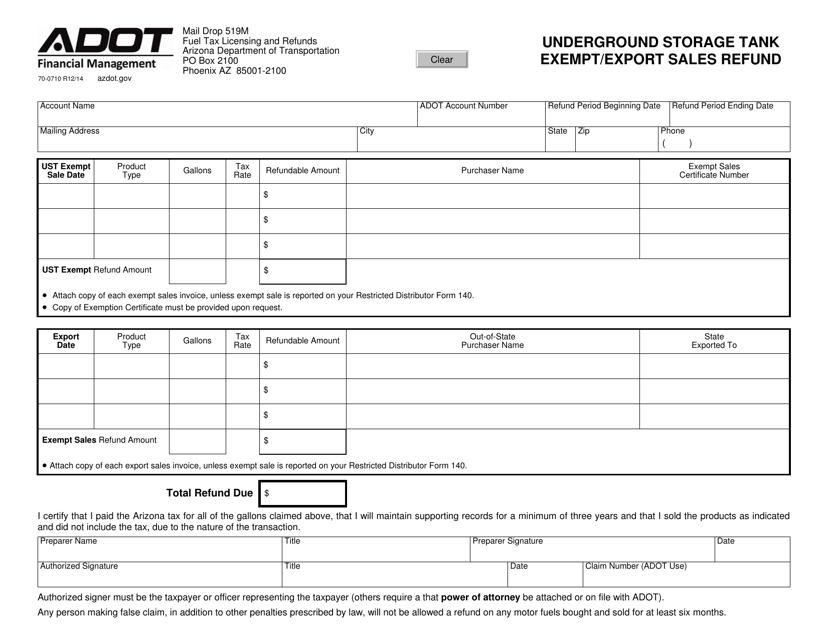

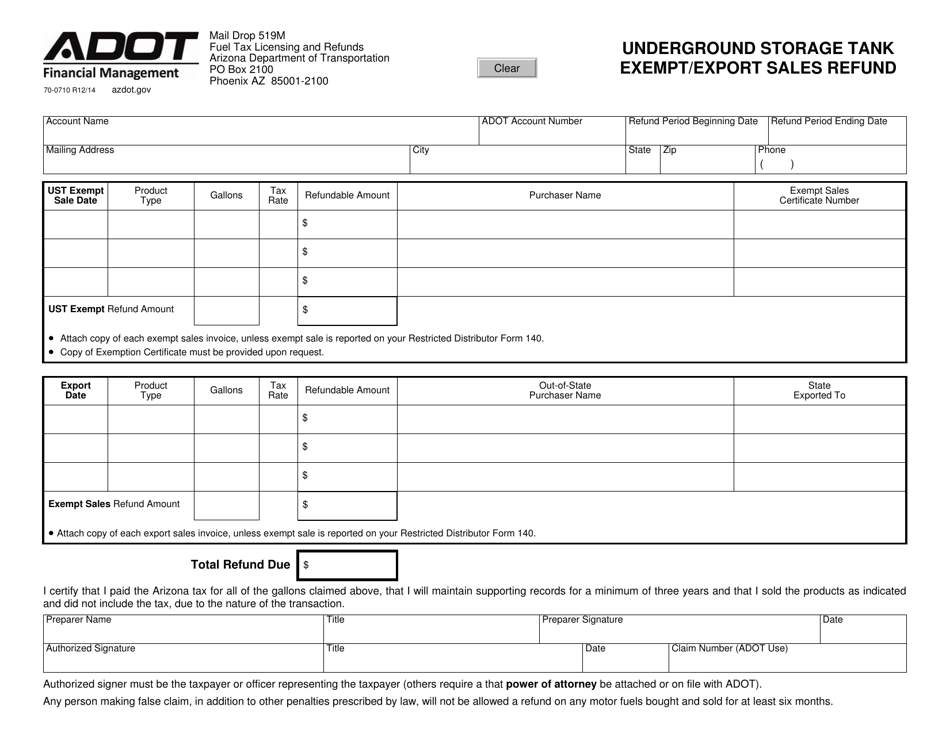

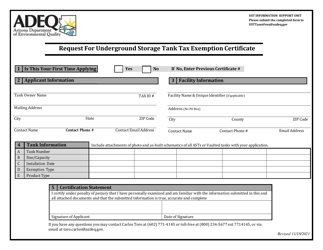

Form 70-0710 Underground Storage Tank Exmpt / Export Sales Refund - Arizona

What Is Form 70-0710?

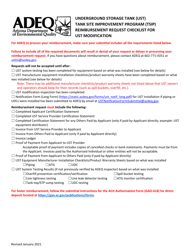

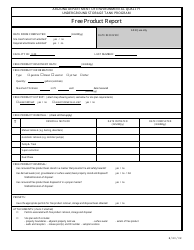

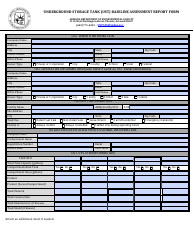

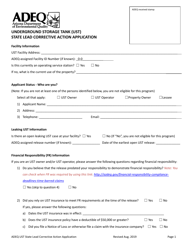

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 70-0710?

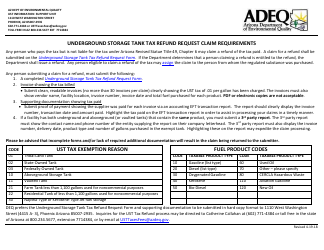

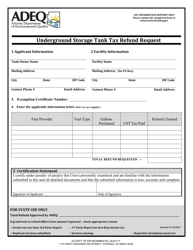

A: Form 70-0710 is a form used for claiming exempt or export sales refund for underground storage tanks in Arizona.

Q: What is an underground storage tank (UST)?

A: An underground storage tank (UST) is a tank or combination of tanks located underground that is used to store petroleum or other hazardous substances.

Q: Who can claim an exempt or export sales refund for USTs in Arizona?

A: The person or entity who purchased and used the petroleum or other hazardous substances stored in the underground storage tank can claim the exempt or export sales refund.

Q: What is the purpose of the exempt or export sales refund for USTs in Arizona?

A: The purpose of the exempt or export sales refund is to provide a refund of the taxes paid on the purchase of petroleum or other hazardous substances that were stored in an underground storage tank and subsequently exported or used in an exempt manner.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-0710 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.