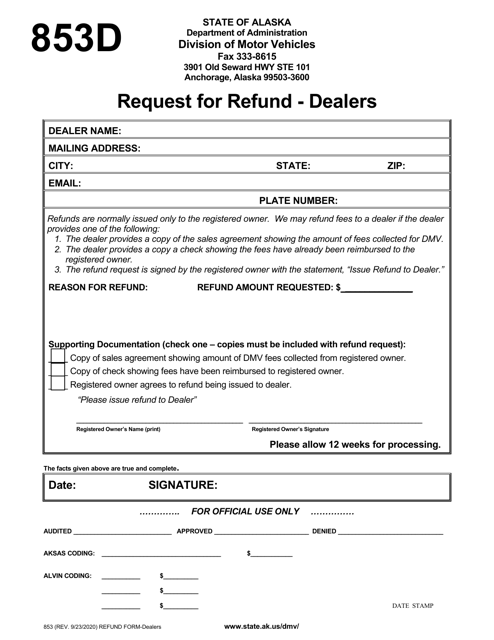

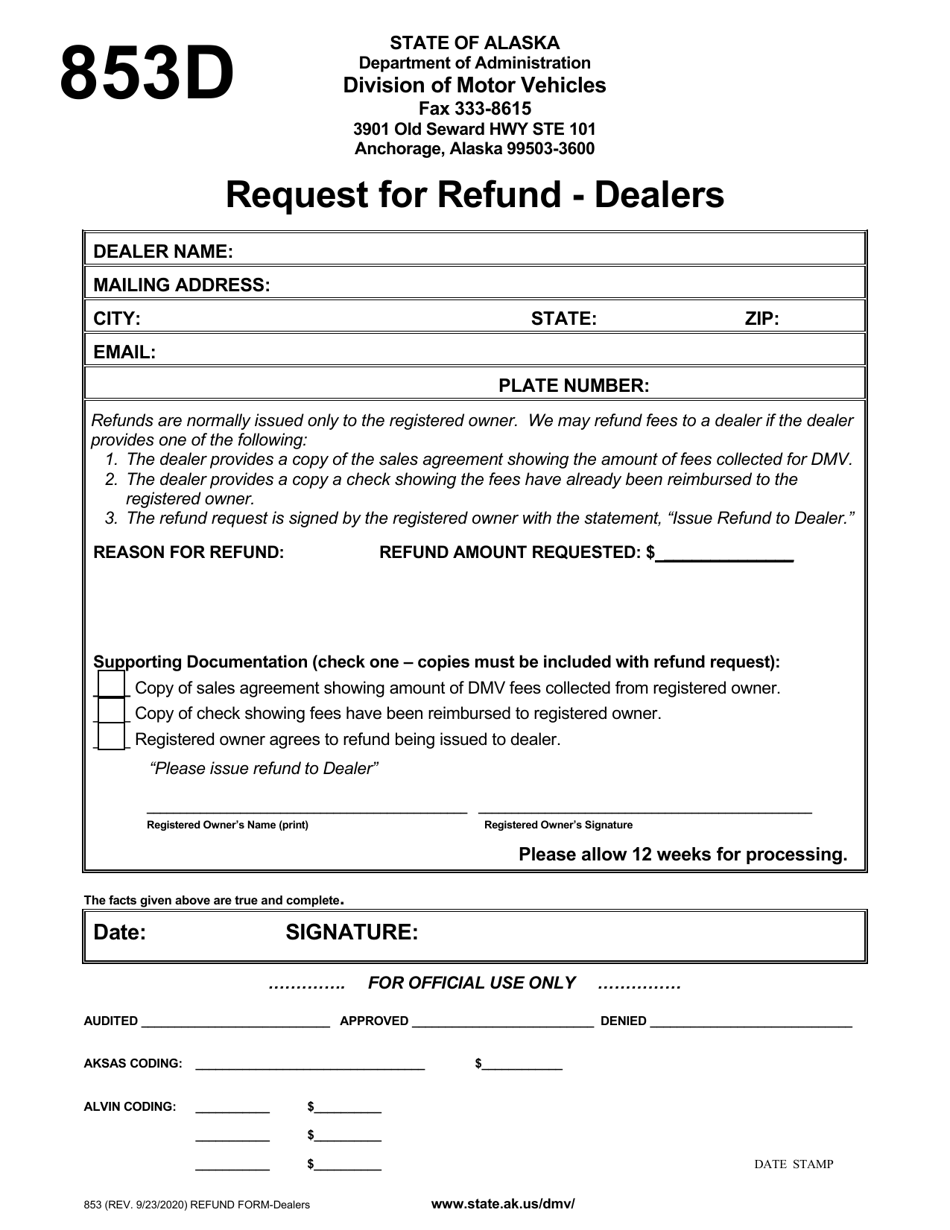

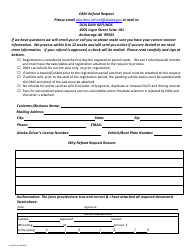

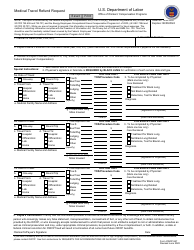

Form 853D Request for Refund - Dealers - Alaska

What Is Form 853D?

This is a legal form that was released by the Alaska Department of Administration - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 853D?

A: Form 853D is a request for refund form for dealers in Alaska.

Q: Who can use Form 853D?

A: Dealers in Alaska can use Form 853D to request a refund.

Q: What is the purpose of Form 853D?

A: Form 853D is used to request a refund for certain taxes or fees paid by dealers in Alaska.

Q: Is there a deadline for filing Form 853D?

A: Yes, Form 853D must be filed within 3 years from the date the tax or fee was paid.

Q: What taxes or fees can be refunded using Form 853D?

A: Form 853D can be used to request a refund for certain taxes or fees paid by dealers in Alaska, such as sales taxes or license fees.

Q: What supporting documentation is required for Form 853D?

A: You will need to provide supporting documentation, such as receipts or invoices, to support your request for a refund using Form 853D.

Q: How long does it take to process a Form 853D refund?

A: The processing time for a Form 853D refund can vary, but it typically takes several weeks.

Q: Can Form 853D be filed electronically?

A: No, Form 853D must be filed by mail or in person.

Q: What should I do if I have questions about Form 853D?

A: If you have questions about Form 853D, you should contact the Alaska Department of Revenue for assistance.

Form Details:

- Released on September 23, 2020;

- The latest edition provided by the Alaska Department of Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 853D by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.