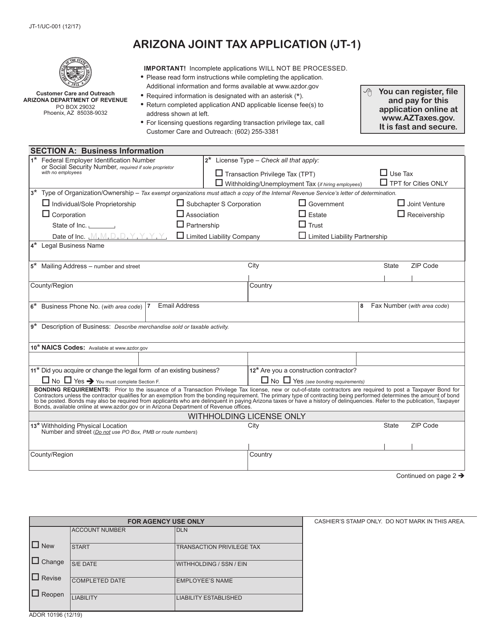

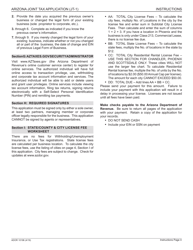

Form JT-1 (ADOR10196) Arizona Joint Tax Application - Arizona

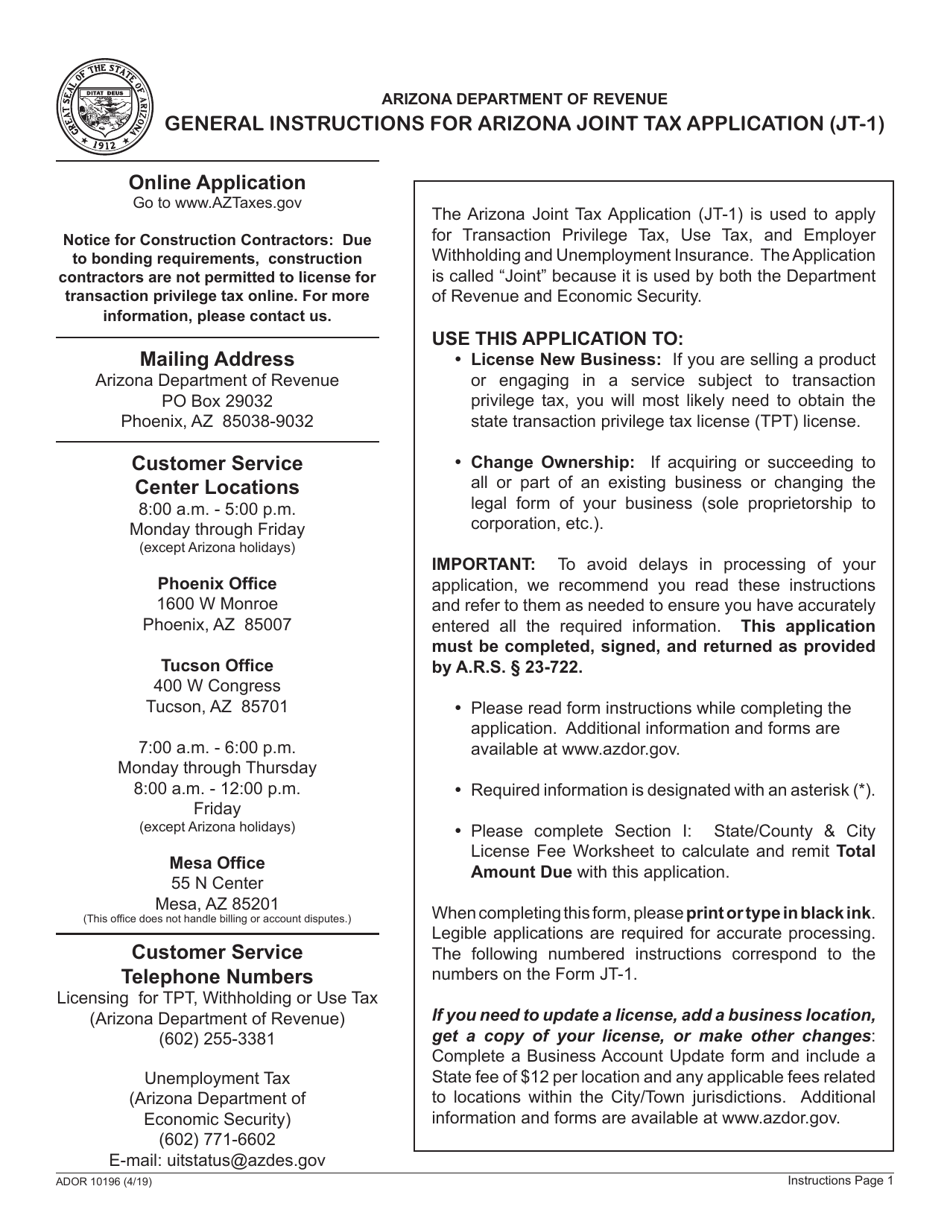

What Is Form JT-1 (ADOR10196)?

