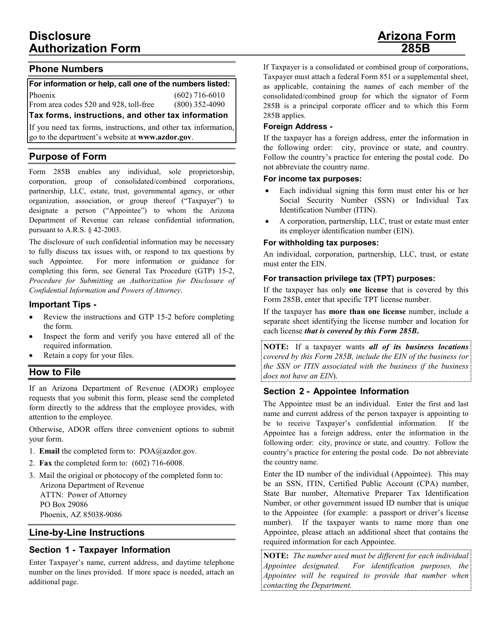

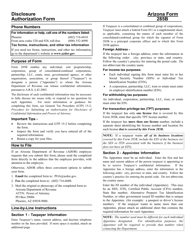

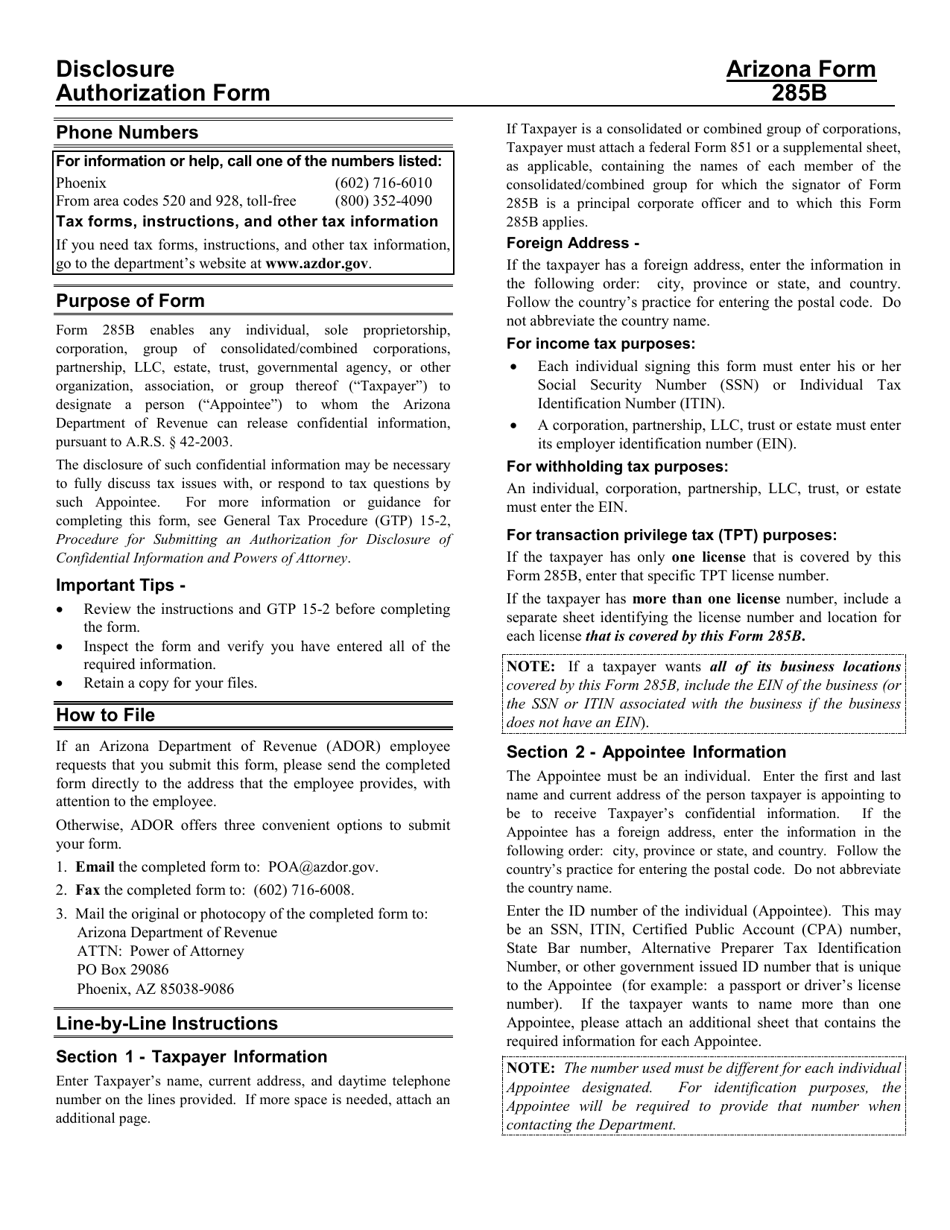

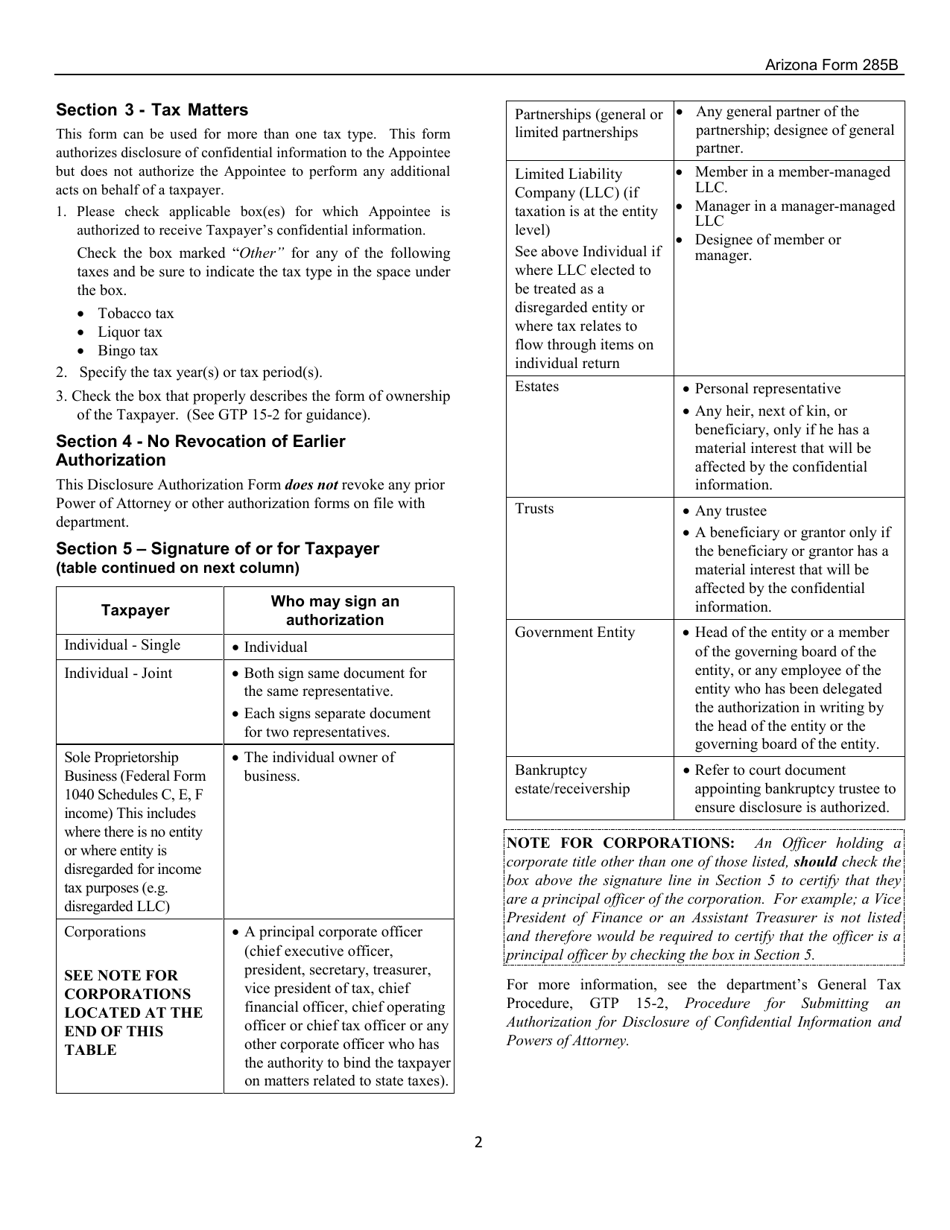

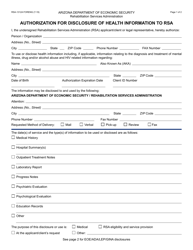

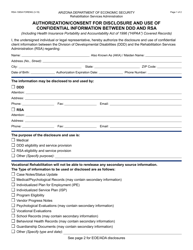

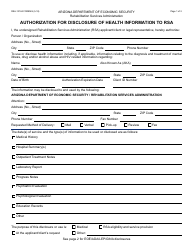

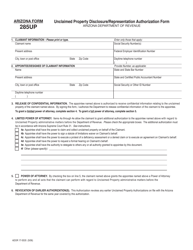

Instructions for Arizona Form 285B, ADOR10955 Disclosure Authorization Form - Arizona

This document contains official instructions for Arizona Form 285B , and Form ADOR10955 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 285B (ADOR10955) is available for download through this link.

FAQ

Q: What is Arizona Form 285B?

A: Arizona Form 285B is the ADOR10955 Disclosure Authorization Form.

