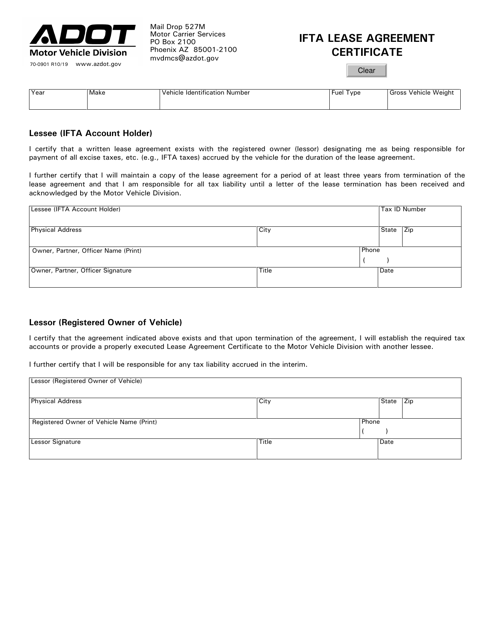

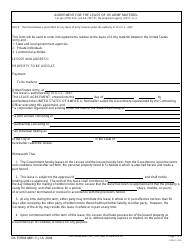

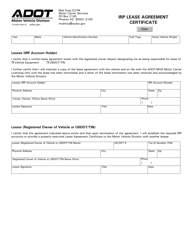

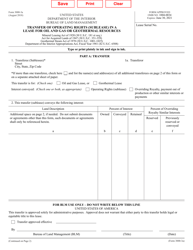

Form 70-0901 Ifta Lease Agreement Certificate - Arizona

What Is Form 70-0901?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form 70-0901 Ifta Lease Agreement Certificate?

A: The purpose of this form is to certify an exception to the International Fuel Tax Agreement (IFTA) reporting requirements for leased vehicles in Arizona.

Q: Who needs to fill out Form 70-0901 Ifta Lease Agreement Certificate?

A: This form needs to be filled out by lessees who wish to claim an exception to the IFTA reporting requirements for leased vehicles in Arizona.

Q: Is there a fee for obtaining Form 70-0901 Ifta Lease Agreement Certificate?

A: No, there is no fee for obtaining this form.

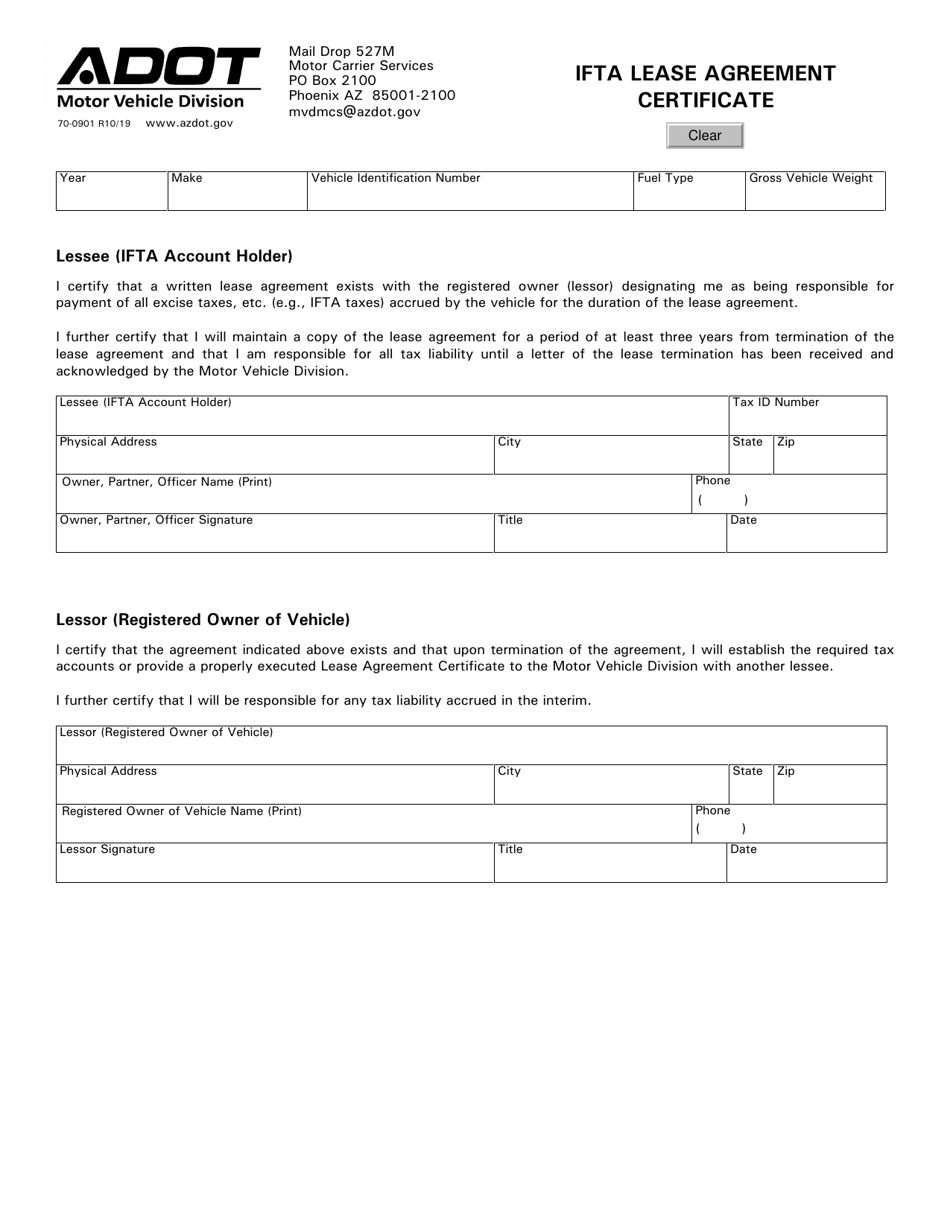

Q: What information is required on Form 70-0901 Ifta Lease Agreement Certificate?

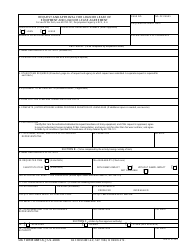

A: The form requires information such as the lessee's name and address, the lessor's name and address, lease agreement details, and vehicle information.

Q: Is Form 70-0901 Ifta Lease Agreement Certificate applicable only in Arizona?

A: Yes, this form is specific to Arizona and is used to certify exceptions to IFTA reporting requirements in the state.

Q: Do I need to renew Form 70-0901 Ifta Lease Agreement Certificate?

A: This form does not require renewal, but it should be kept on file as long as the leased vehicles are in operation.

Q: What should I do with Form 70-0901 Ifta Lease Agreement Certificate once it is completed?

A: The completed form should be kept on file by the lessee, and a copy should be provided to the lessor and maintained by the lessor as well.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 70-0901 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.