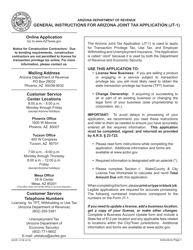

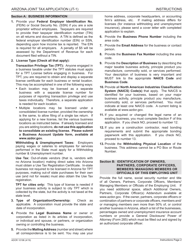

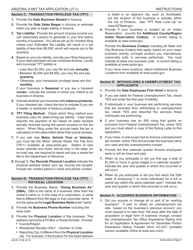

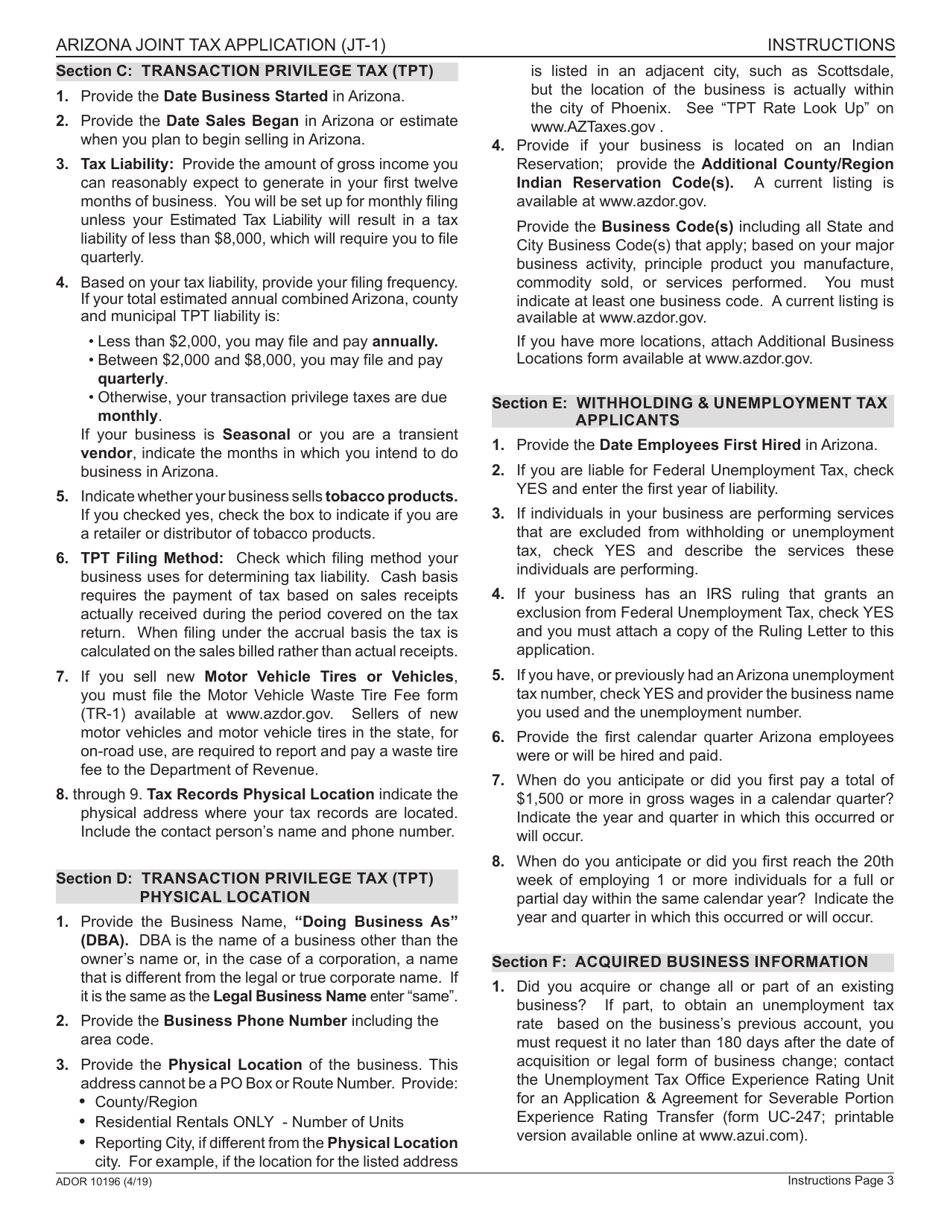

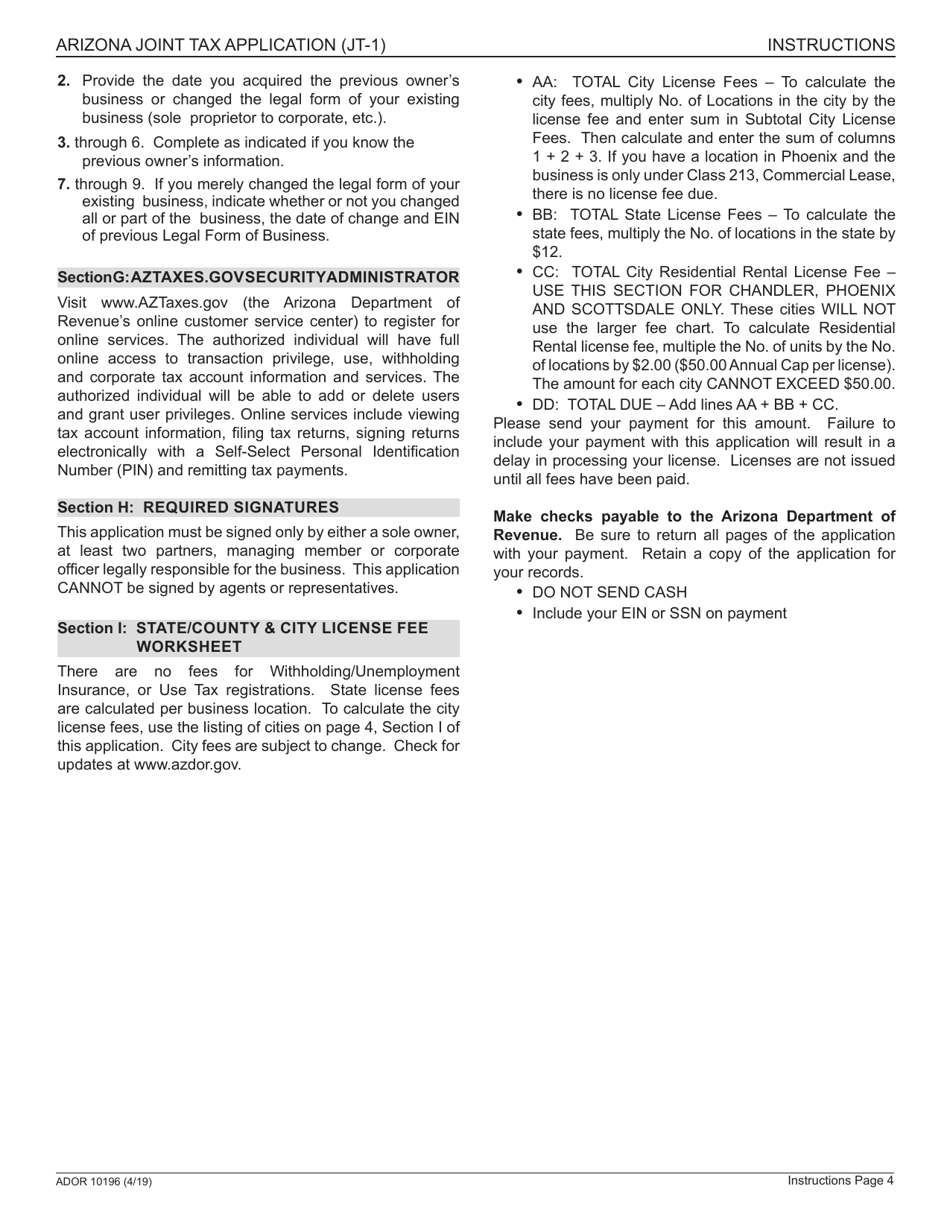

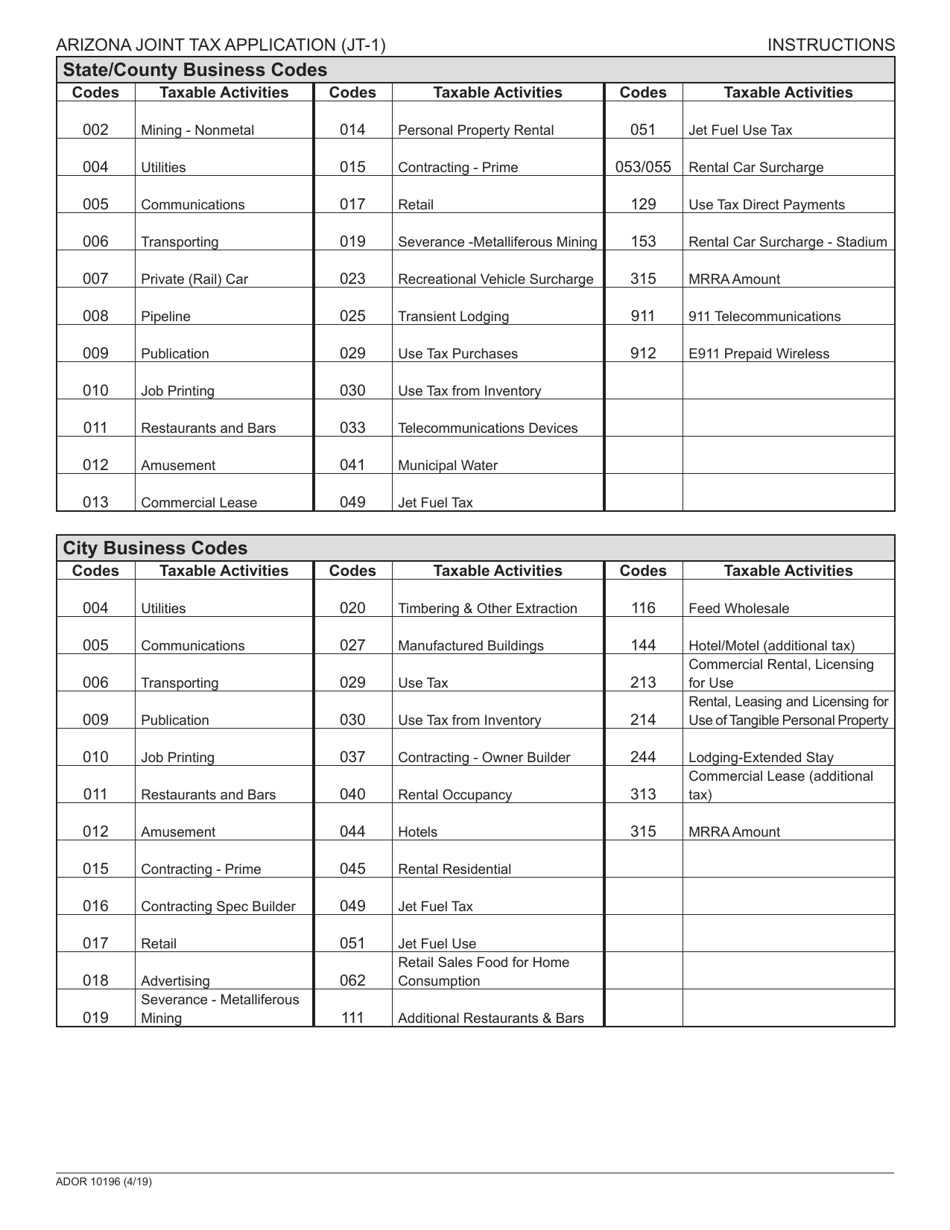

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JT-1?

A: Form JT-1 is the Arizona Joint Tax Application form.

