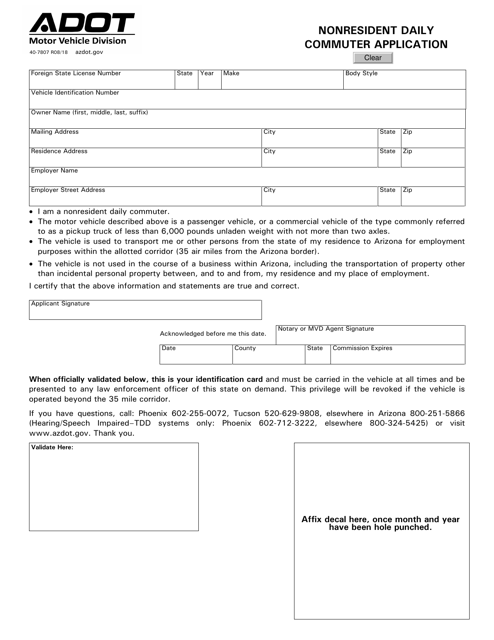

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 40-7807

for the current year.

Form 40-7807 Nonresident Daily Commuter Application - Arizona

What Is Form 40-7807?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-7807?

A: Form 40-7807 is the Nonresident Daily Commuter Application for Arizona.

Q: Who should file Form 40-7807?

A: Nonresidents who commute to Arizona on a daily basis should file Form 40-7807.

Q: What is the purpose of Form 40-7807?

A: The purpose of Form 40-7807 is to claim exemption from Arizona individual income tax.

Q: Can nonresidents claim exemption from Arizona income tax?

A: Yes, nonresidents who commute to Arizona on a daily basis can claim exemption from Arizona income tax.

Q: How often should Form 40-7807 be filed?

A: Form 40-7807 should be filed annually.

Q: Is there a deadline for filing Form 40-7807?

A: Yes, Form 40-7807 should be filed by the due date of the individual income tax return.

Q: Are there any eligibility requirements for claiming exemption on Form 40-7807?

A: Yes, to claim exemption, you must be a nonresident who commutes to Arizona on a daily basis and have no Arizona adjustments or income.

Q: What documentation do I need to submit with Form 40-7807?

A: You may need to submit copies of your federal income tax return, W-2s, and any other supporting documents.

Q: What happens if I don't file Form 40-7807?

A: If you don't file Form 40-7807, you may be subject to paying Arizona income tax on your earnings in the state.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-7807 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.