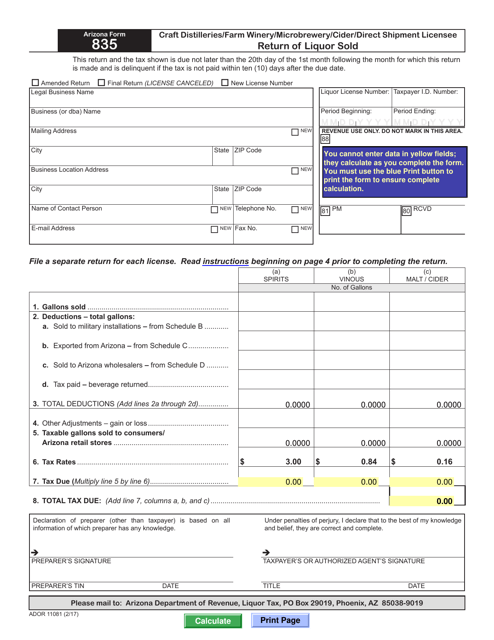

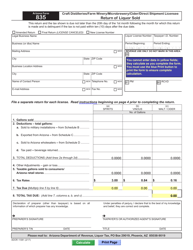

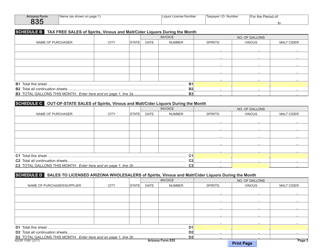

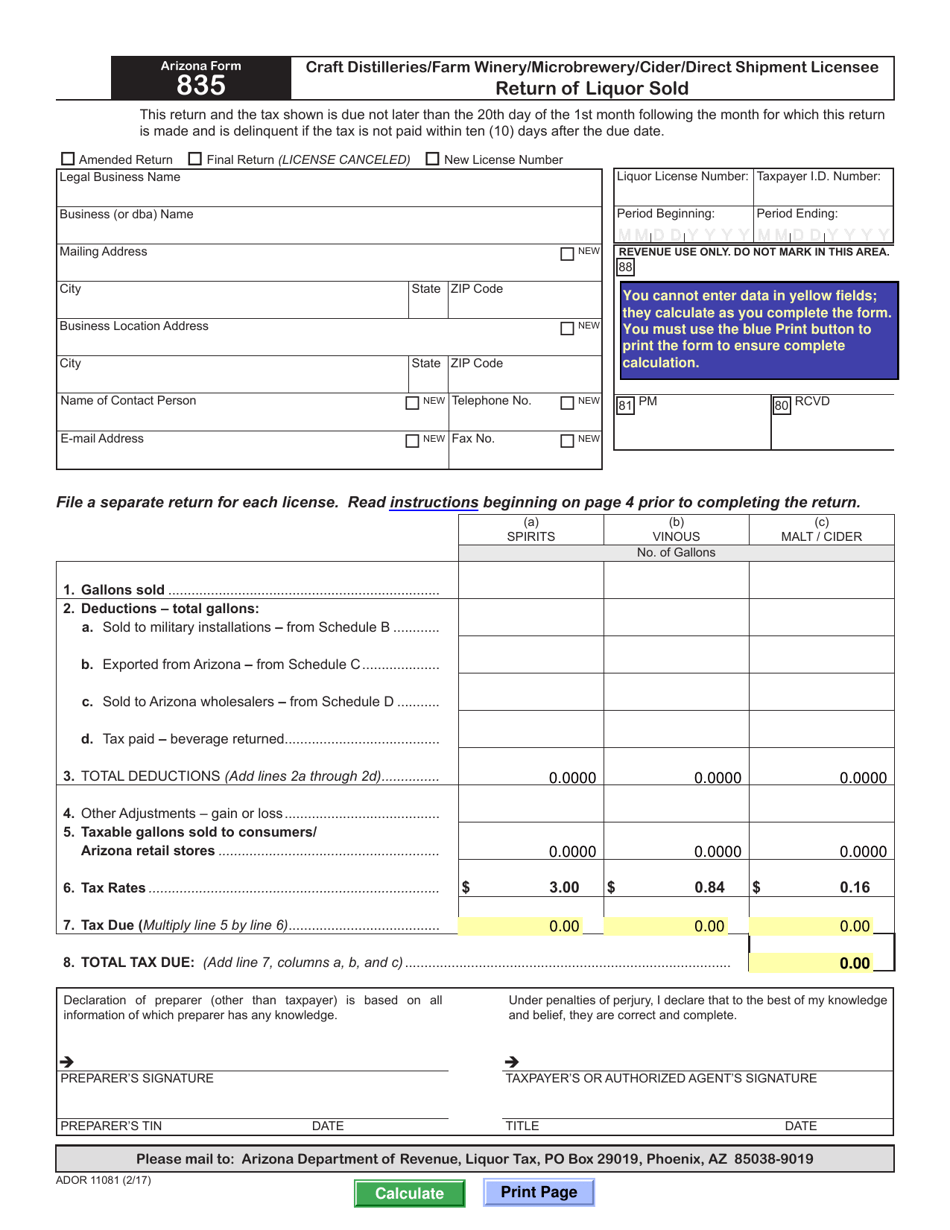

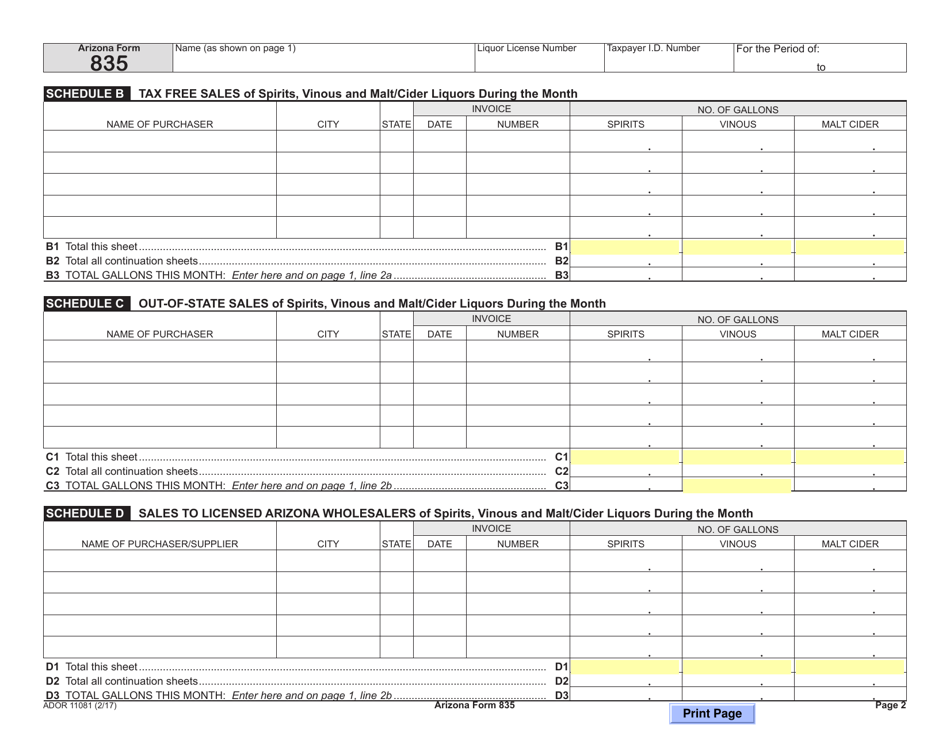

Arizona Form 835 (ADOR11081) Craft Distilleries / Farm Winery / Microbrewery / Cider / Direct Shipment Licensee Return of Liquor Sold - Arizona

What Is Arizona Form 835 (ADOR11081)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 835?

A: Form 835 is a return form for Craft Distilleries, Farm Wineries, Microbreweries, Cideries, and Direct Shipment Licensees in Arizona.

Q: Who needs to file Form 835?

A: Craft Distilleries, Farm Wineries, Microbreweries, Cideries, and Direct Shipment Licensees in Arizona need to file Form 835.

Q: What is the purpose of Form 835?

A: Form 835 is used to report the liquor sold by Craft Distilleries, Farm Wineries, Microbreweries, Cideries, and Direct Shipment Licensees in Arizona.

