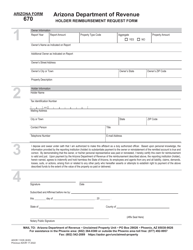

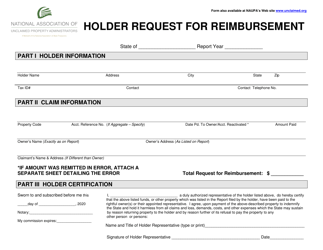

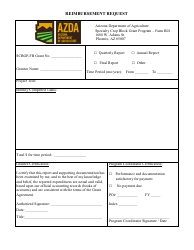

Instructions for Arizona Form 670, ADOR11035 Holder Reimbursement Request Form - Arizona

This document contains official instructions for Arizona Form 670 , and Form ADOR11035 . Both forms are released and collected by the Arizona Department of Revenue. An up-to-date fillable Arizona Form 670 (ADOR11035) is available for download through this link.

FAQ

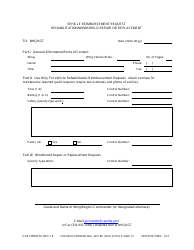

Q: What is Arizona Form 670?

A: Arizona Form 670 is the ADOR11035 Holder Reimbursement Request Form.

Q: What is the purpose of Arizona Form 670?

A: The purpose of Arizona Form 670 is to request reimbursement for holders of property in Arizona.

Q: Who needs to fill out Arizona Form 670?

A: Holders of unclaimed property in Arizona who are seeking reimbursement need to fill out Arizona Form 670.

Q: What information is required on Arizona Form 670?

A: Arizona Form 670 requires holders to provide their contact information, details of the property, and documentation supporting their reimbursement request.

Q: Are there any fees associated with filing Arizona Form 670?

A: No, there are no fees associated with filing Arizona Form 670.

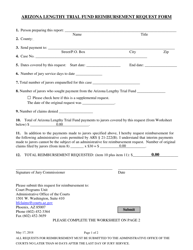

Q: Are there any deadlines for submitting Arizona Form 670?

A: Yes, Arizona Form 670 must be submitted within three years after the holder's right to the property arose.

Q: Who should I contact for further assistance with Arizona Form 670?

A: For further assistance with Arizona Form 670, you should contact the Arizona Department of Revenue (ADOR).

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Arizona Department of Revenue.