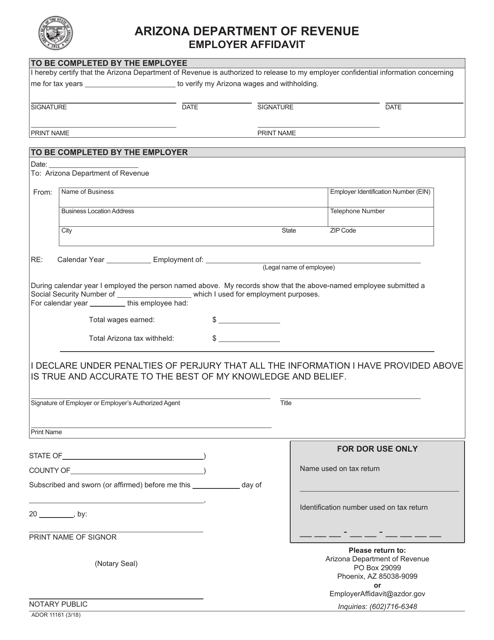

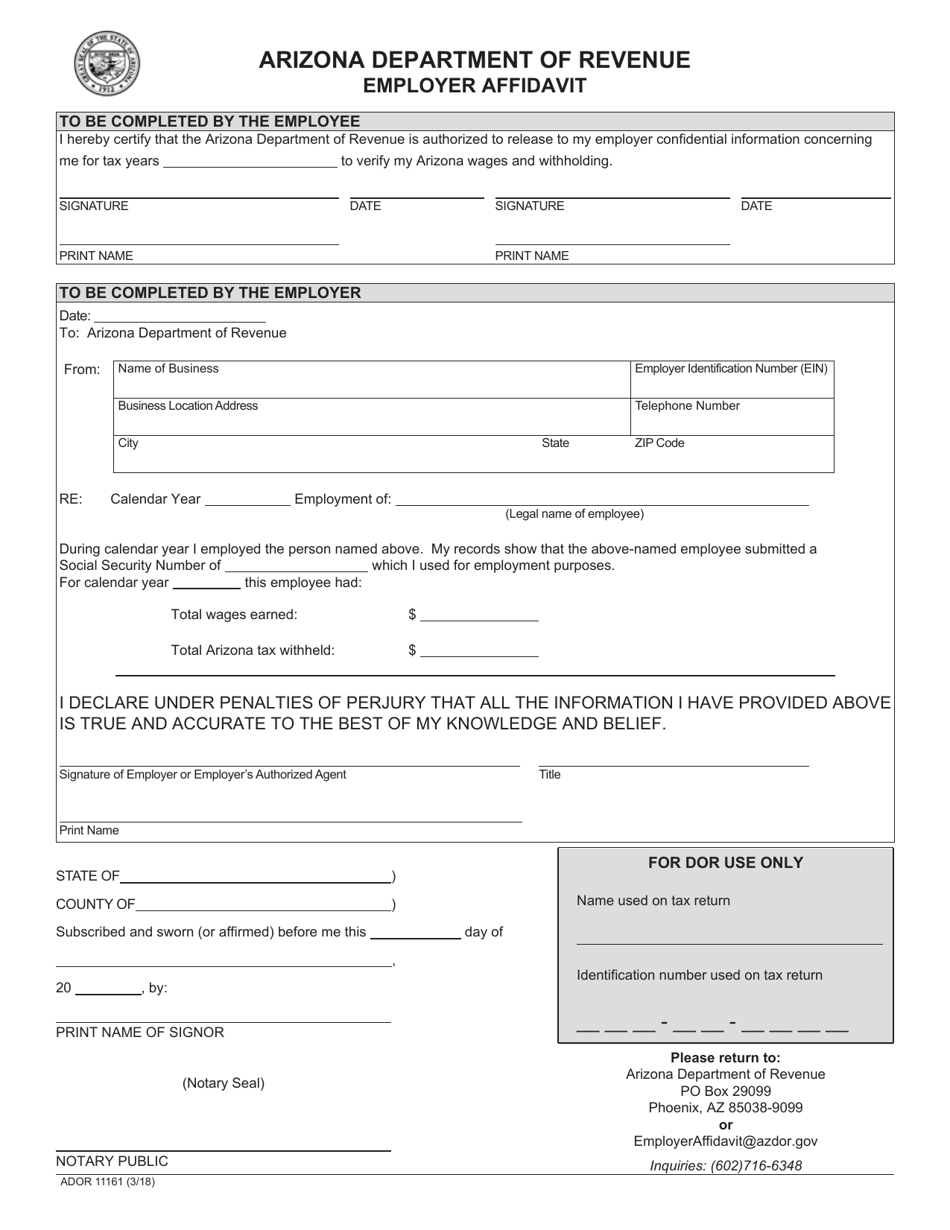

Form ADOR11161 Employer Affidavit - Arizona

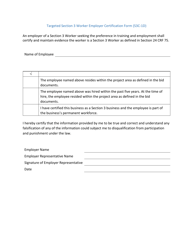

What Is Form ADOR11161?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR11161 Employer Affidavit?

A: Form ADOR11161 Employer Affidavit is a document used in Arizona by employers to provide information about their employees to the Arizona Department of Revenue.

Q: Who needs to fill out Form ADOR11161?

A: Employers in Arizona who are requested by the Arizona Department of Revenue to provide information about their employees need to fill out Form ADOR11161.

Q: What information is required on Form ADOR11161?

A: Form ADOR11161 requires information about the employer, including their name and address, as well as information about the employees, such as their name, social security number, and wages.

Q: Is there a deadline for submitting Form ADOR11161?

A: Yes, the Arizona Department of Revenue will provide a deadline for submitting Form ADOR11161 to employers when it requests the information.

Q: What happens if I don't submit Form ADOR11161?

A: Failure to submit Form ADOR11161 as requested by the Arizona Department of Revenue may result in penalties or other consequences.

Q: Can I get an extension for filing Form ADOR11161?

A: Extensions for filing Form ADOR11161 may be allowed in certain circumstances. It's best to contact the Arizona Department of Revenue for more information.

Q: Is Form ADOR11161 used for both Arizona and Canada?

A: No, Form ADOR11161 is specific to employers in Arizona and is not used for reporting employee information to Canada.

Q: What should I do if I have further questions about Form ADOR11161?

A: If you have further questions about Form ADOR11161, you should contact the Arizona Department of Revenue for assistance.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADOR11161 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.