Q: When is the deadline to file Form 835?

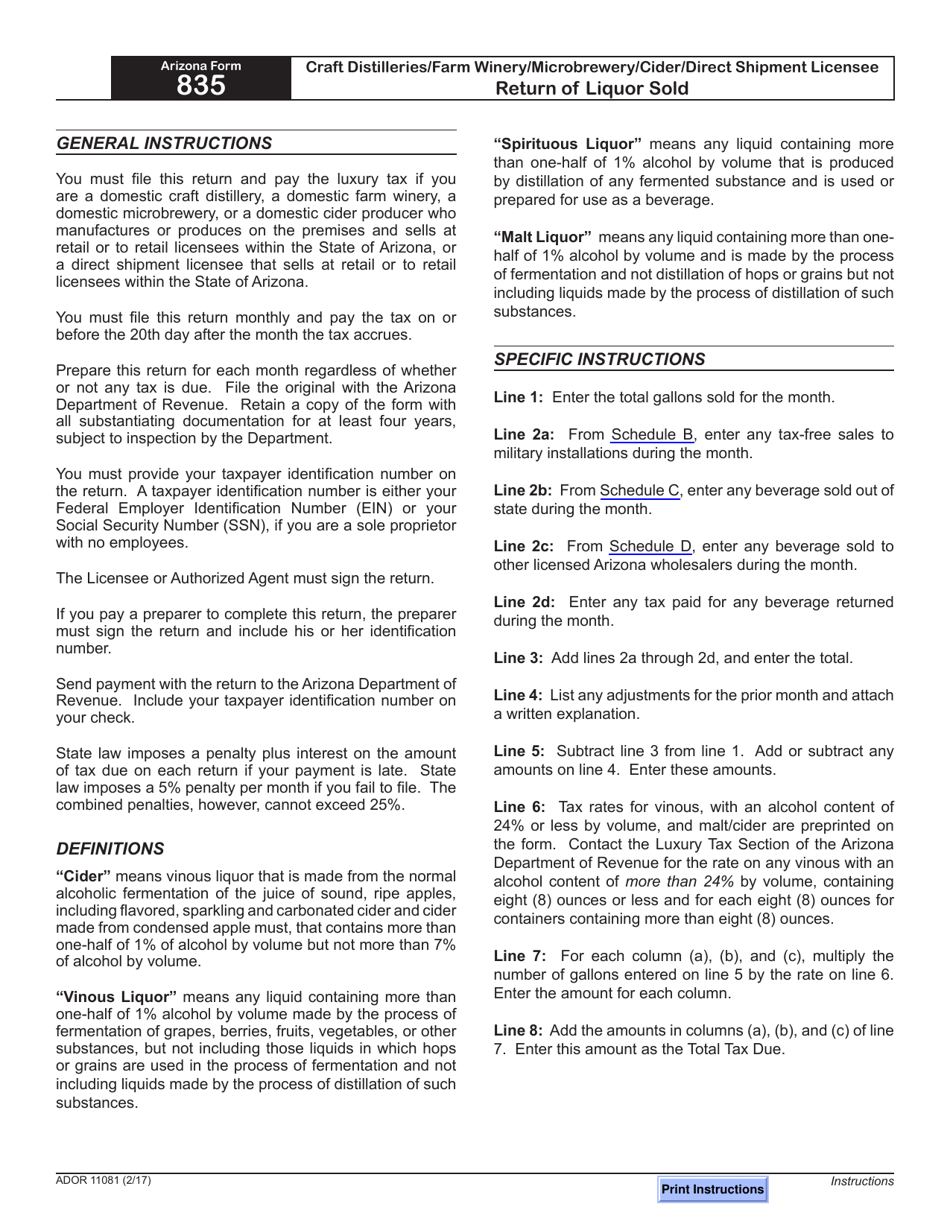

A: The deadline to file Form 835 varies depending on the reporting period. Please refer to the instructions provided with the form for the specific deadline.

Q: Are there any penalties for not filing Form 835?

A: Yes, there may be penalties for late or non-filing of Form 835. It is important to comply with the filing requirements to avoid penalties.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 835 (ADOR11081) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.