Q: What is the purpose of Arizona Form 285B?

A: The purpose of Arizona Form 285B is to authorize the Arizona Department of Revenue (ADOR) to disclose information to a third party regarding your tax matters.

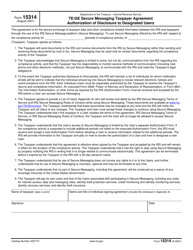

Q: Who should fill out Arizona Form 285B?

A: You should fill out Arizona Form 285B if you want to authorize a third party, such as a tax preparer or representative, to access your tax information.

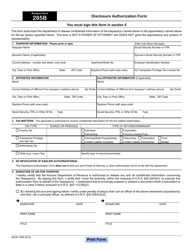

Q: What information is required on Arizona Form 285B?

A: Arizona Form 285B requires you to provide your personal information, including your name, social security number, and contact details. You also need to provide the name and contact information of the third party you are authorizing.

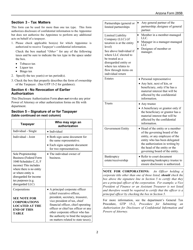

Q: Can I revoke the authorization given on Arizona Form 285B?

A: Yes, you can revoke the authorization given on Arizona Form 285B by submitting a written request to the Arizona Department of Revenue.

Q: When should I submit Arizona Form 285B?

A: You should submit Arizona Form 285B before or at the same time as the third party requests your tax information.

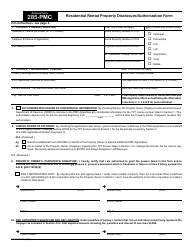

Q: Is there a fee for submitting Arizona Form 285B?

A: No, there is no fee for submitting Arizona Form 285B.

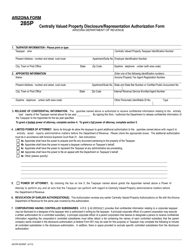

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.