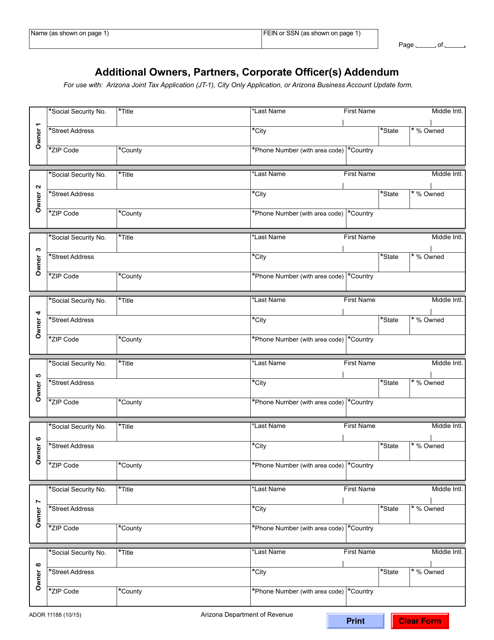

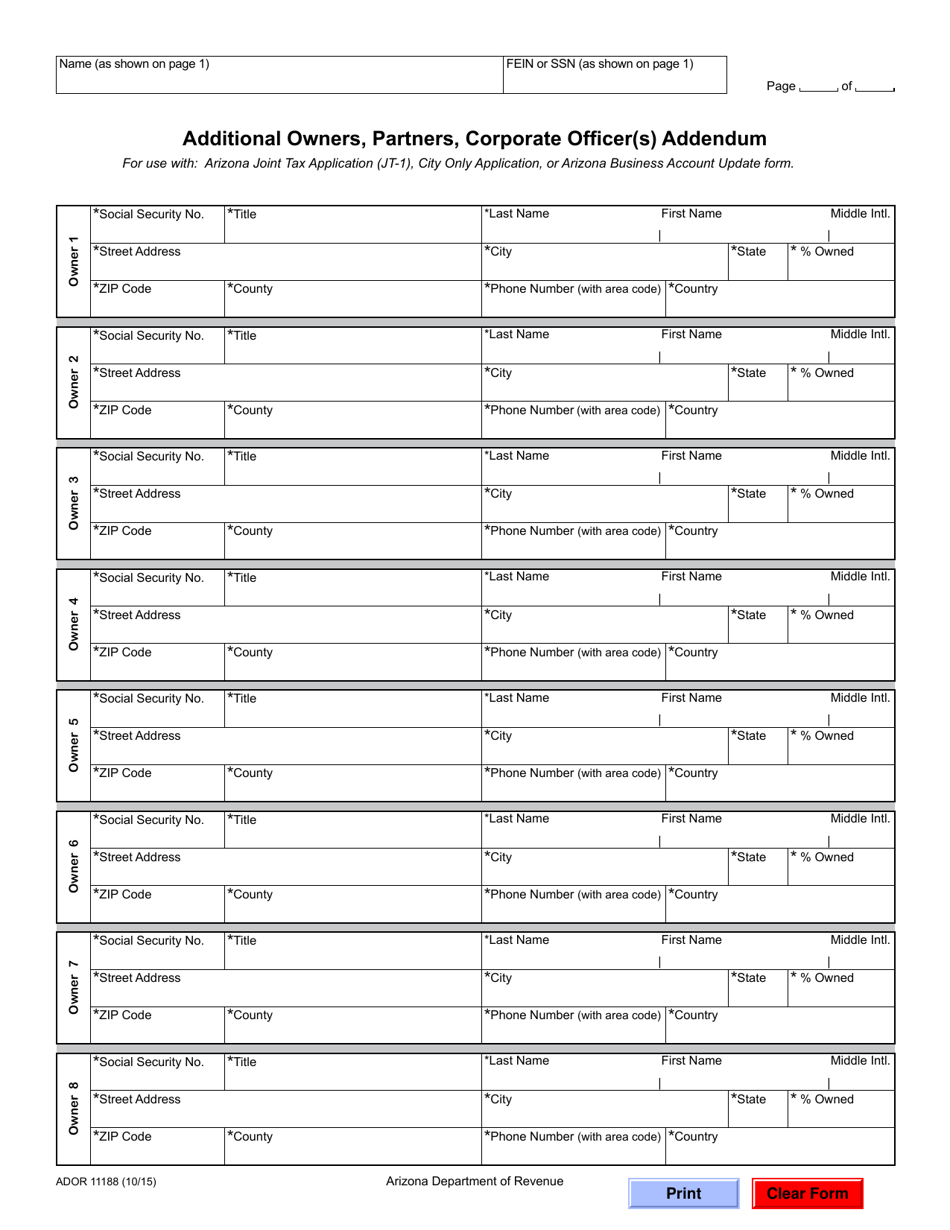

Form ADOR11188 Additional Owners, Partners, Corporate Officer(S) Addendum - Arizona

What Is Form ADOR11188?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR11188?

A: Form ADOR11188 is the Additional Owners, Partners, Corporate Officer(s) Addendum form in Arizona.

Q: What is the purpose of Form ADOR11188?

A: The purpose of Form ADOR11188 is to add additional owners, partners, or corporate officers to an existing business entity.

Q: Who needs to fill out Form ADOR11188?

A: Form ADOR11188 needs to be filled out by businesses in Arizona that want to add additional owners, partners, or corporate officers to their existing business.

Q: Is Form ADOR11188 mandatory?

A: Yes, if you want to add additional owners, partners, or corporate officers to your business entity in Arizona, filling out Form ADOR11188 is mandatory.

Q: Are there any fees associated with filing Form ADOR11188?

A: There are no fees associated with filing Form ADOR11188.

Q: What information do I need to provide on Form ADOR11188?

A: On Form ADOR11188, you need to provide information about the additional owners, partners, or corporate officers you want to add, including their names, social security numbers or federal employer identification numbers, and their titles in the business.

Q: How do I submit Form ADOR11188?

A: You can submit Form ADOR11188 through mail or electronically, according to the instructions provided on the form.

Q: Is there a deadline for submitting Form ADOR11188?

A: There is no specific deadline mentioned on the form, but it is recommended to submit it as soon as you want to add additional owners, partners, or corporate officers to your business entity.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR11188 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.