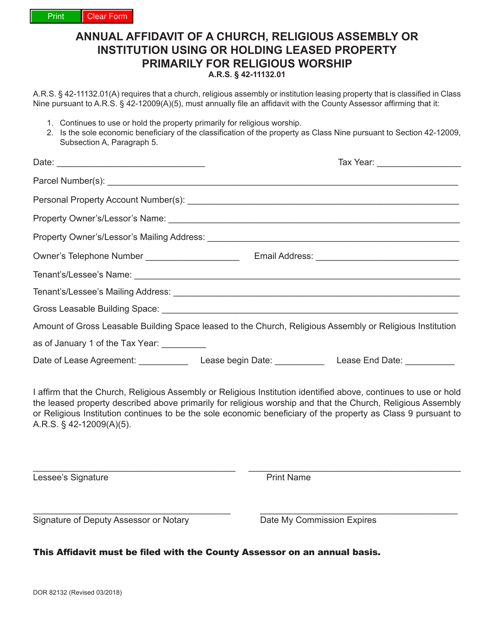

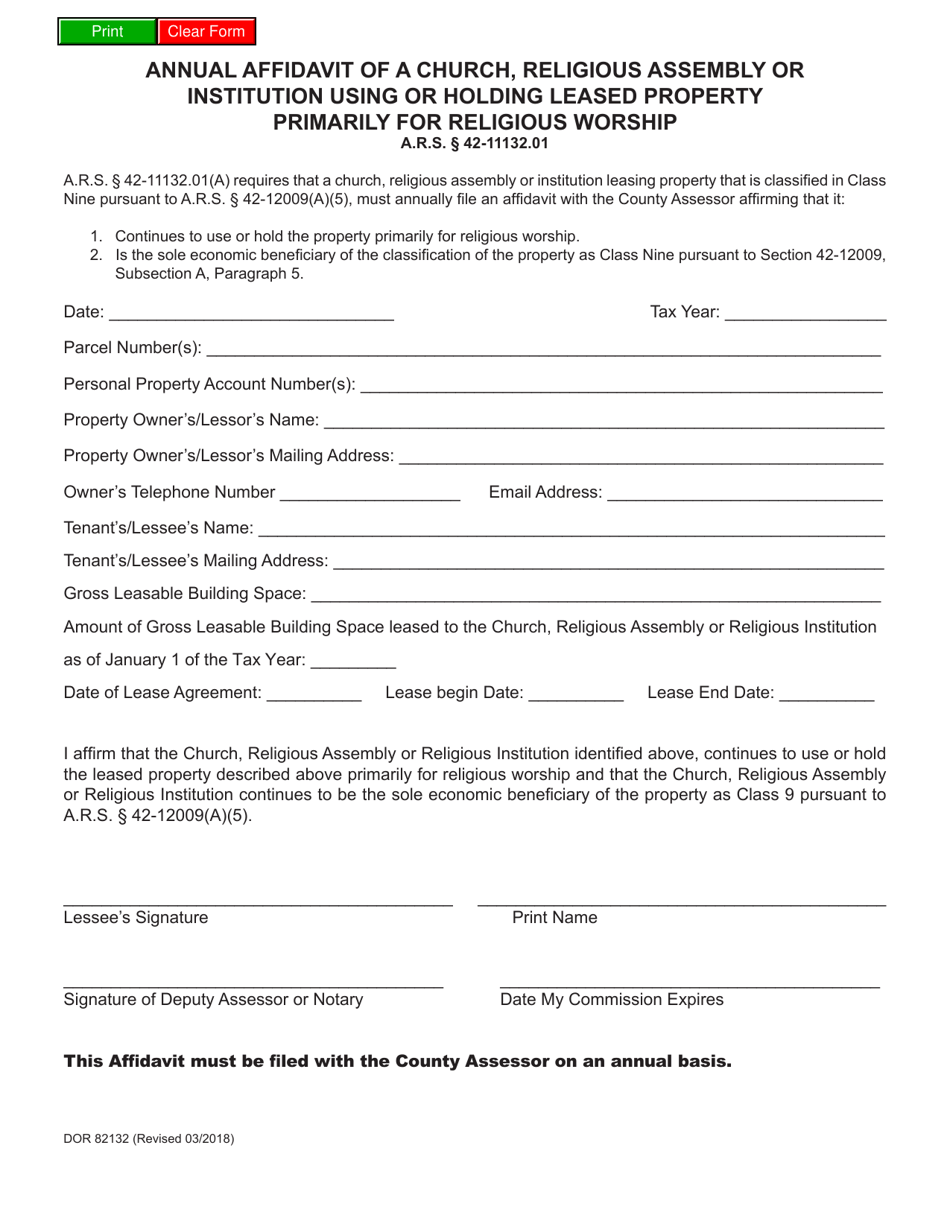

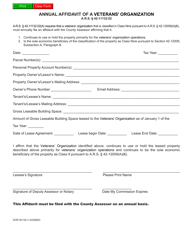

Form DOR82132 Annual Affidavit of a Church, Religious Assembly or Institution Using or Holding Leased Property Primarily for Religious Worship - Arizona

What Is Form DOR82132?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82132?

A: Form DOR82132 is the Annual Affidavit of a Church, Religious Assembly or Institution Using or Holding Leased Property Primarily for Religious Worship in Arizona.

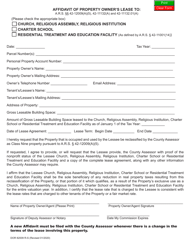

Q: Who needs to file Form DOR82132?

A: Churches, religious assemblies, or institutions that use or hold leased property primarily for religious worship in Arizona need to file Form DOR82132.

Q: What is the purpose of Form DOR82132?

A: The purpose of Form DOR82132 is to report information about the leased property used primarily for religious worship and to determine if the property is eligible for a property tax exemption in Arizona.

Q: When is Form DOR82132 due?

A: Form DOR82132 is due by the first Monday in March of each year.

Q: Is there a fee for filing Form DOR82132?

A: No, there is no fee for filing Form DOR82132.

Q: What information do I need to complete Form DOR82132?

A: You will need information about the leased property, including the address, lease start and end dates, and details about its use primarily for religious worship.

Q: What happens if I don't file Form DOR82132?

A: Failure to file Form DOR82132 may result in the property not being eligible for a property tax exemption in Arizona.

Q: Can I get assistance in completing Form DOR82132?

A: Yes, you can contact the Arizona Department of Revenue for assistance in completing Form DOR82132.

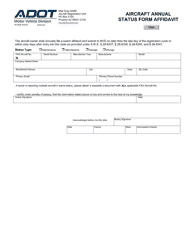

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82132 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.