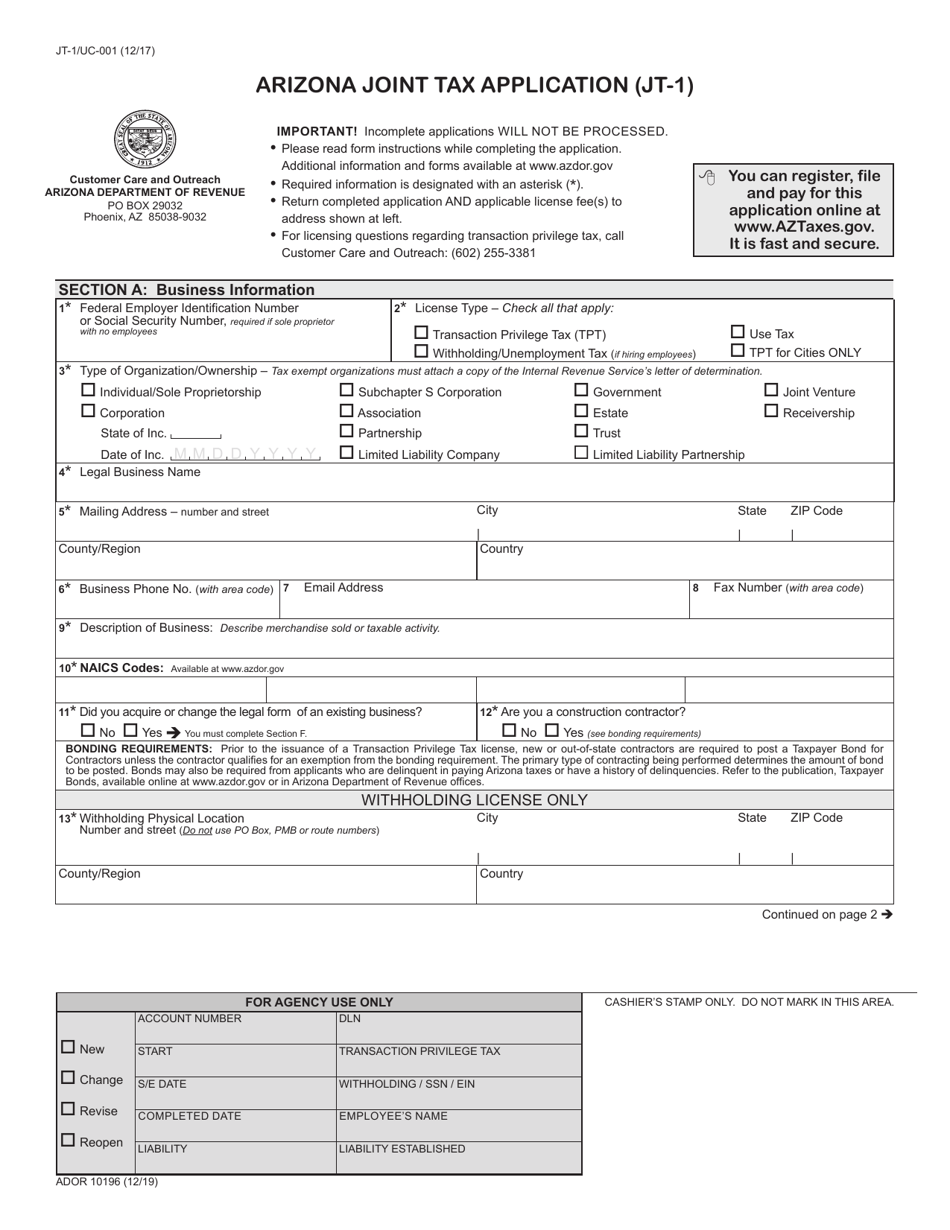

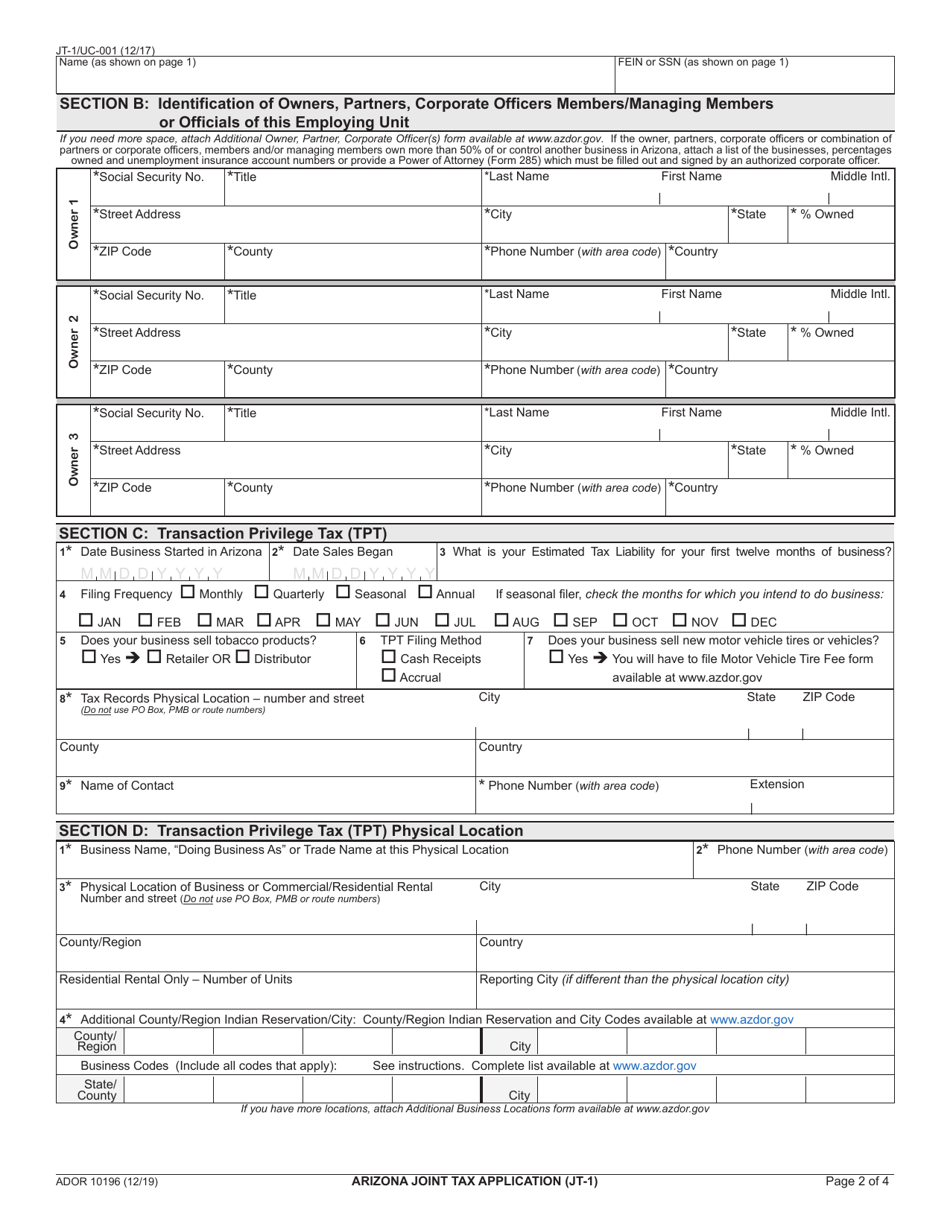

Q: What is the purpose of Form JT-1?

A: The purpose of Form JT-1 is to apply for a joint tax account in Arizona.

Q: Who should use Form JT-1?

A: Form JT-1 should be used by individuals or entities