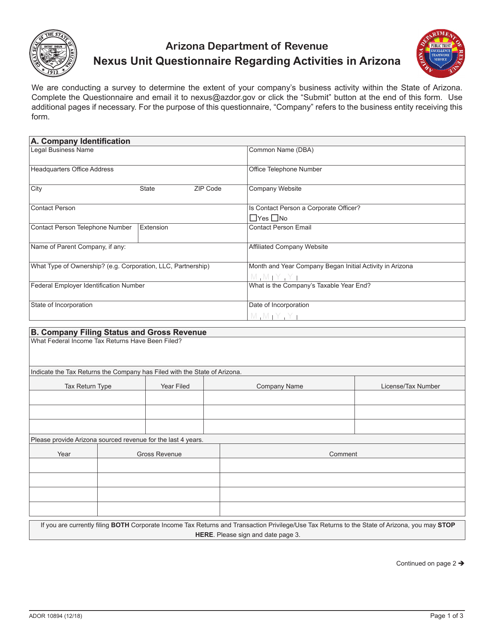

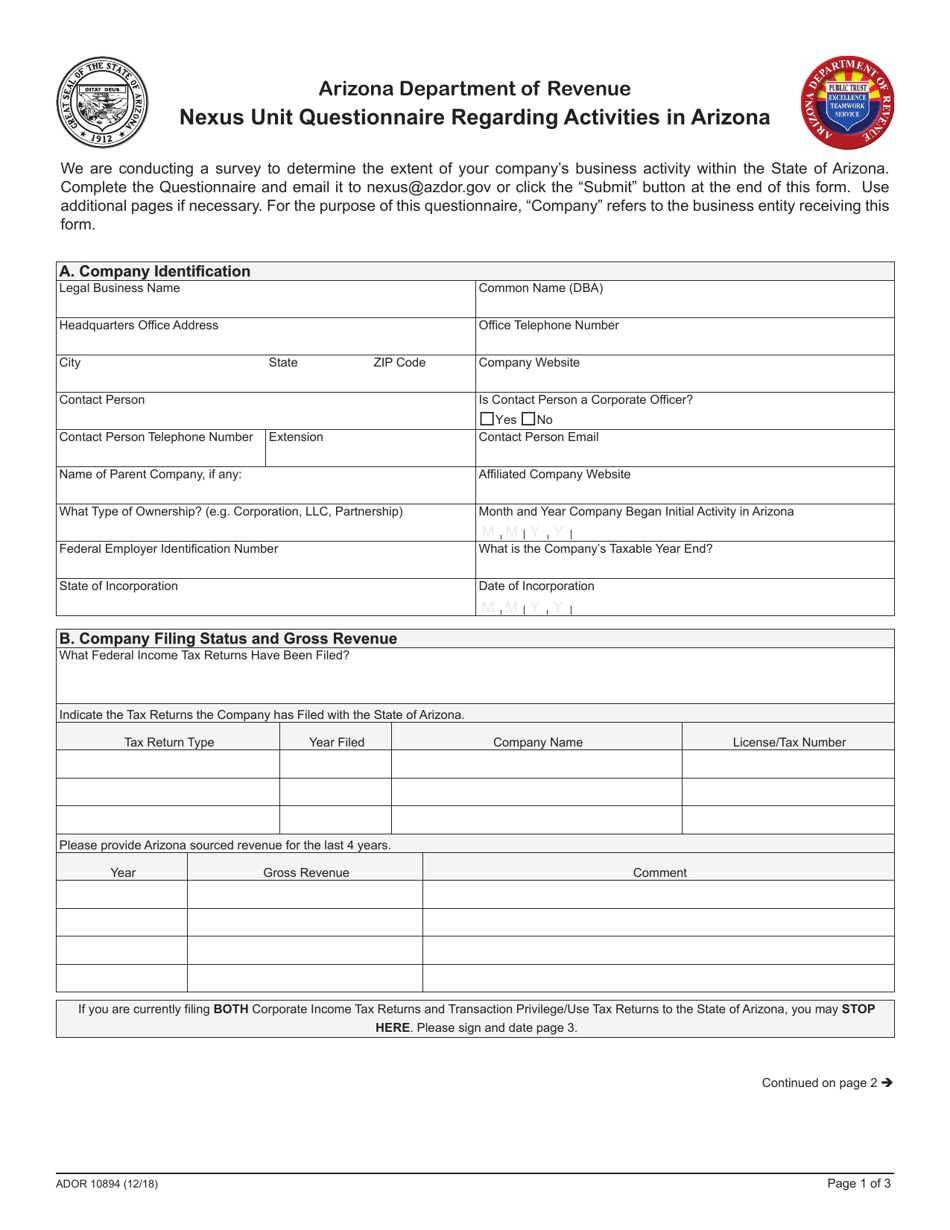

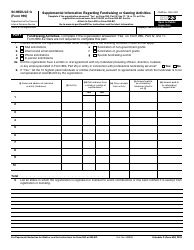

Form ADOR10894 Nexus Unit Questionnaire Regarding Activities in Arizona - Arizona

What Is Form ADOR10894?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR10894?

