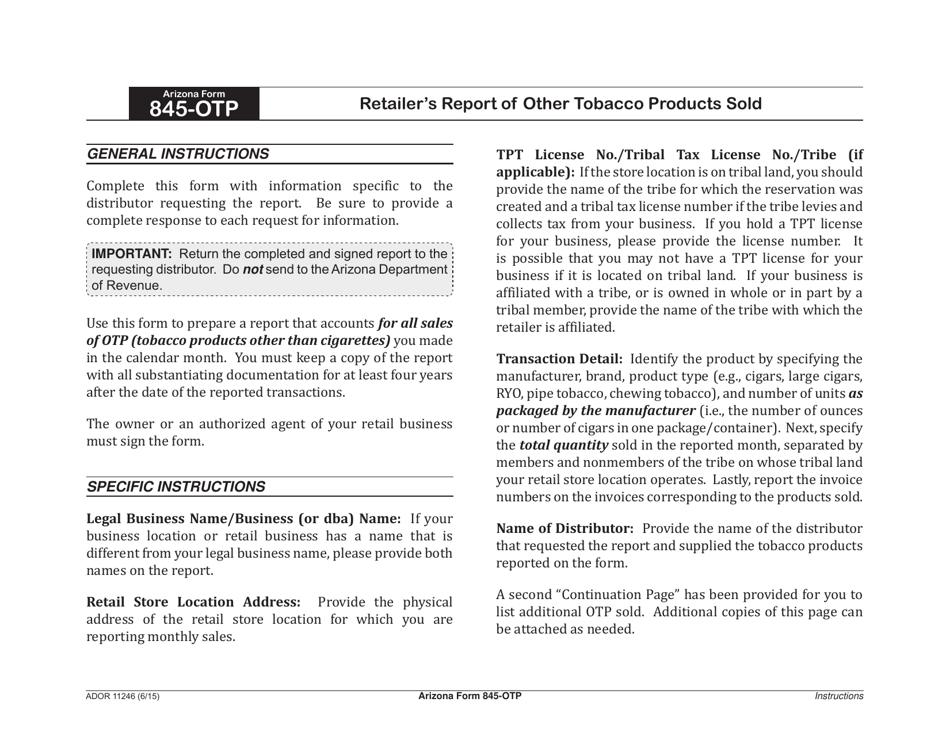

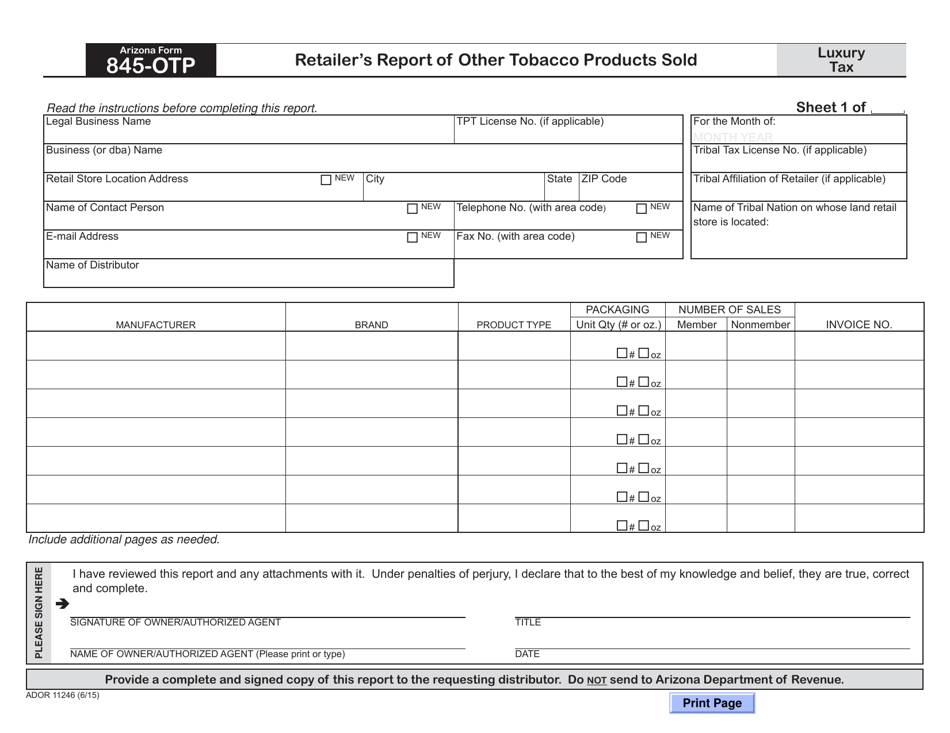

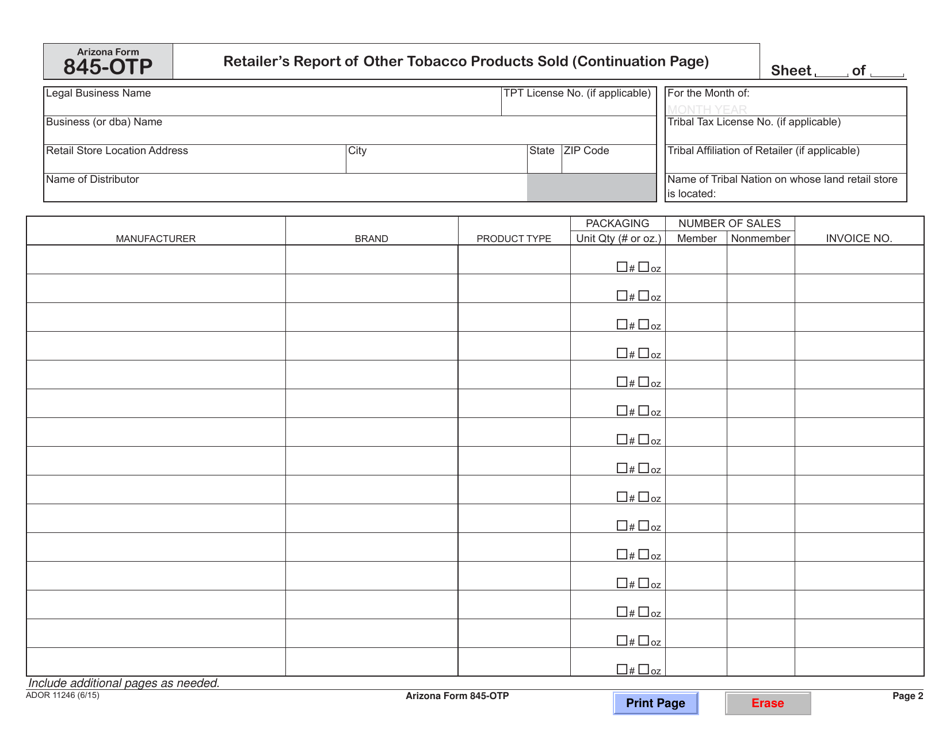

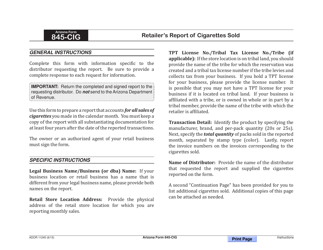

Arizona Form 845-OTP (ADOR11246) Retailer's Report of Other Tobacco Products Sold - Arizona

What Is Arizona Form 845-OTP (ADOR11246)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

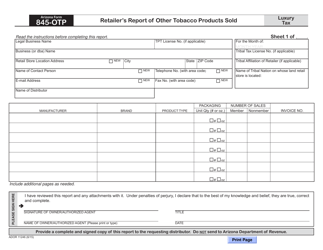

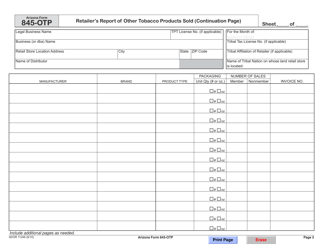

Q: What is Arizona Form 845-OTP?

A: Arizona Form 845-OTP is a form used by retailers to report the sale of other tobacco products in Arizona.

Q: Who needs to file Arizona Form 845-OTP?

A: Retailers who sell other tobacco products in Arizona need to file Arizona Form 845-OTP.

Q: What are other tobacco products?

A: Other tobacco products include items such as cigars, pipe tobacco, snuff, chewing tobacco, and electronic cigarettes.

Q: When is Arizona Form 845-OTP due?

A: Arizona Form 845-OTP is due on the 20th day of the month following the reporting period.

Q: Is there a penalty for not filing Arizona Form 845-OTP?

A: Yes, there are penalties for not filing Arizona Form 845-OTP, including fines and potential suspension of a retailer's license.

Q: Are there any exemptions from filing Arizona Form 845-OTP?

A: Yes, certain retailers may be exempt from filing Arizona Form 845-OTP. It is recommended to check the instructions of the form or contact the Arizona Department of Revenue for more information.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 845-OTP (ADOR11246) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.