This version of the form is not currently in use and is provided for reference only. Download this version of

Form DOR82135C

for the current year.

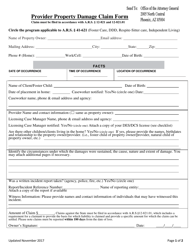

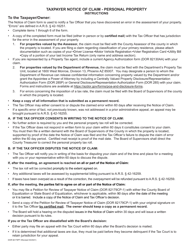

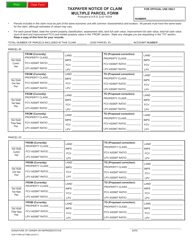

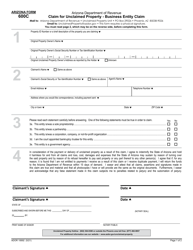

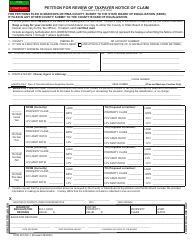

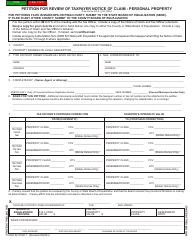

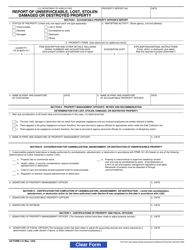

Form DOR82135C Taxpayer Notice of Claim - Damaged or Destroyed Property - Arizona

What Is Form DOR82135C?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOR82135C?

A: Form DOR82135C is a Taxpayer Notice of Claim for Damaged or Destroyed Property in Arizona.

Q: When should I use Form DOR82135C?

A: You should use Form DOR82135C if your property has been damaged or destroyed and you want to file a claim for a reduction in property taxes.

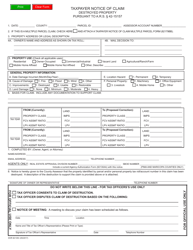

Q: What information do I need to provide on Form DOR82135C?

A: You need to provide information about yourself, the property affected, the type of damage or destruction, and any insurance coverage.

Q: Are there any deadlines for filing Form DOR82135C?

A: Yes, you must file Form DOR82135C within 60 days of the damage or destruction occurring or within 60 days of receiving notice from the county assessor's office.

Q: Is there a fee for filing Form DOR82135C?

A: No, there is no fee for filing Form DOR82135C.

Q: What happens after I submit Form DOR82135C?

A: The county assessor's office will review your claim and may schedule an inspection of the property. They will then determine if a reduction in property taxes is warranted.

Q: Can I appeal if my claim is denied?

A: Yes, if your claim is denied, you have the right to appeal the decision to the Arizona Tax Court.

Q: Can I file a claim for damage to my vehicle using Form DOR82135C?

A: No, Form DOR82135C is specifically for claims related to real property, such as homes or land.

Q: Can I file a claim for damage caused by natural disasters using Form DOR82135C?

A: Yes, you can file a claim for damage caused by natural disasters, such as floods, fires, or earthquakes, using Form DOR82135C.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOR82135C by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.