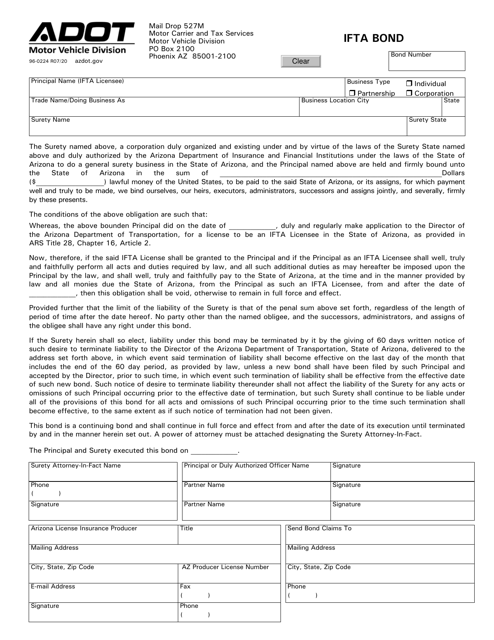

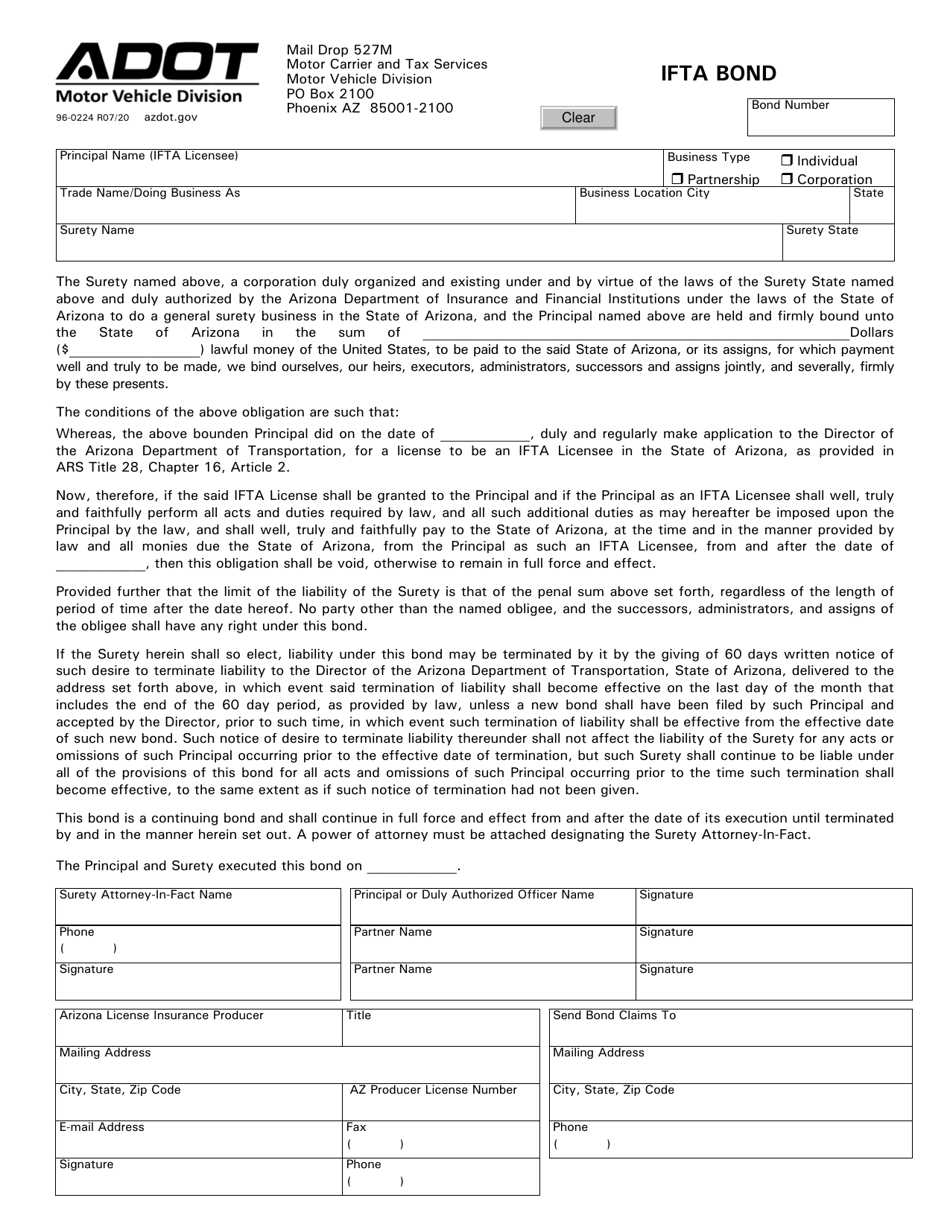

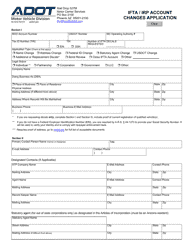

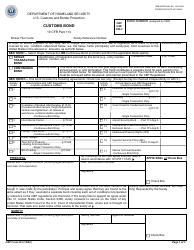

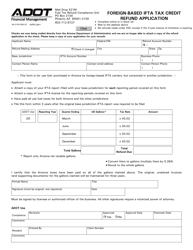

Form 96-0224 Ifta Bond - Arizona

What Is Form 96-0224?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

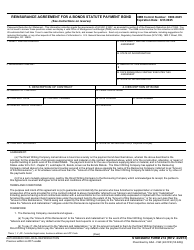

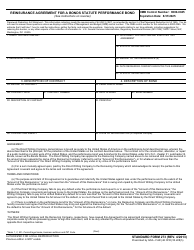

Q: What is Form 96-0224 Ifta Bond?

A: Form 96-0224 Ifta Bond is a bond form used in the state of Arizona for the International Fuel Tax Agreement (IFTA).

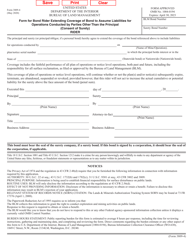

Q: What is the purpose of Form 96-0224 Ifta Bond?

A: The purpose of Form 96-0224 Ifta Bond is to provide a financial guarantee to the state of Arizona that the IFTA taxes will be paid on time.

Q: Who needs to file Form 96-0224 Ifta Bond?

A: Motor carriers who operate qualified motor vehicles in multiple jurisdictions and are required to participate in the IFTA program need to file Form 96-0224 Ifta Bond in Arizona.

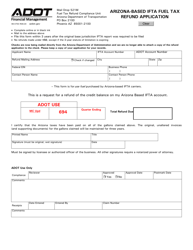

Q: How can I obtain Form 96-0224 Ifta Bond?

A: You can obtain Form 96-0224 Ifta Bond from the Arizona Department of Transportation (ADOT) Motor Vehicle Division.

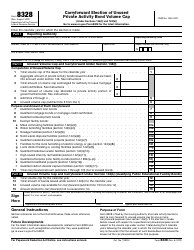

Q: What information is required on Form 96-0224 Ifta Bond?

A: Form 96-0224 Ifta Bond requires information such as the motor carrier's name, address, federal employer identification number (FEIN), and the amount of the bond.

Q: Are there any fees associated with Form 96-0224 Ifta Bond?

A: Yes, there is a $100 filing fee for Form 96-0224 Ifta Bond in Arizona.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 96-0224 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.