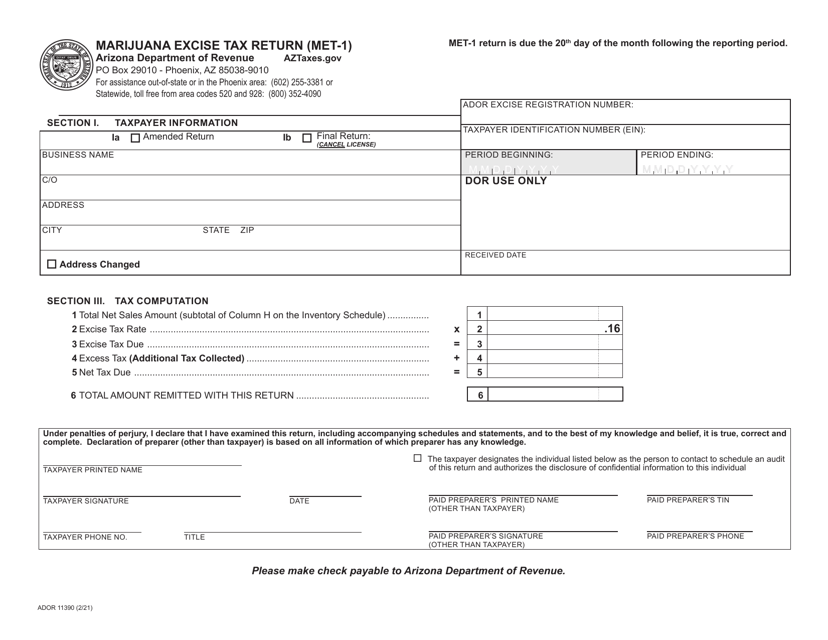

Form MET-1 (ADOR11390) Marijuana Excise Tax Return - Arizona

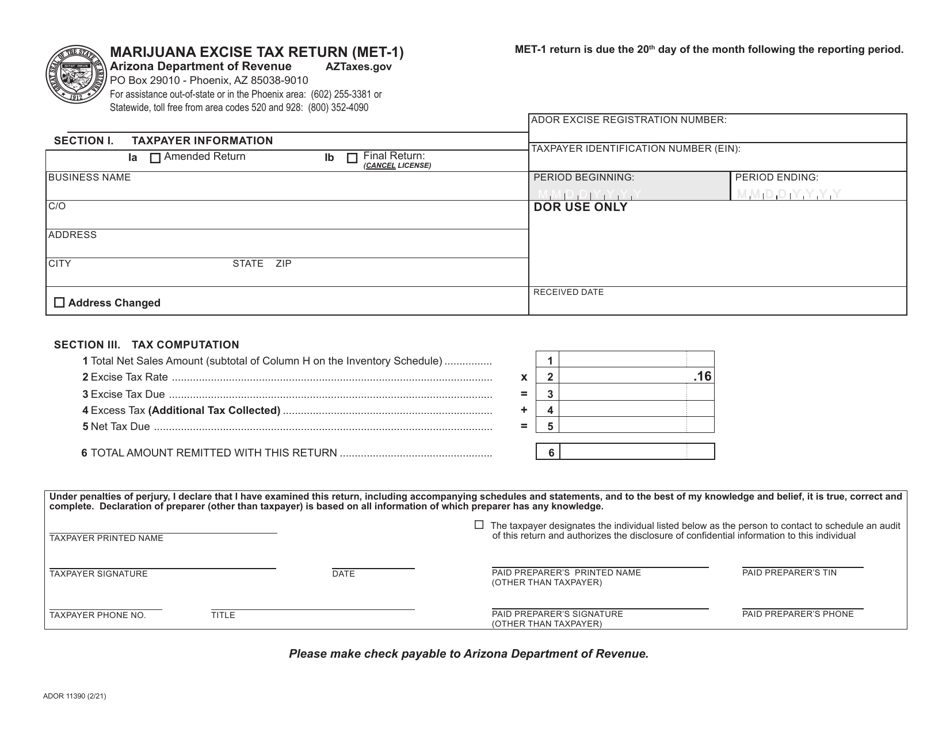

What Is Form MET-1 (ADOR11390)?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. Check the official instructions before completing and submitting the form.

FAQ

Q: What is MET-1?

A: MET-1 is the Marijuana Excise Tax Return form in Arizona.

Q: Who needs to file the MET-1 form?

A: Any licensed marijuana establishment in Arizona needs to file the MET-1 form.

Q: What is the purpose of the MET-1 form?

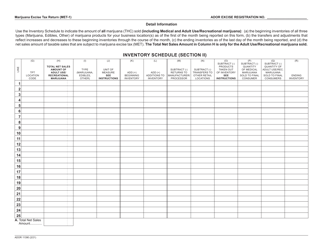

A: The MET-1 form is used to report and pay excise tax on the sale of marijuana in Arizona.

Q: When is the MET-1 form due?

A: The MET-1 form is due on the 15th of each month for the previous month's sales.

Q: What information is required on the MET-1 form?

A: The MET-1 form requires information such as total sales, tax due, and any adjustments or deductions.

Q: What happens if I do not file the MET-1 form?

A: Failure to file the MET-1 form or pay the required tax may result in penalties and interest.

Q: Do I need to keep copies of the MET-1 form?

A: Yes, you should keep copies of the MET-1 form and any supporting documentation for at least four years.

Q: Who can I contact for more information about the MET-1 form?

A: You can contact the Arizona Department of Revenue for more information about the MET-1 form.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MET-1 (ADOR11390) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.