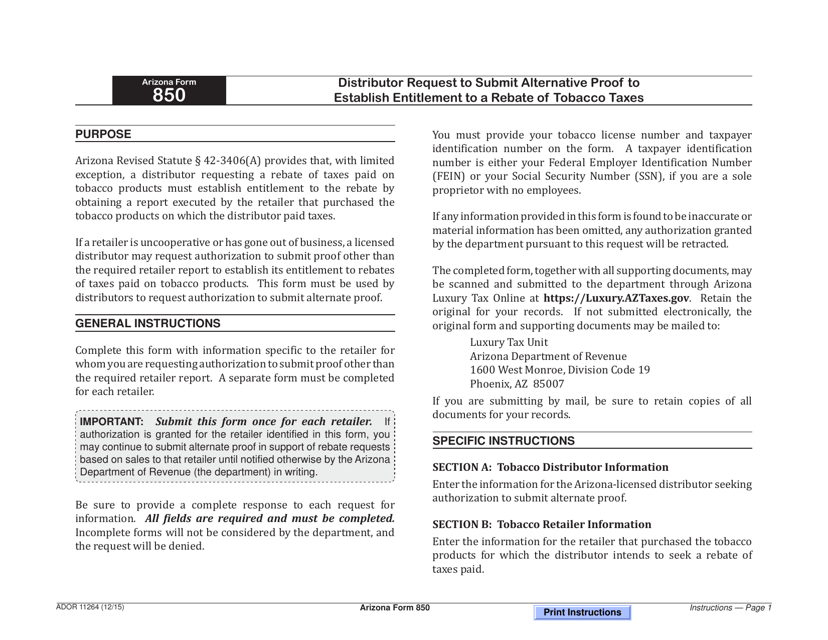

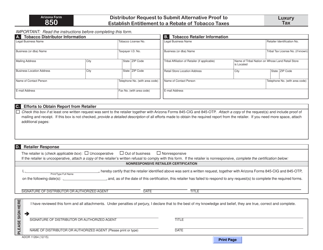

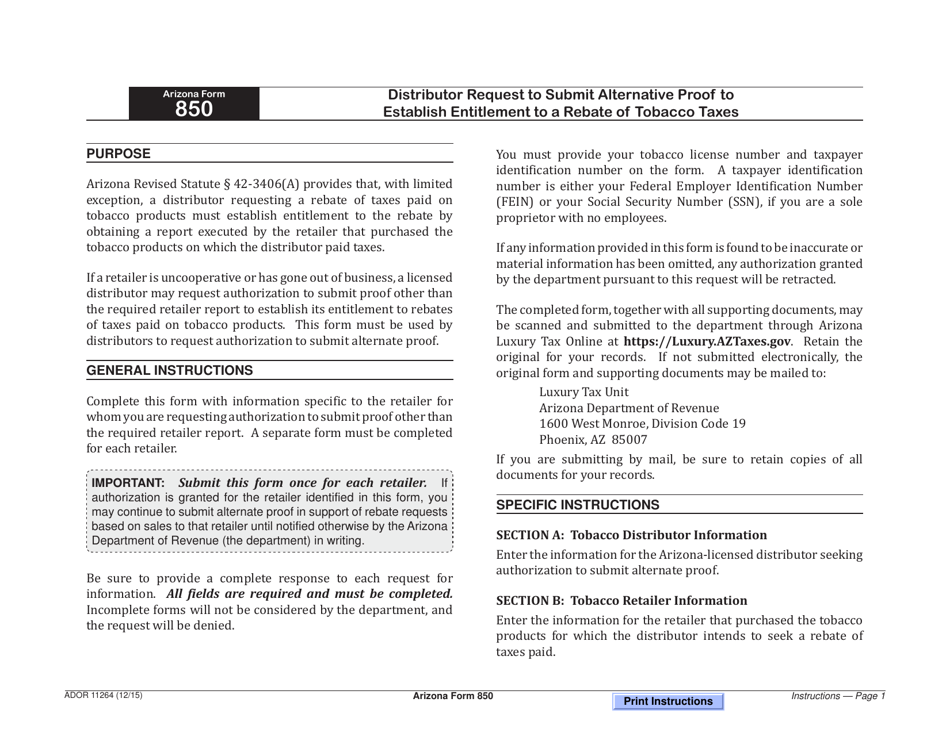

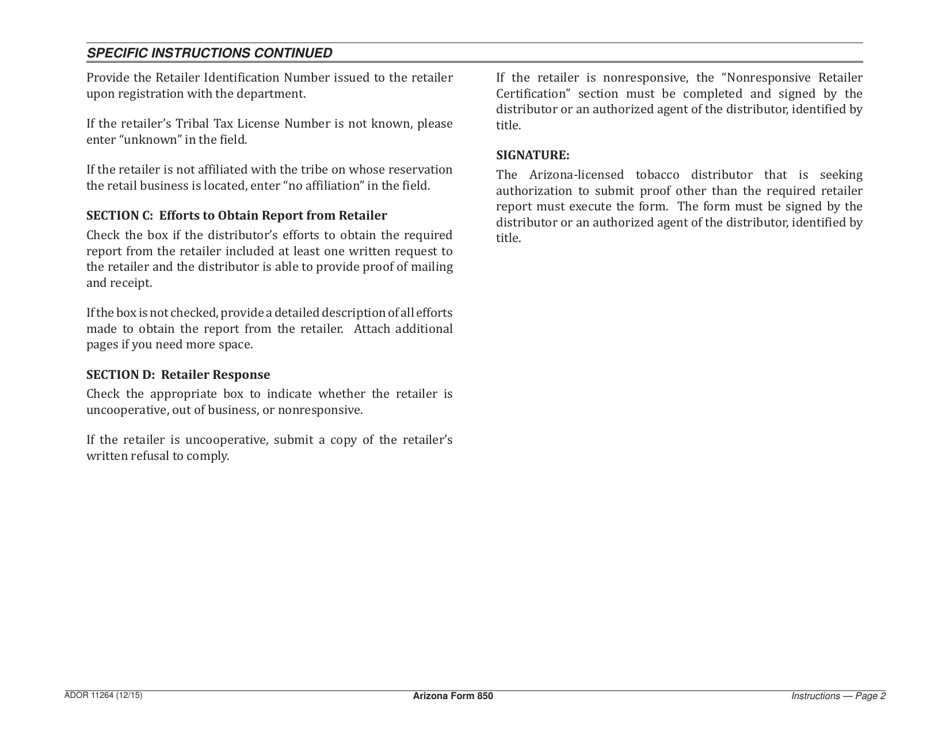

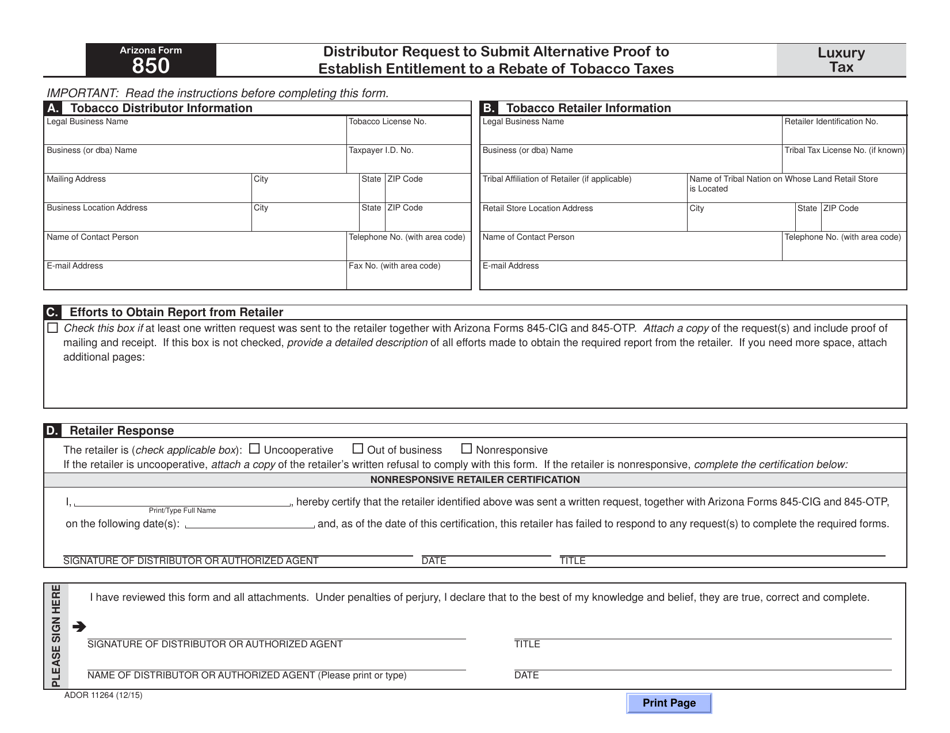

Arizona Form 850 (ADOR11264) Distributor Request to Submit Alternative Proof to Establish Entitlement to a Rebate of Tobacco Taxes - Arizona

What Is Arizona Form 850 (ADOR11264)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 850 (ADOR11264)?

A: It is a form used for Distributor Request to Submit Alternative Proof to Establish Entitlement to a Rebate of Tobacco Taxes in Arizona.

Q: Who can use Arizona Form 850?

A: Distributors who want to provide alternative proof to establish their entitlement to a rebate of tobacco taxes in Arizona can use this form.

Q: What is the purpose of Arizona Form 850?

A: The form is used to request permission to submit alternative proof to establish entitlement to a rebate of tobacco taxes in Arizona.

Q: Is Arizona Form 850 specific to tobacco taxes?

A: Yes, this form is specifically used for rebates of tobacco taxes in Arizona.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 850 (ADOR11264) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.