that want to apply for a joint tax account in Arizona.

Q: Is Form JT-1 specific to Arizona?

A: Yes, Form JT-1 is specific to Arizona and is used for joint tax application in the state.

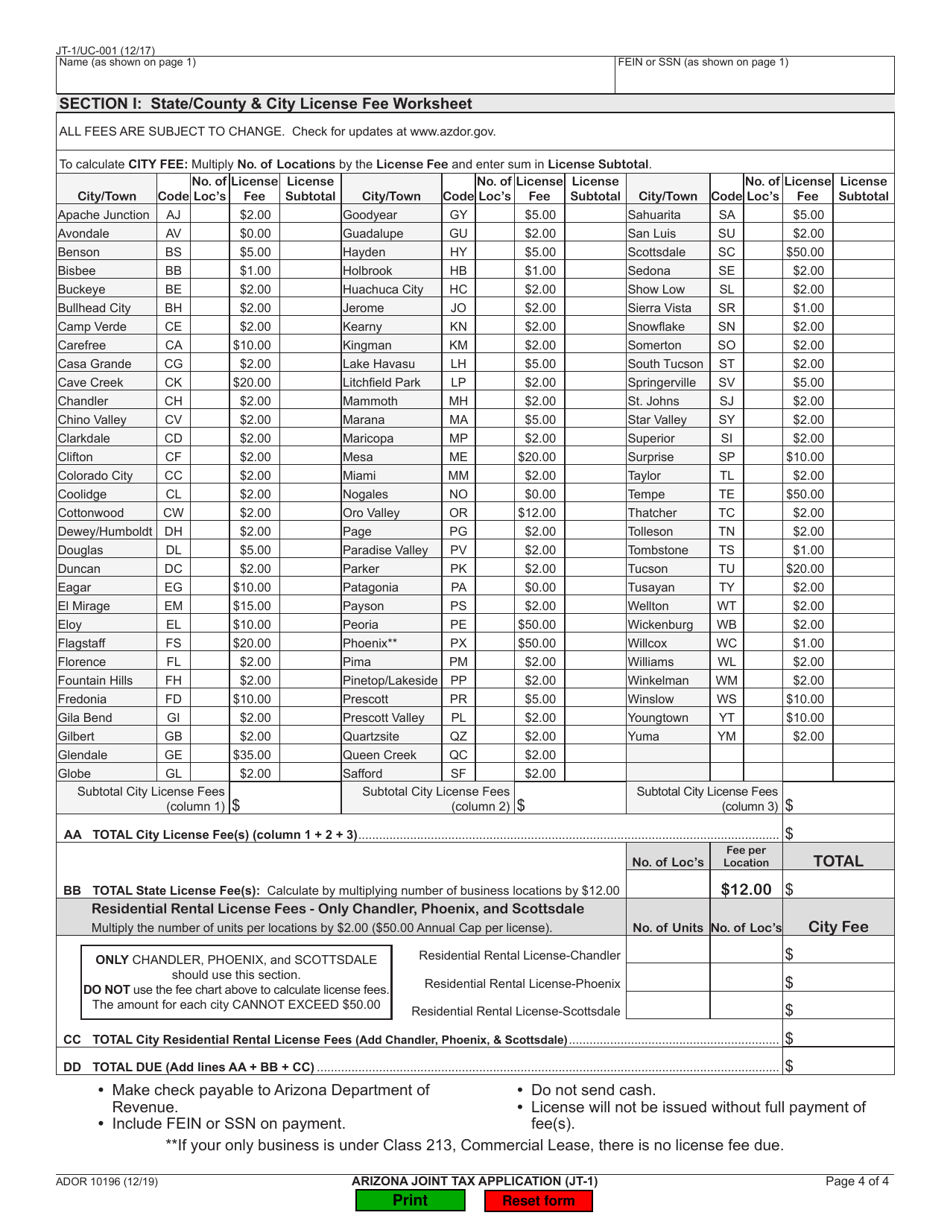

Q: Are there any fees associated with filing Form JT-1?

