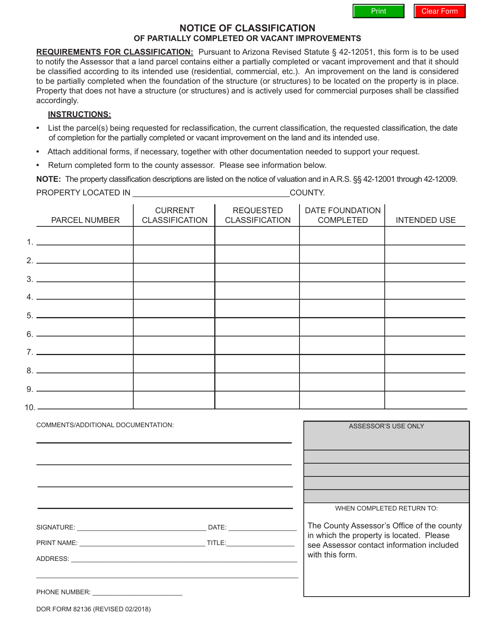

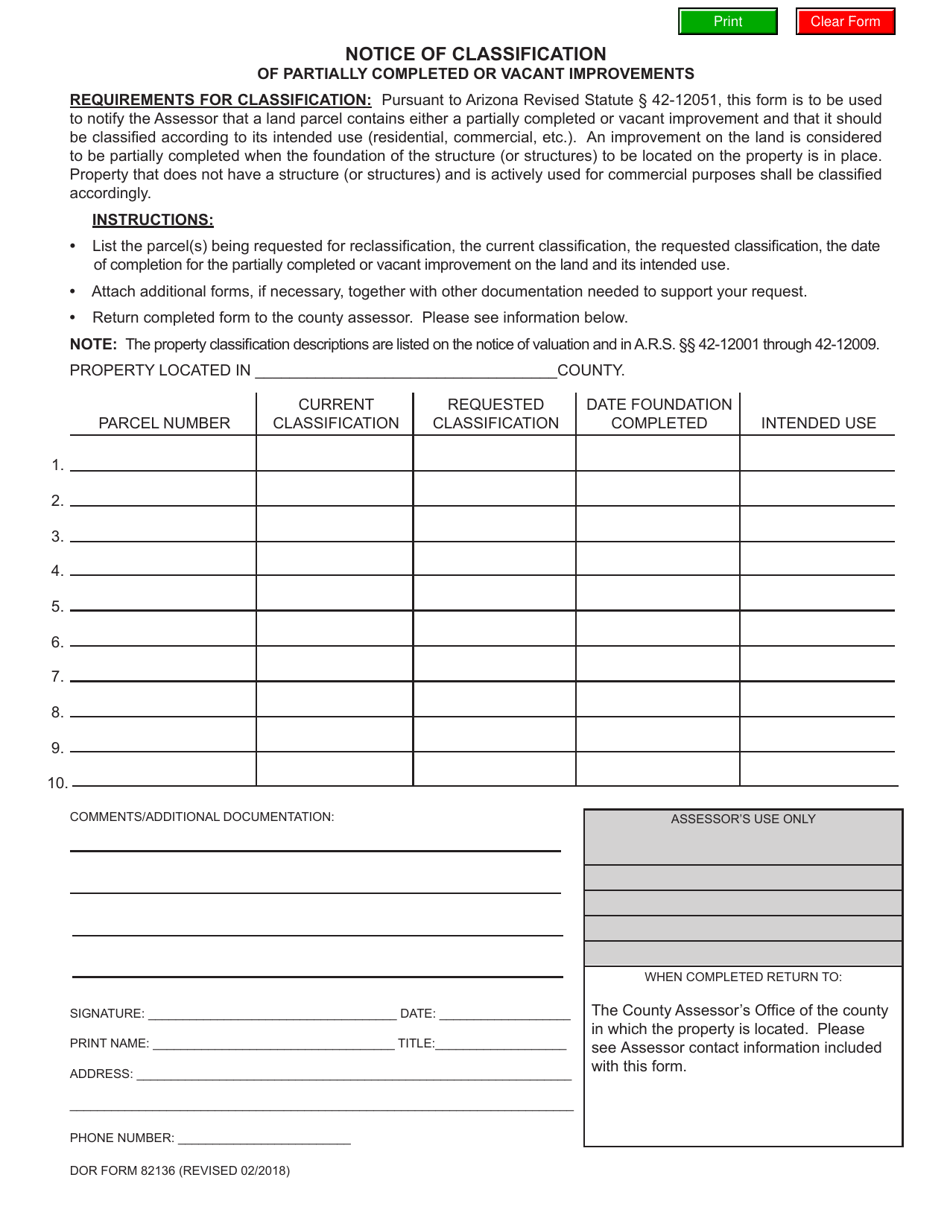

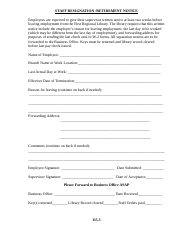

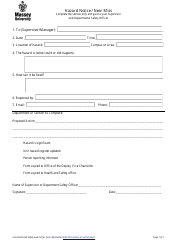

Form DOR82136 Notice of Classification of Partially Completed or Vacant Improvements - Arizona

What Is Form DOR82136?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82136?

A: Form DOR82136 is a notice of classification for partially completed or vacant improvements in Arizona.

Q: Who needs to use Form DOR82136?

A: Property owners or developers who have partially completed or vacant improvements in Arizona need to use Form DOR82136.

Q: What is the purpose of Form DOR82136?

A: The purpose of Form DOR82136 is to notify the Arizona Department of Revenue of the classification of partially completed or vacant improvements for property tax assessment purposes.

Q: When should Form DOR82136 be filed?

A: Form DOR82136 should be filed within 30 days of the completion of construction or the date the property became vacant.

Q: Is there a fee for filing Form DOR82136?

A: There is no fee for filing Form DOR82136.

Q: Are there any penalties for not filing Form DOR82136?

A: Failure to file Form DOR82136 may result in penalties, including the loss of certain tax exemptions or an increase in property taxes.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

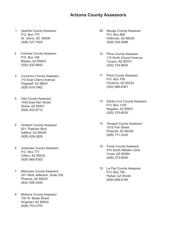

Download a fillable version of Form DOR82136 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.