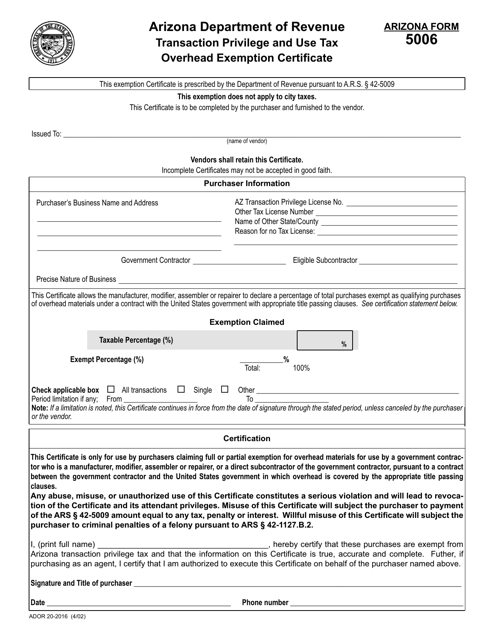

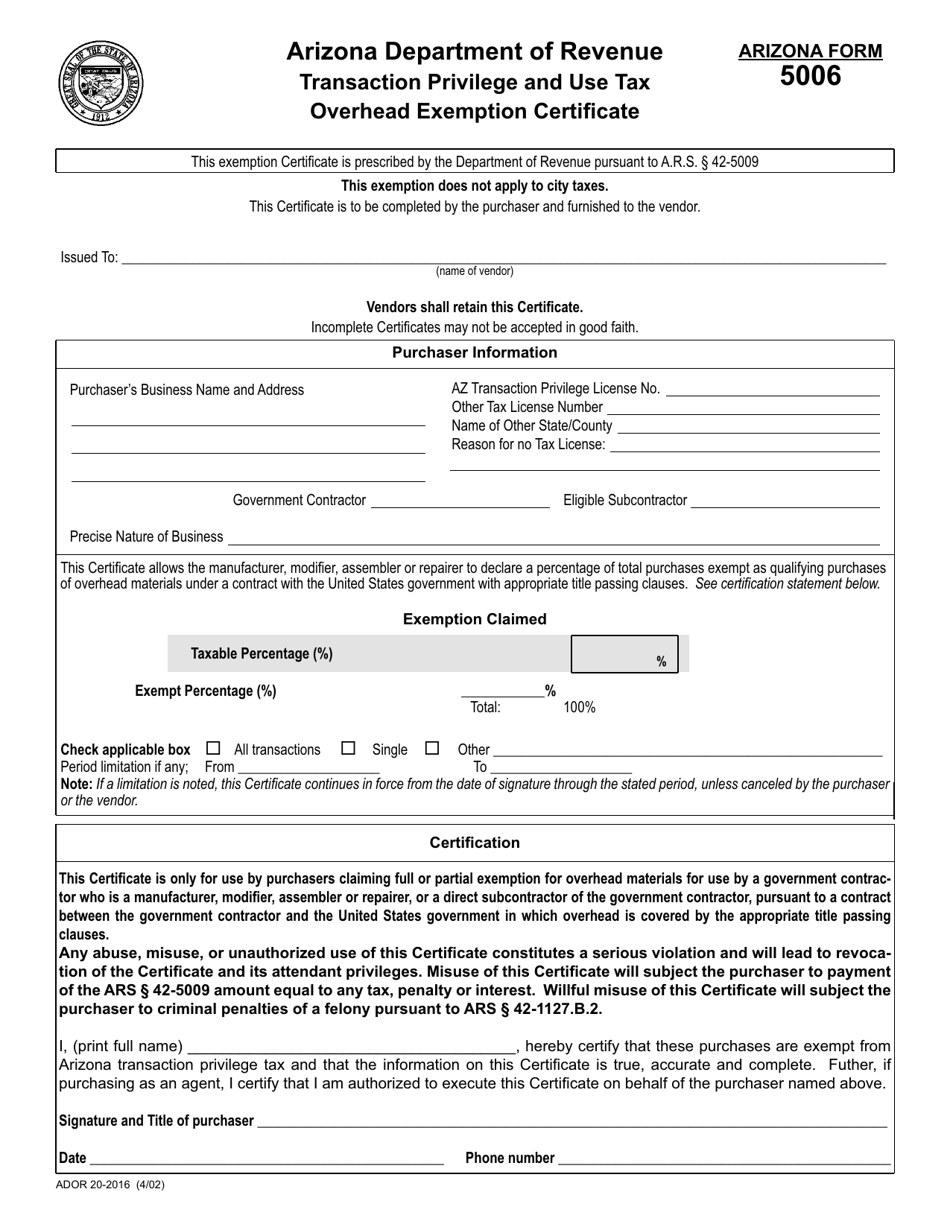

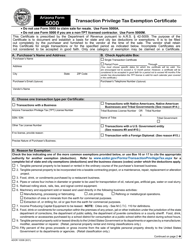

Arizona Form 5006 (ADOR20-2016) Transaction Privilege and Use Tax Overhead Exemption Certificate - Arizona

What Is Arizona Form 5006 (ADOR20-2016)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

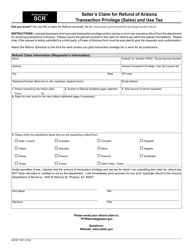

Q: What is Arizona Form 5006?