A: Form ADOR10894 is a Nexus Unit Questionnaire specifically for businesses that have activities in Arizona.

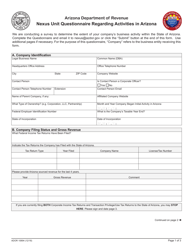

Q: Who needs to complete Form ADOR10894?

A: Businesses that have activities in Arizona need to complete Form ADOR10894.

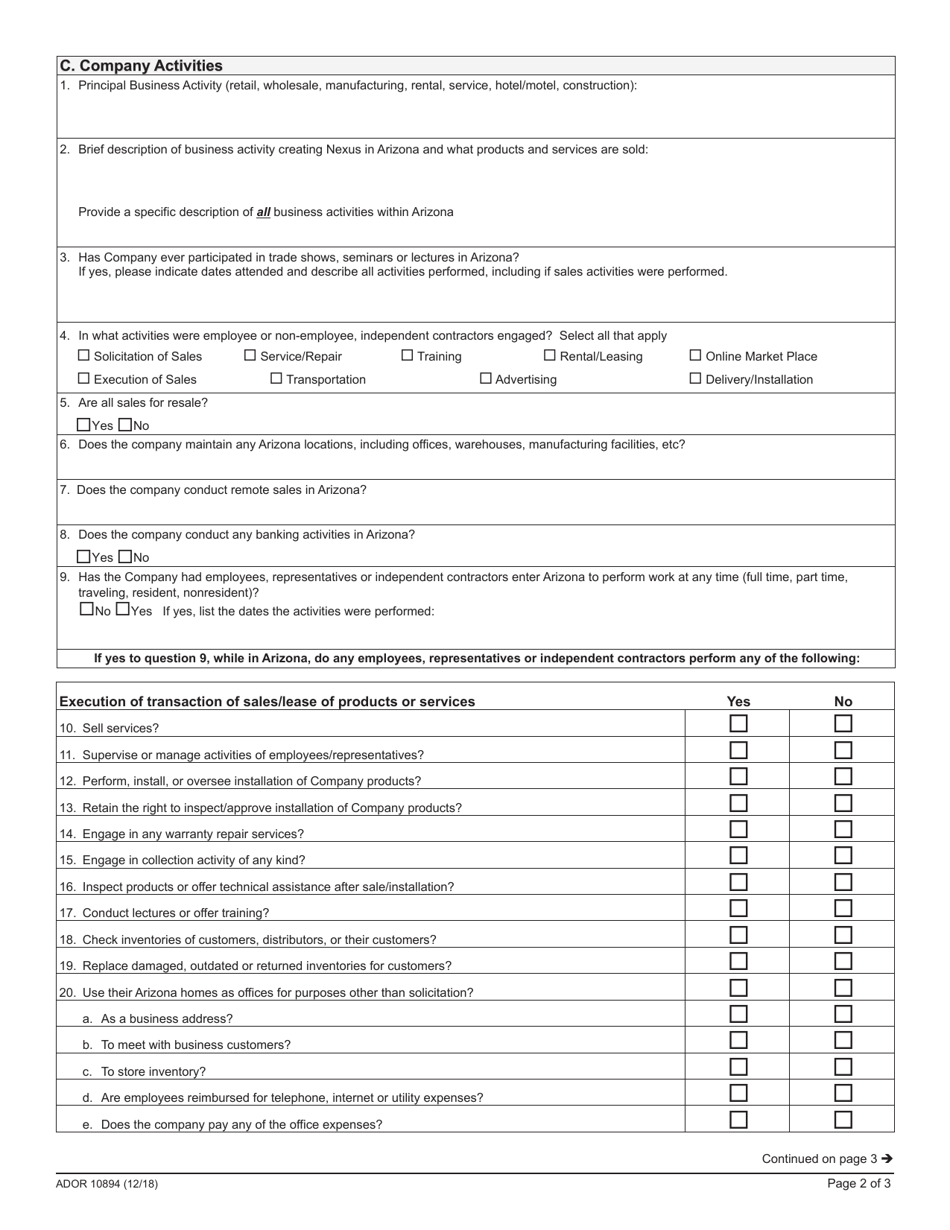

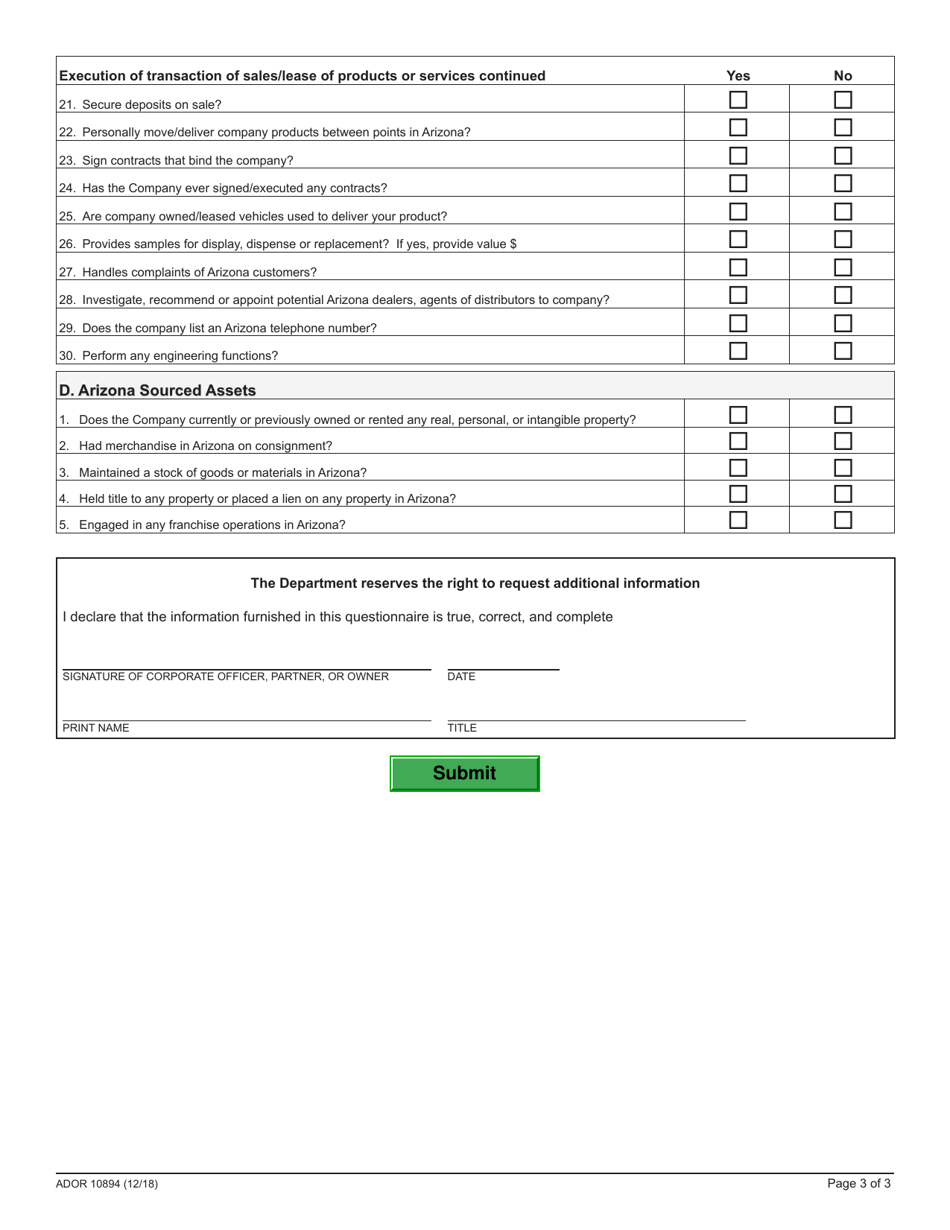

Q: What is the purpose of Form ADOR10894?

A: The purpose of Form ADOR10894 is to determine if a business has nexus, or a connection, with Arizona, and if they are required to register and pay taxes in the state.

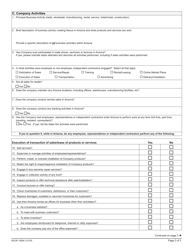

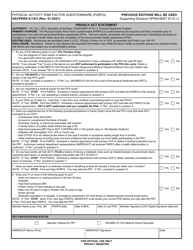

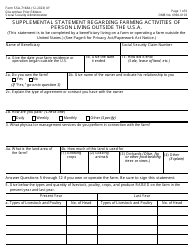

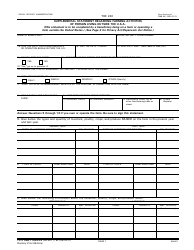

Q: How do I complete Form ADOR10894?

A: You need to answer all the questions on the form regarding your business activities in Arizona and provide any requested documentation.

Q: What happens after I submit Form ADOR10894?

A: After you submit Form ADOR10894, the Arizona Department of Revenue will review your questionnaire and determine if you have nexus in Arizona.

Q: What if I have nexus in Arizona?

A: If you have nexus in Arizona, you will be required to register with the Arizona Department of Revenue and comply with their tax obligations.

Q: What if I do not have nexus in Arizona?

A: If you do not have nexus in Arizona, you will not be required to register or pay taxes in the state.

Q: Is there a deadline to submit Form ADOR10894?

A: There is no specific deadline mentioned for submitting Form ADOR10894. However, it is recommended to submit the form as soon as possible if you have activities in Arizona.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR10894 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.