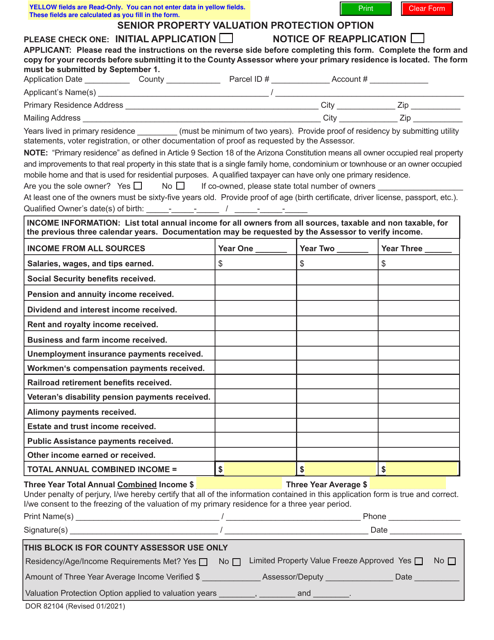

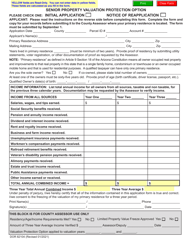

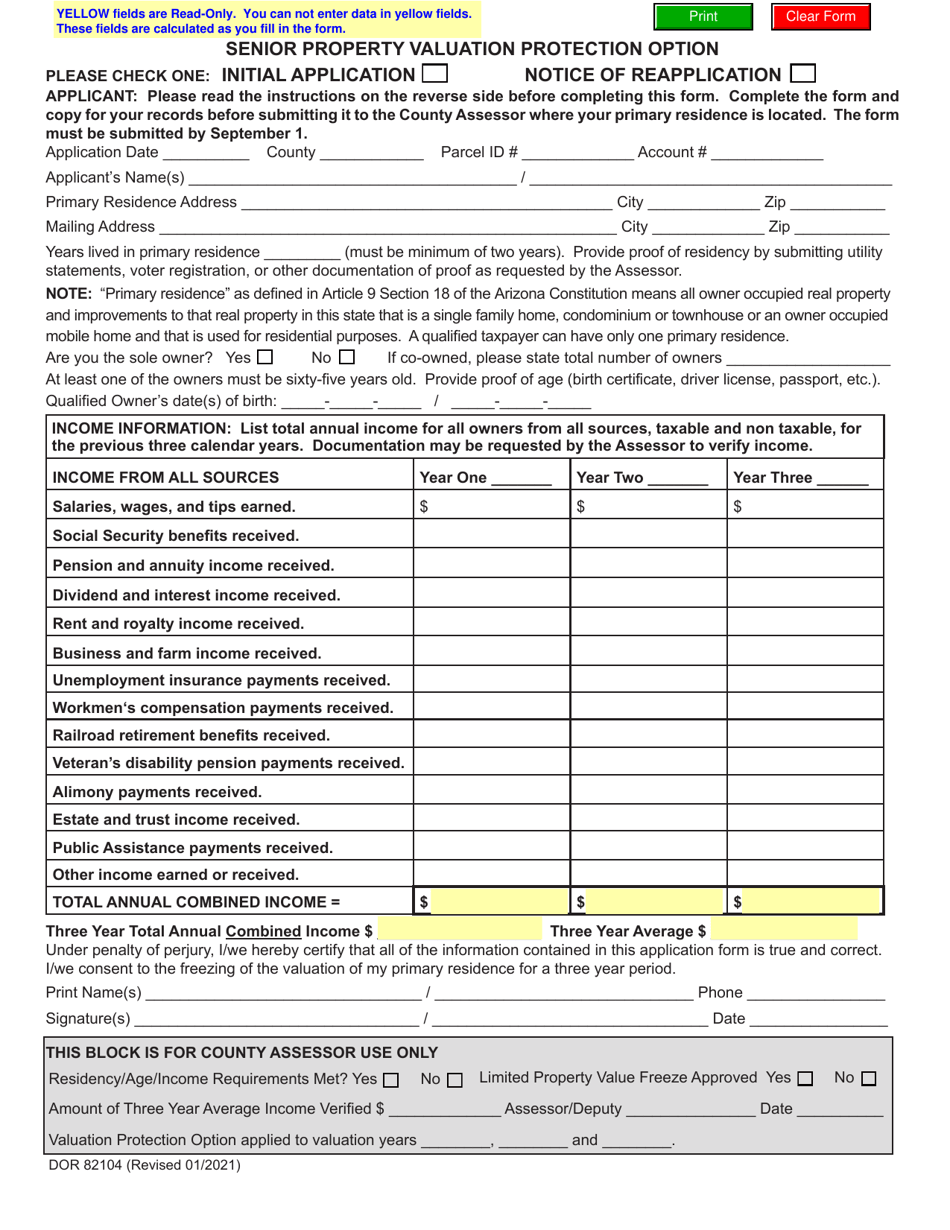

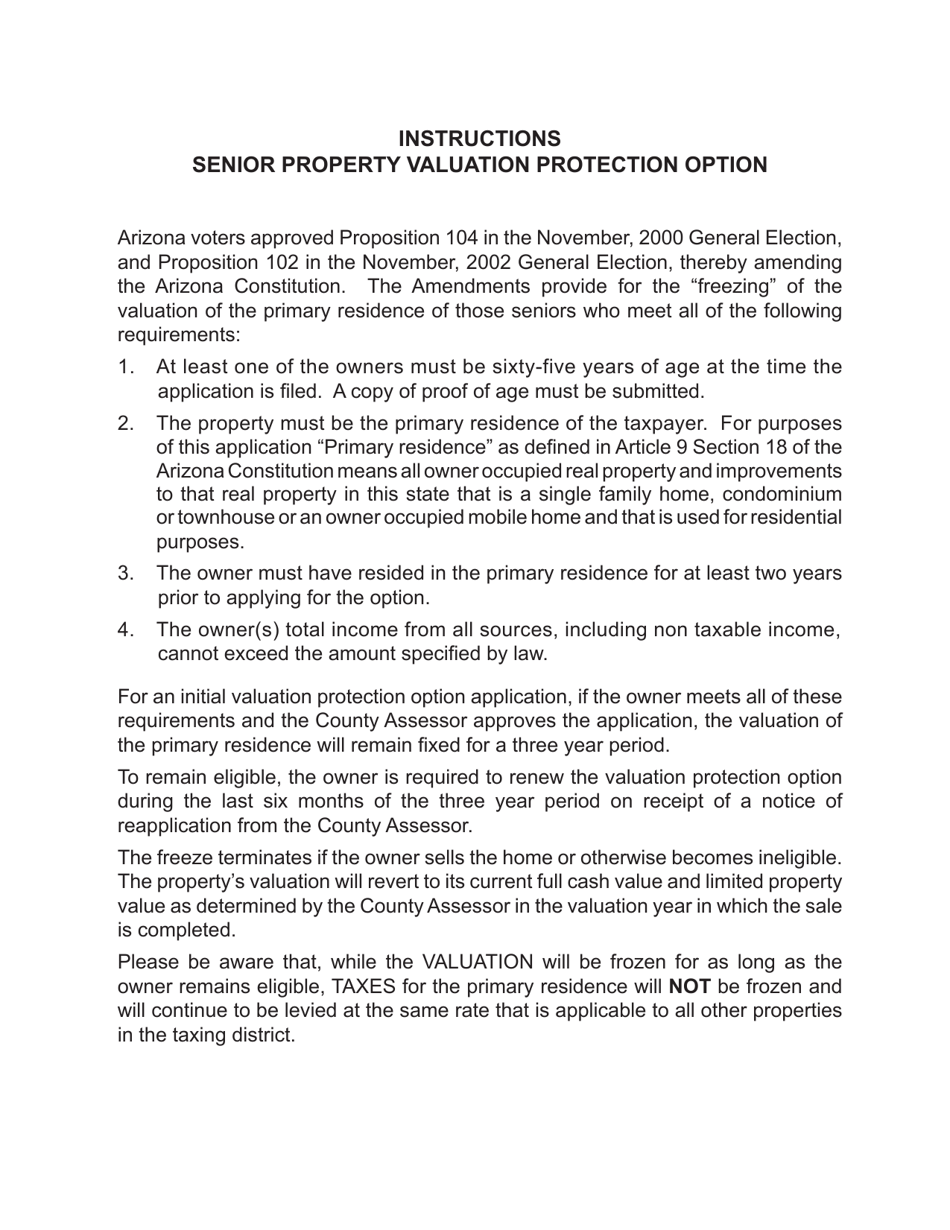

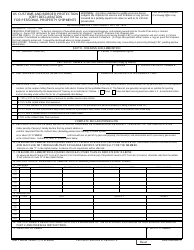

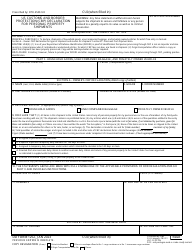

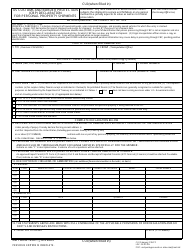

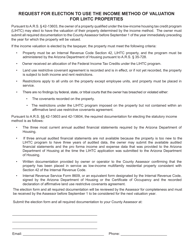

Form DOR82104 Senior Property Valuation Protection Option - Arizona

What Is Form DOR82104?

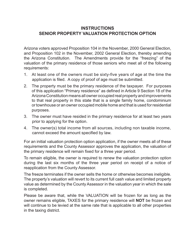

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82104?

A: Form DOR82104 is the Senior Property Valuation Protection Option in Arizona.

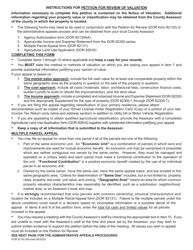

Q: Who is eligible to use Form DOR82104?

A: This form is specifically for senior citizens who own property in Arizona.

Q: What is the purpose of Form DOR82104?

A: The purpose of this form is to provide senior citizens with a property valuation protection option that limits the increase in property value for tax purposes.

Q: How does Form DOR82104 work?

A: By completing this form, eligible senior citizens can choose to have the limited property value increase based on the Consumer Price Index for that year.

Q: What are the benefits of using Form DOR82104?

A: Using this form can help seniors limit the increase in property taxes, making it more affordable for them to keep their homes.

Q: What is the deadline for submitting Form DOR82104?

A: The form must be submitted to the Arizona Department of Revenue by September 1st of the year it is filed.

Q: Are there any fees associated with Form DOR82104?

A: No, there are no fees to file this form.

Q: Can a property owner appeal the valuation determined by Form DOR82104?

A: Yes, property owners have the right to appeal the valuation determined by this form if they believe it is incorrect.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82104 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.