A: Arizona Form 5006 is the Transaction Privilege and Use Tax Overhead Exemption Certificate.

Q: What is the purpose of Arizona Form 5006?

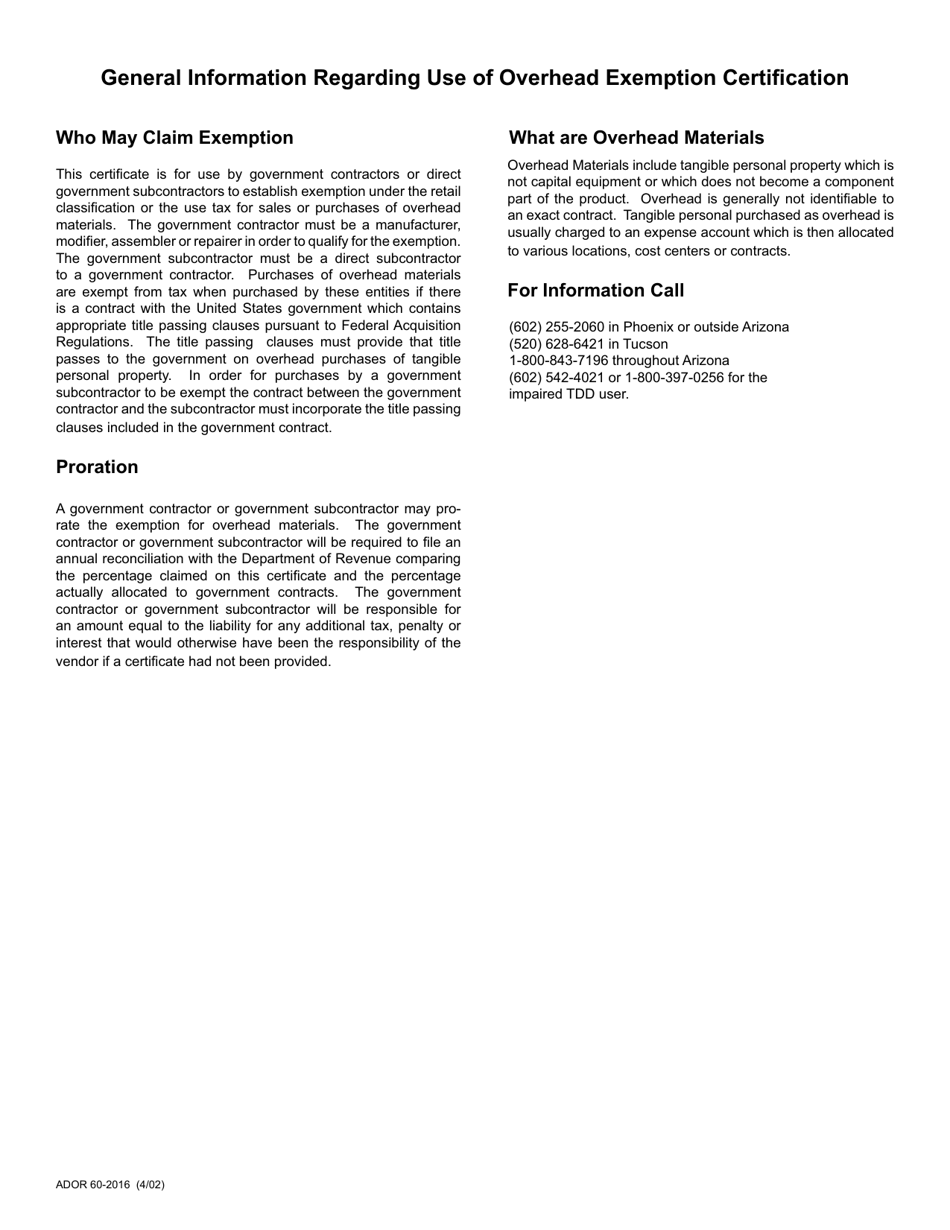

A: The purpose of Arizona Form 5006 is to claim an exemption from transaction privilege and use taxes on overhead costs.

Q: Who needs to use Arizona Form 5006?

A: Businesses or individuals who want to claim an exemption from transaction privilege and use taxes on their overhead costs in Arizona need to use Arizona Form 5006.

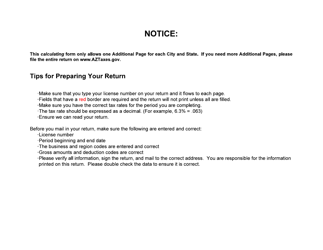

Q: How do I complete Arizona Form 5006?

A: To complete Arizona Form 5006, you need to provide your business information, describe your overhead costs, and sign the form to certify the accuracy of the information provided.

Form Details:

- Released on April 1, 2002;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 5006 (ADOR20-2016) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.