A: There are no fees associated with filing Form JT-1.

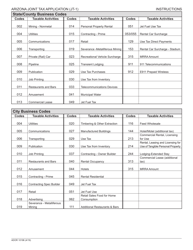

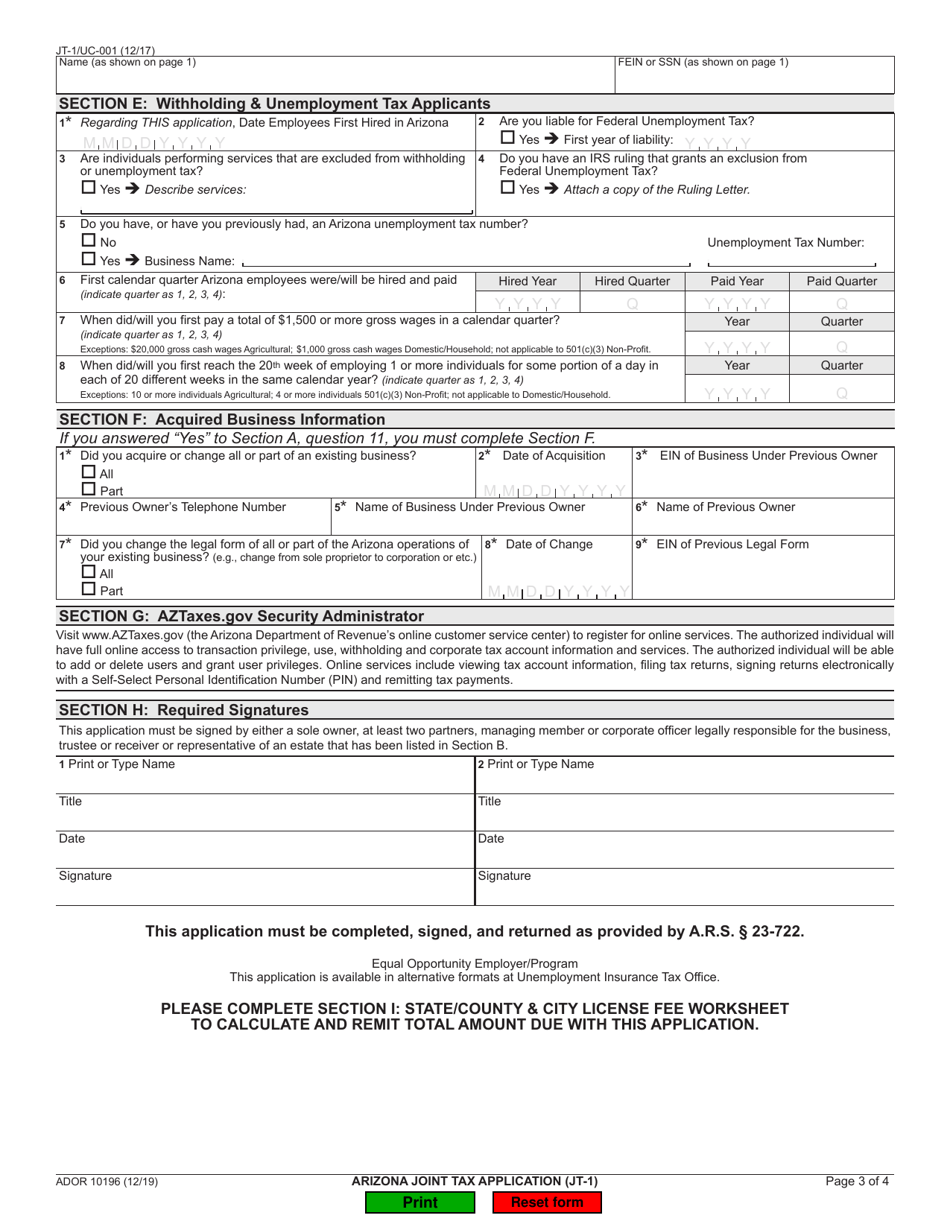

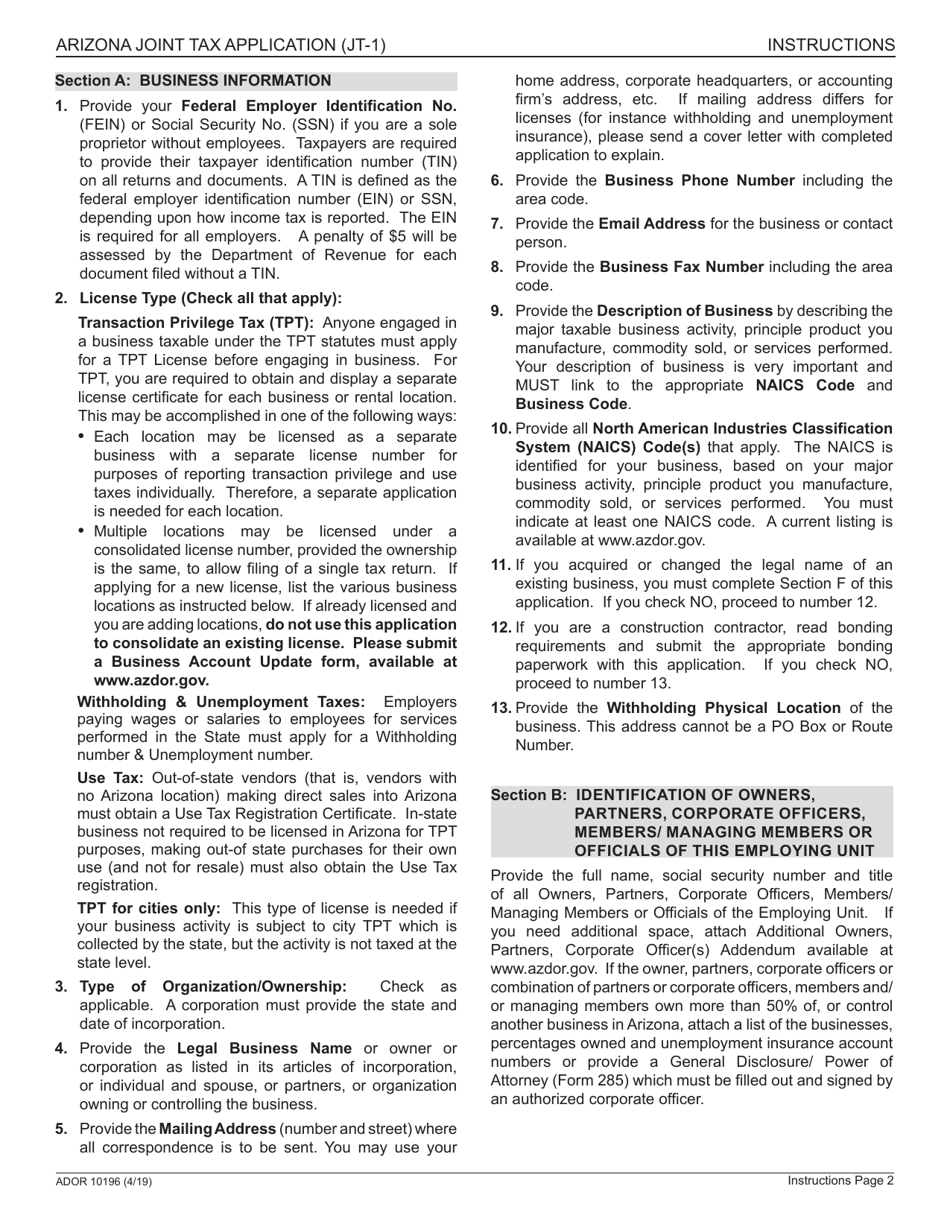

Q: What information is required on Form JT-1?

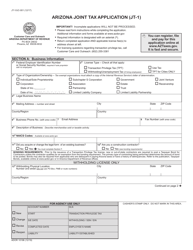

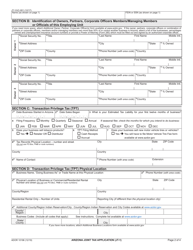

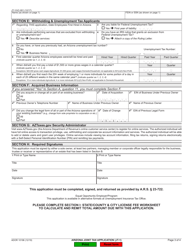

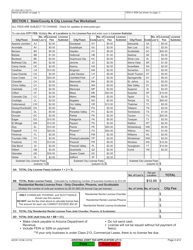

A: Form JT-1 requires information such as the names and addresses of the individuals or entities applying, their tax identification numbers, and the type of tax account they are applying for.

Q: How should Form JT-1 be filed?

A: Form JT-1 should be filed by mail or in person at an ADOR office.

Q: When should Form JT-1 be filed?

A: Form JT-1 should be filed as soon as the individuals or entities want to establish a joint tax account in Arizona.

Q: Is it mandatory to file Form JT-1?

A: Filing Form JT-1 is not mandatory, but it is necessary if individuals or entities want to establish a joint tax account in Arizona.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JT-1 (ADOR10196) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.