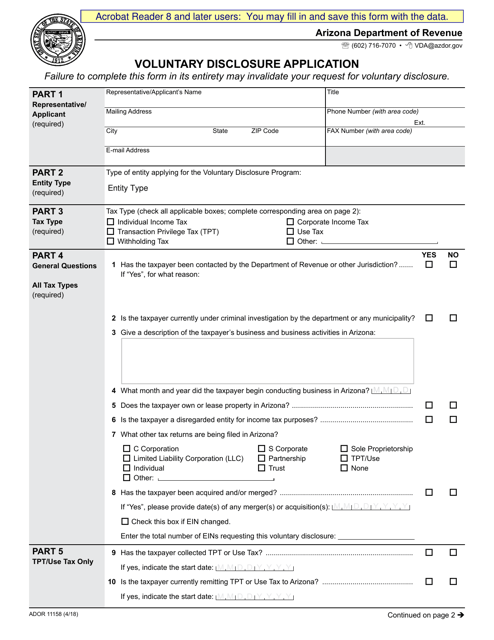

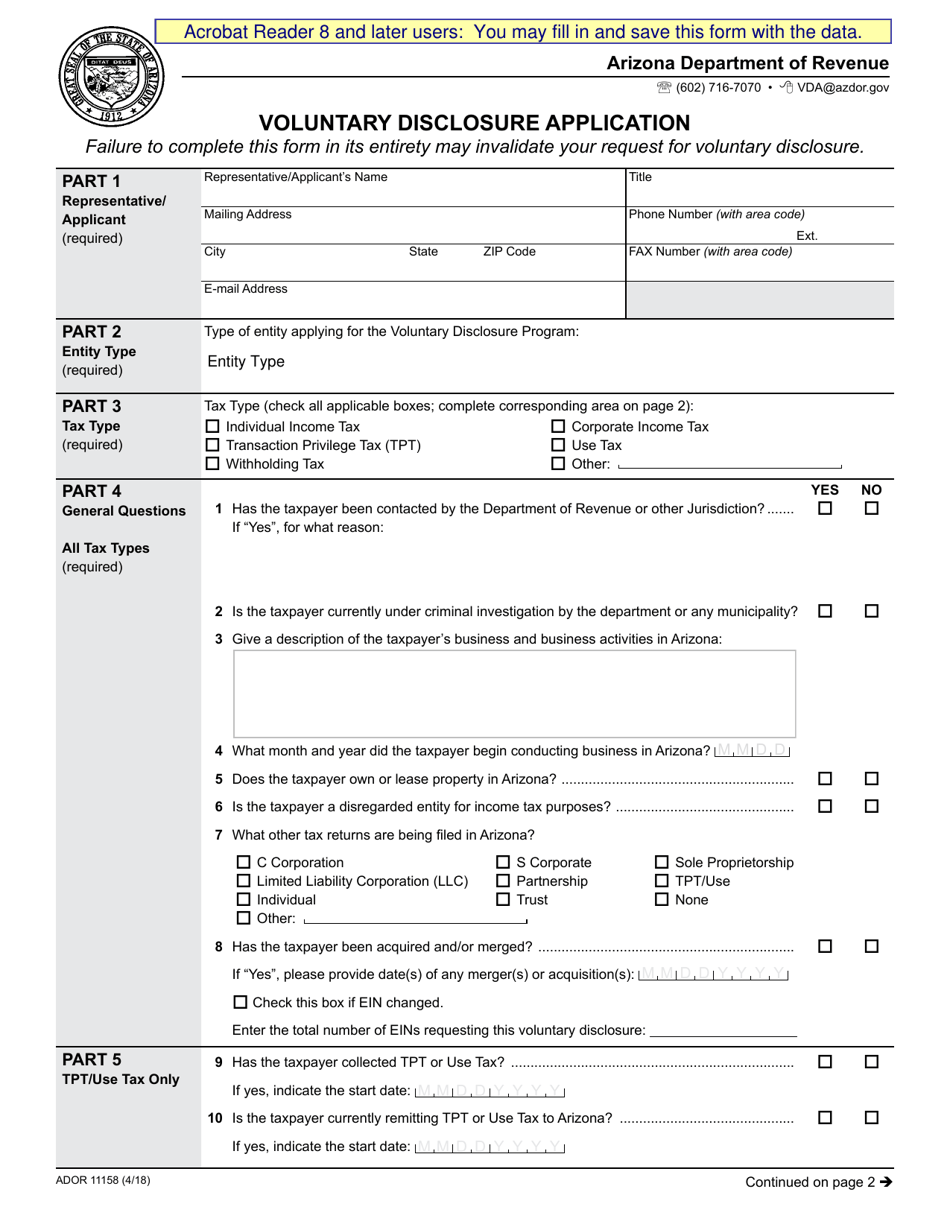

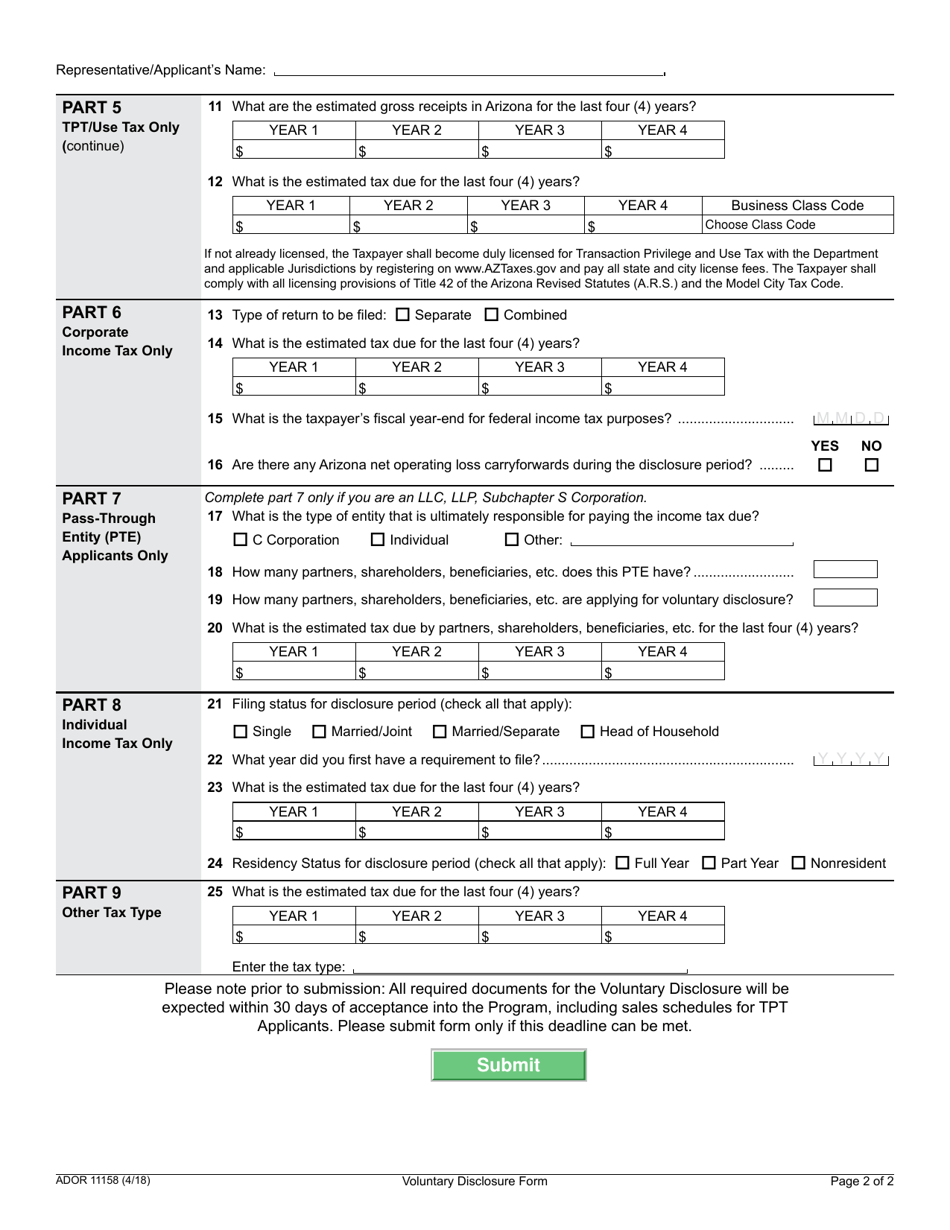

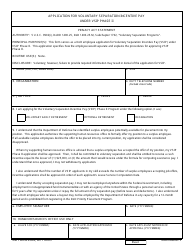

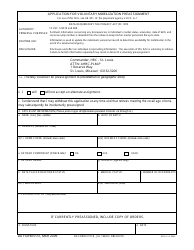

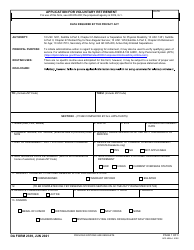

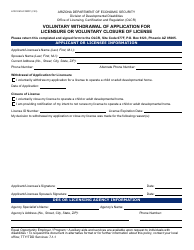

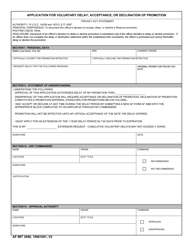

Form ADOR11158 Voluntary Disclosure Application - Arizona

What Is Form ADOR11158?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

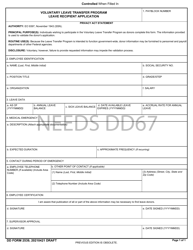

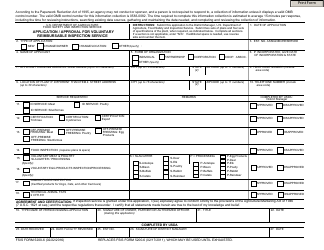

Q: What is the Form ADOR11158?

A: Form ADOR11158 is a Voluntary Disclosure Application in Arizona.

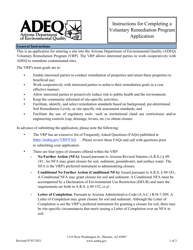

Q: What is a Voluntary Disclosure Application?

A: A Voluntary Disclosure Application is a process by which taxpayers can come forward voluntarily and disclose any previously unreported or underreported taxes.

Q: Who can file a Form ADOR11158?

A: Any taxpayer who has unreported or underreported taxes in Arizona can file a Form ADOR11158.

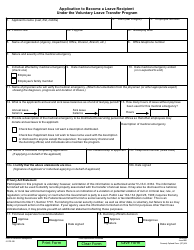

Q: What is the purpose of filing a Form ADOR11158?

A: The purpose of filing a Form ADOR11158 is to correct any tax errors or omissions and come into compliance with Arizona tax laws.

Q: Is filing a Form ADOR11158 mandatory?

A: Filing a Form ADOR11158 is not mandatory, but it is recommended for taxpayers who have unreported or underreported taxes.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11158 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.