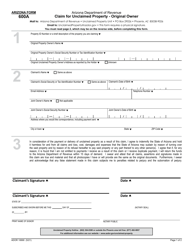

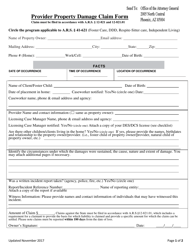

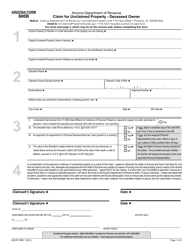

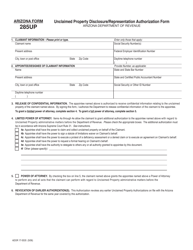

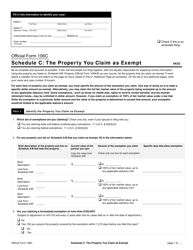

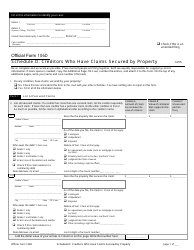

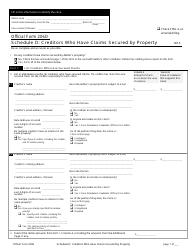

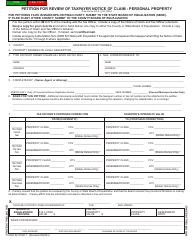

Arizona Form 600A (ADOR10690) Claim for Unclaimed Property - Original Owner - Arizona

What Is Arizona Form 600A (ADOR10690)?

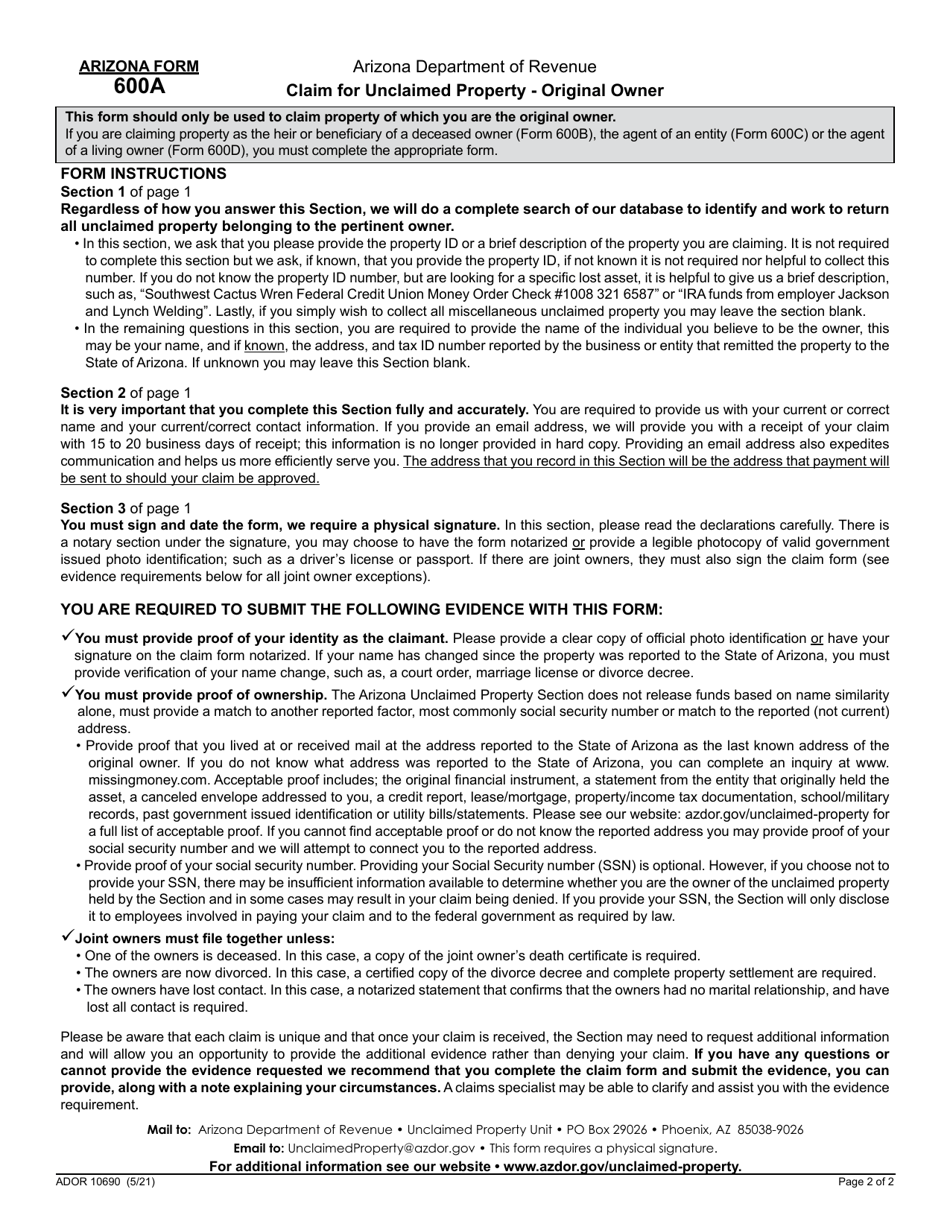

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Arizona Form 600A?

A: Arizona Form 600A is a claim form for unclaimed property in Arizona.

Q: Who can use Arizona Form 600A?

A: Any original owner of unclaimed property in Arizona can use the form.

Q: What is unclaimed property?

A: Unclaimed property refers to financial assets or valuables that have been abandoned by their owners.

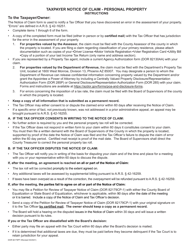

Q: How do I file a claim using Arizona Form 600A?

A: Fill out the form with necessary details and submit it to the Arizona Department of Revenue.

Q: What happens after I file a claim?

A: The Arizona Department of Revenue will review your claim and contact you if further information is needed.

Q: Can I track the status of my claim?

A: Yes, you can track the status of your claim by contacting the Arizona Department of Revenue.

Q: What if my claim is approved?

A: If your claim is approved, you will receive the unclaimed property or its value.

Q: What if my claim is denied?

A: If your claim is denied, you may have the option to appeal the decision.

Q: Are there any fees for filing a claim?

A: No, there are no fees for filing a claim for unclaimed property in Arizona.

Q: Can I claim unclaimed property from another state using Arizona Form 600A?

A: No, Arizona Form 600A is specifically for claiming unclaimed property in Arizona.

Q: How long does it take to process a claim?

A: The processing time for a claim may vary and depends on the complexity of the case.

Q: What should I do if I have more questions?

A: If you have more questions, you can contact the Arizona Department of Revenue for assistance.

Form Details:

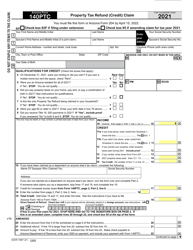

- Released on May 1, 2021;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Arizona Form 600A (ADOR10690) by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.