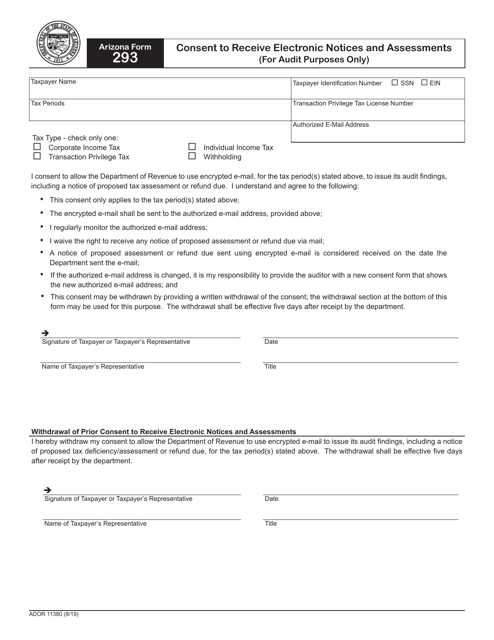

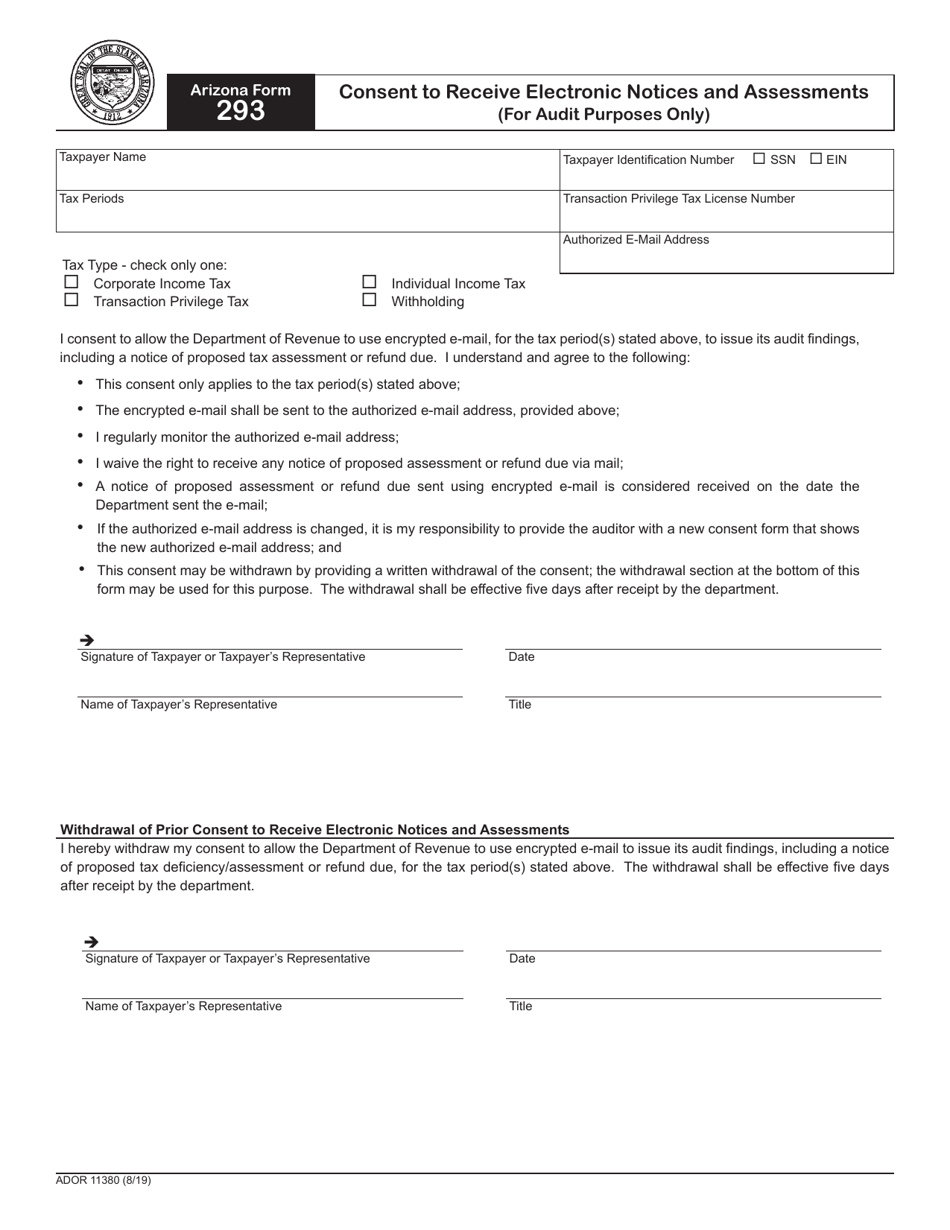

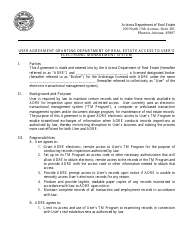

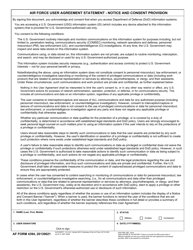

Arizona Form 293 (ADOR11380) Consent to Receive Electronic Notices and Assessments (For Audit Purposes Only) - Arizona

What Is Arizona Form 293 (ADOR11380)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 293?

A: Form 293 is the Consent to Receive Electronic Notices and Assessments form for Arizona.

Q: What is the purpose of Form 293?

A: The purpose of Form 293 is to give consent to receive electronic notices and assessments for audit purposes in Arizona.

Q: Who needs to fill out Form 293?

A: Anyone who wishes to receive electronic notices and assessments for audit purposes in Arizona needs to fill out Form 293.

Q: Is Form 293 mandatory?

A: No, Form 293 is not mandatory. It is optional for individuals who prefer to receive electronic notices and assessments.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 293 (ADOR11380) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.