This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

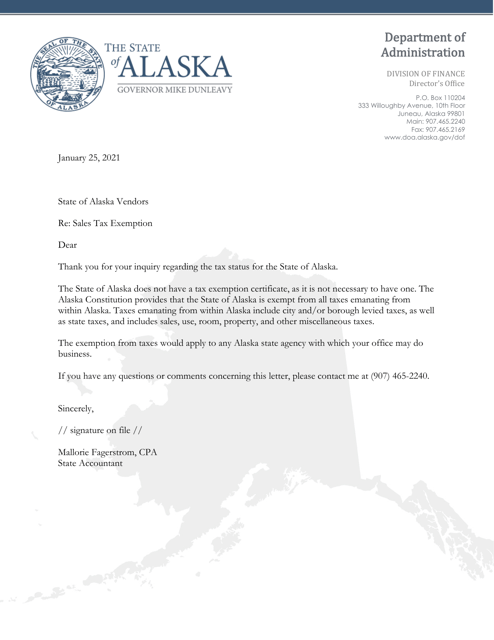

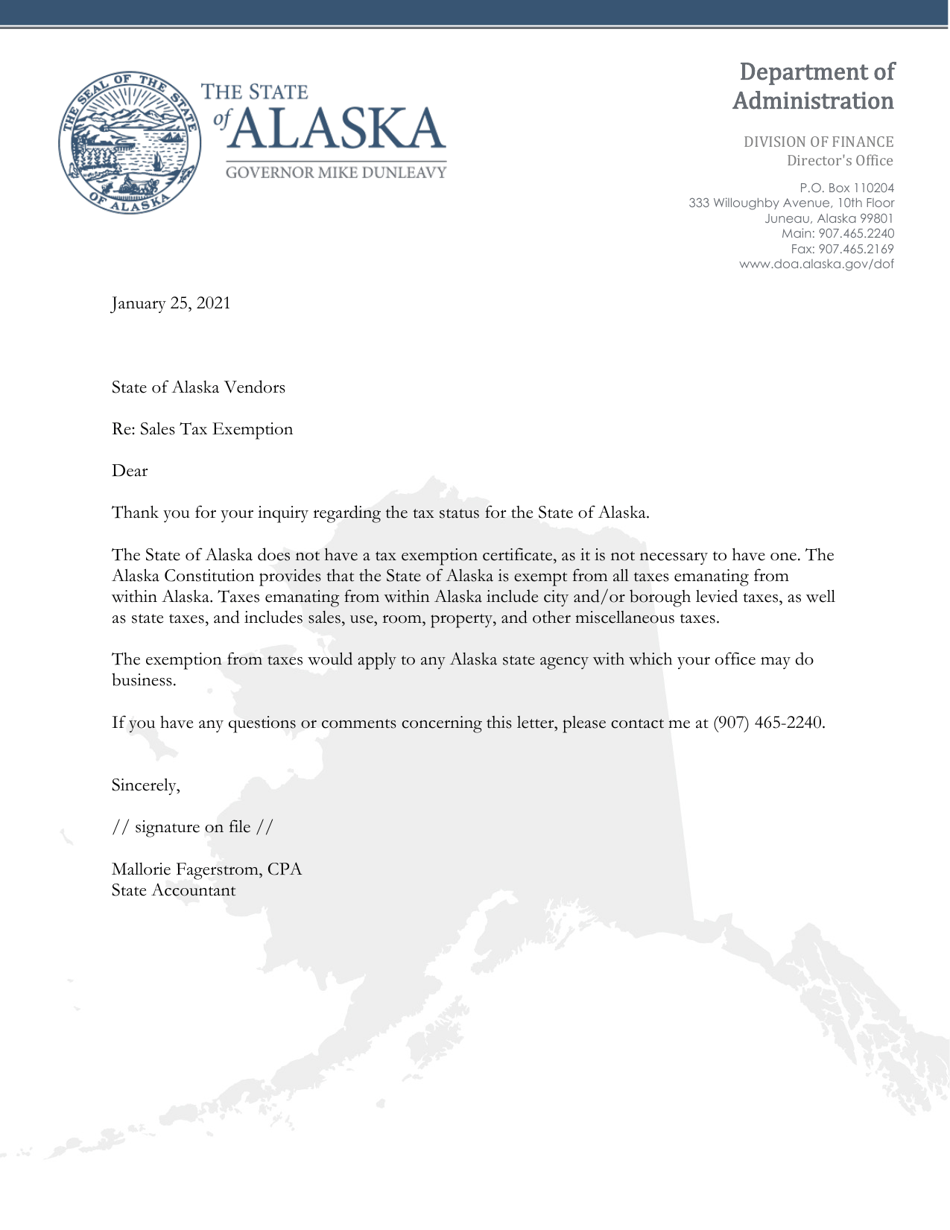

State Sales Tax Exemption - Response Letter - Alaska

State Sales Tax Exemption - Response Letter is a legal document that was released by the Alaska Department of Administration - a government authority operating within Alaska.

FAQ

Q: What is the state sales tax exemption?

A: The state sales tax exemption is a policy that allows certain individuals or organizations to be exempt from paying sales tax on eligible purchases.

Q: Who is eligible for the state sales tax exemption in Alaska?

A: Eligibility for the state sales tax exemption in Alaska can vary depending on the specific situation. Generally, it may apply to qualified individuals, such as senior citizens or disabled individuals, as well as certain organizations such as non-profit entities.

Q: How do I apply for the state sales tax exemption in Alaska?

A: To apply for the state sales tax exemption in Alaska, you will need to complete the appropriate application form provided by the Alaska Department of Revenue. The form should be submitted to the department for review and processing.

Q: What purchases are eligible for the state sales tax exemption?

A: The specific list of eligible purchases for the state sales tax exemption in Alaska can vary. Generally, essential goods and services, such as clothing, groceries, and medical supplies, may be eligible. It's important to consult the Alaska Department of Revenue or the specific exemption guidelines for more detailed information.

Q: Do I still need to pay local sales taxes if I qualify for the state sales tax exemption?

A: In Alaska, local sales taxes may still apply even if you qualify for the state sales tax exemption. It's important to check the local tax regulations in your area to determine if any additional taxes are required.

Form Details:

- Released on January 25, 2021;

- The latest edition currently provided by the Alaska Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.