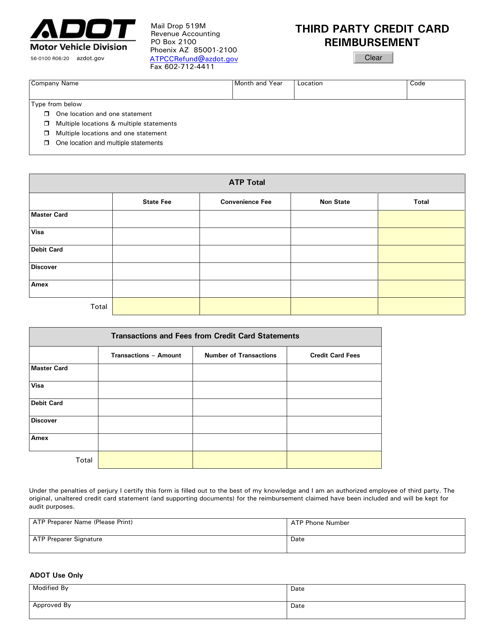

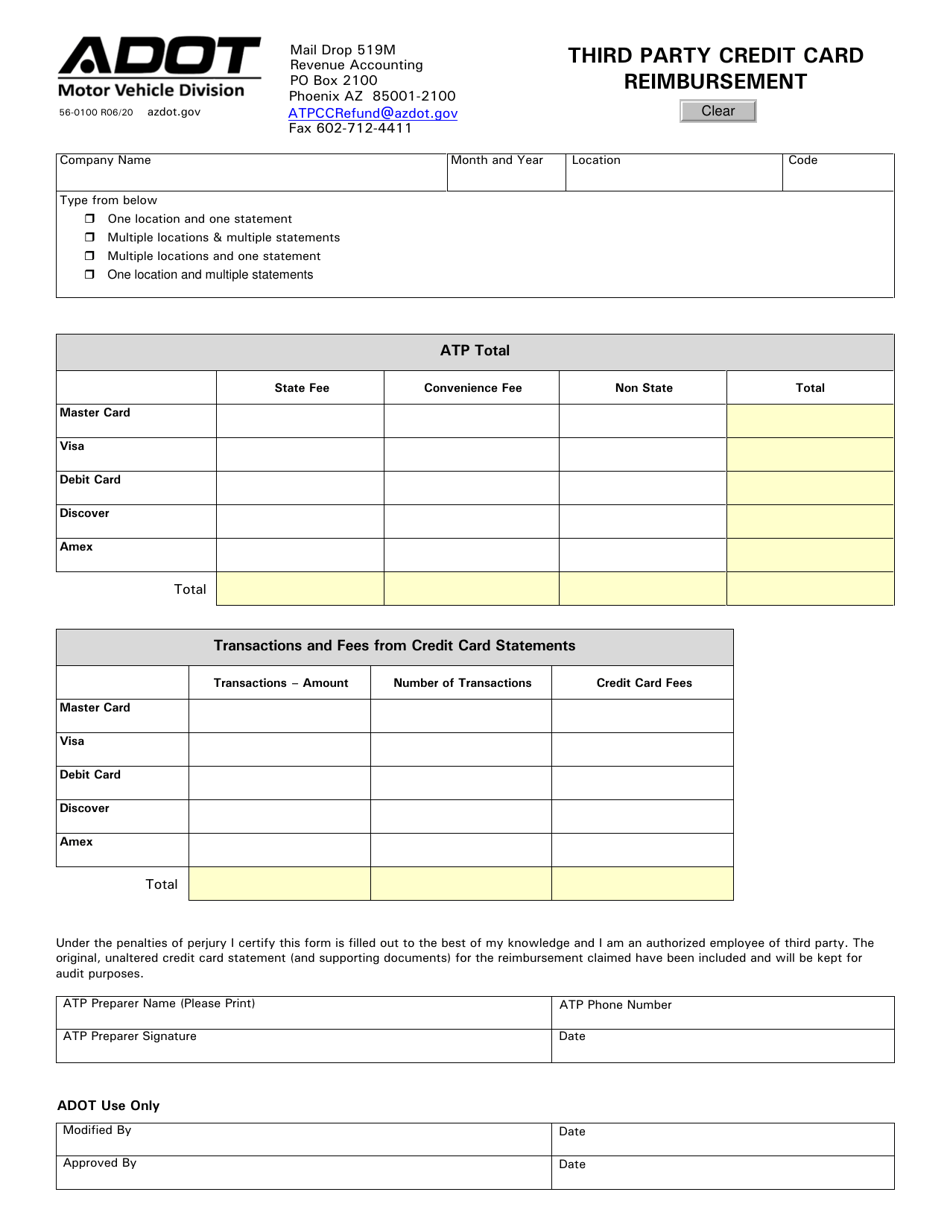

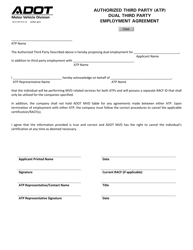

Form 56-0100 Third Party Credit Card Reimbursement - Arizona

What Is Form 56-0100?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56-0100?

A: Form 56-0100 is a Third Party Credit Card Reimbursement form in Arizona.

Q: What is the purpose of Form 56-0100?

A: The purpose of Form 56-0100 is to request reimbursement for expenses paid by a third party's credit card.

Q: Who should use Form 56-0100?

A: Form 56-0100 should be used by individuals or entities who have paid expenses using a third party's credit card and are seeking reimbursement.

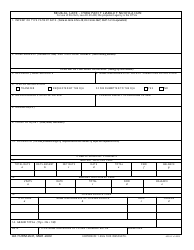

Q: Is there a deadline for submitting Form 56-0100?

A: There is currently no specific deadline mentioned for submitting Form 56-0100. It is recommended to submit it as soon as possible after incurring the expenses.

Q: What supporting documents are required with Form 56-0100?

A: Along with Form 56-0100, you need to include copies of the credit card statements, receipts, and any other relevant documentation that supports the expenses incurred.

Q: Is there a fee for filing Form 56-0100?

A: There is no fee for filing Form 56-0100.

Q: Can I file Form 56-0100 electronically?

A: As of now, the Arizona Department of Revenue does not accept electronic filing of Form 56-0100. It must be filed by mail.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 56-0100 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.