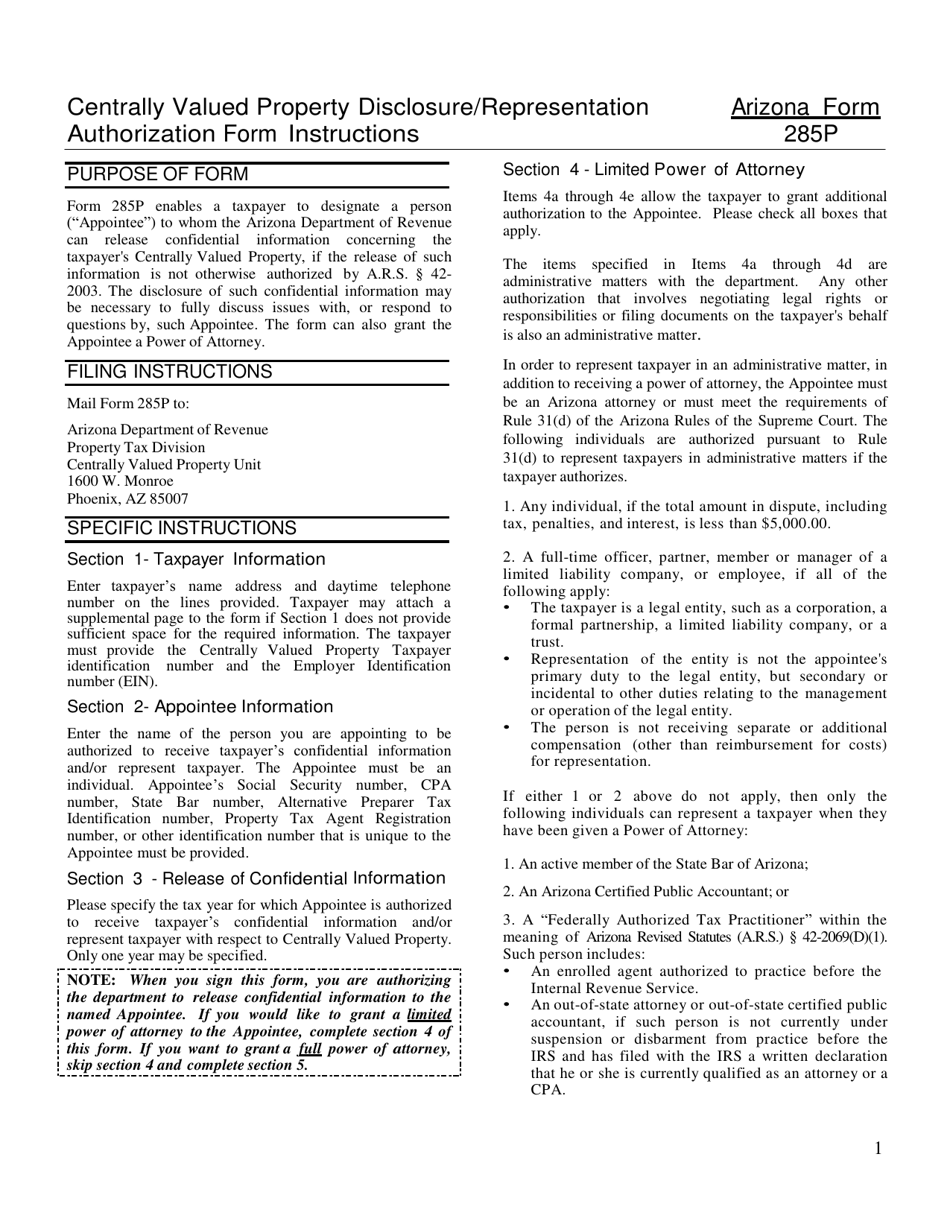

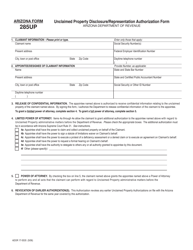

Instructions for Arizona Form 285P, ADOR82285P Centrally Valued Property Disclosure / Representation Authorization Form - Arizona

This document contains official instructions for Arizona Form 285P , and Form ADOR82285P . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 285P (ADOR82285P) is available for download through this link.

FAQ

Q: What is Arizona Form 285P?

A: Arizona Form 285P is the ADOR82285P Centrally Valued Property Disclosure/Representation Authorization Form for Arizona.

Q: What is the purpose of Arizona Form 285P?

A: The purpose of Arizona Form 285P is to disclose and authorize representation for centrally valued property in Arizona.

Q: What information do I need to provide on Arizona Form 285P?

A: You will need to provide information about the centrally valued property, including its location, ownership, and value.

Q: Is Arizona Form 285P mandatory?

A: Yes, if you own centrally valued property in Arizona, you are required to complete and submit Arizona Form 285P.

Q: Are there any filing fees for Arizona Form 285P?

A: No, there are no filing fees for Arizona Form 285P.

Q: What is the deadline for filing Arizona Form 285P?

A: The deadline for filing Arizona Form 285P is typically May 1st of each year.

Q: What happens if I don't file Arizona Form 285P?

A: Failure to file Arizona Form 285P may result in penalties and potential assessment of taxes for the centrally valued property.

Q: Can I get an extension to file Arizona Form 285P?

A: Yes, you can request an extension to file Arizona Form 285P, but it must be done before the May 1st deadline.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.