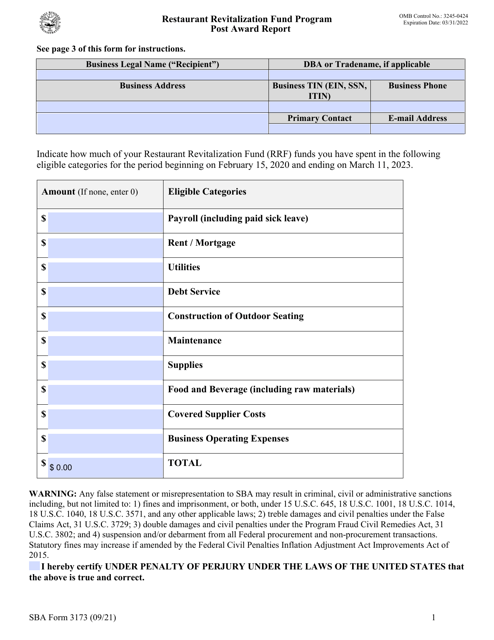

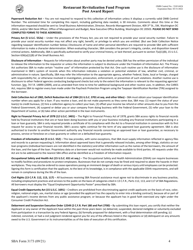

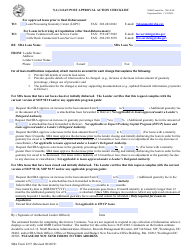

SBA Form 3173 Post Award Report - Restaurant Revitalization Fund Program

What Is SBA Form 3173?

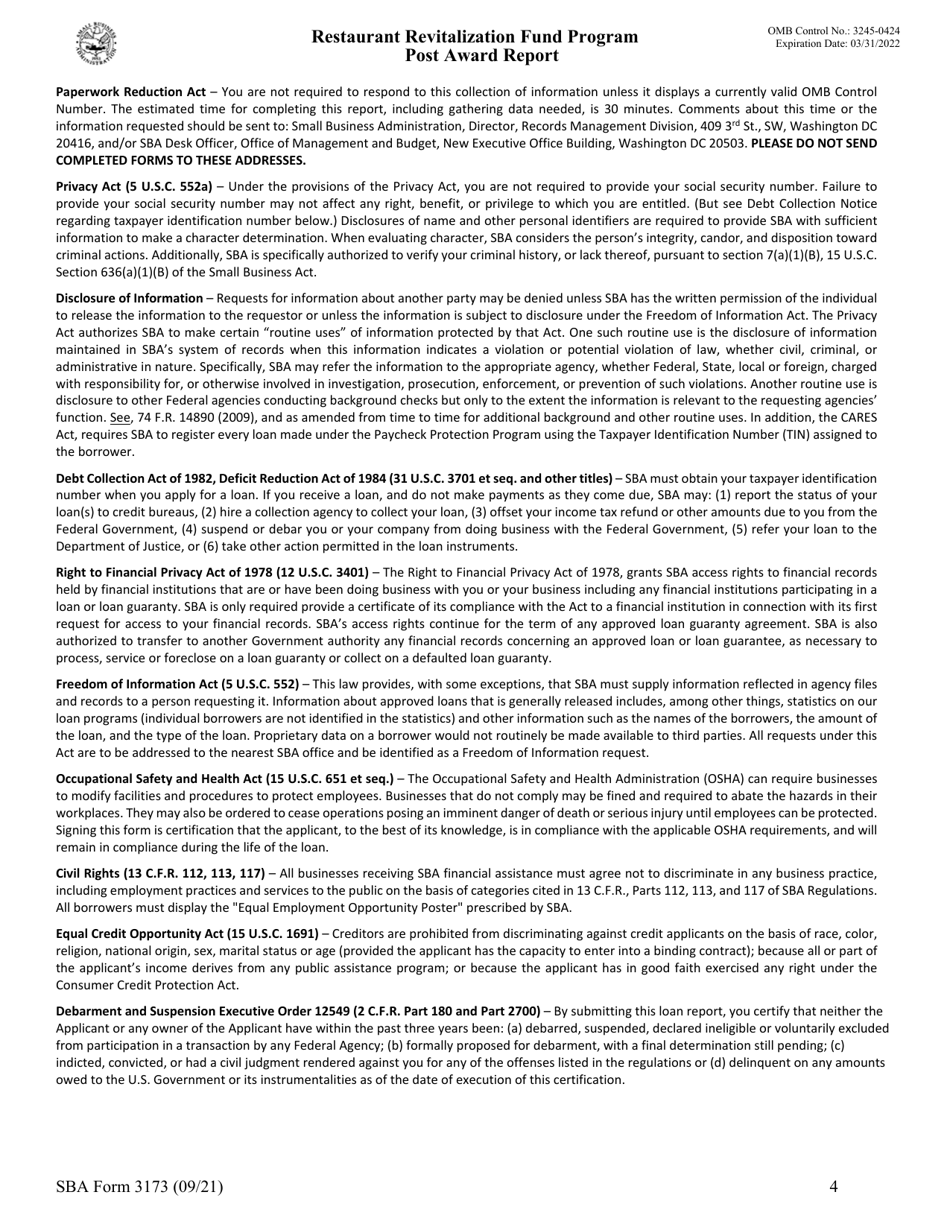

This is a legal form that was released by the U.S. Small Business Administration on September 1, 2021 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is SBA Form 3173?

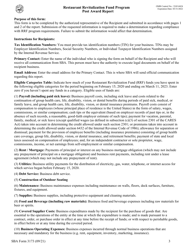

A: SBA Form 3173 is the Post Award Report for the Restaurant Revitalization Fund Program.

Q: What is the Restaurant Revitalization Fund Program?

A: The Restaurant Revitalization Fund Program is a program launched by the Small Business Administration (SBA) to provide financial assistance to restaurants and other food service businesses affected by the COVID-19 pandemic.

Q: Who needs to fill out SBA Form 3173?

A: Applicants who have received funding through the Restaurant Revitalization Fund Program need to fill out SBA Form 3173.

Q: What information is required in SBA Form 3173?

A: SBA Form 3173 requires information such as the business name, grant amount, revenue loss calculations, and certification of compliance with program requirements.

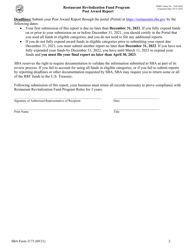

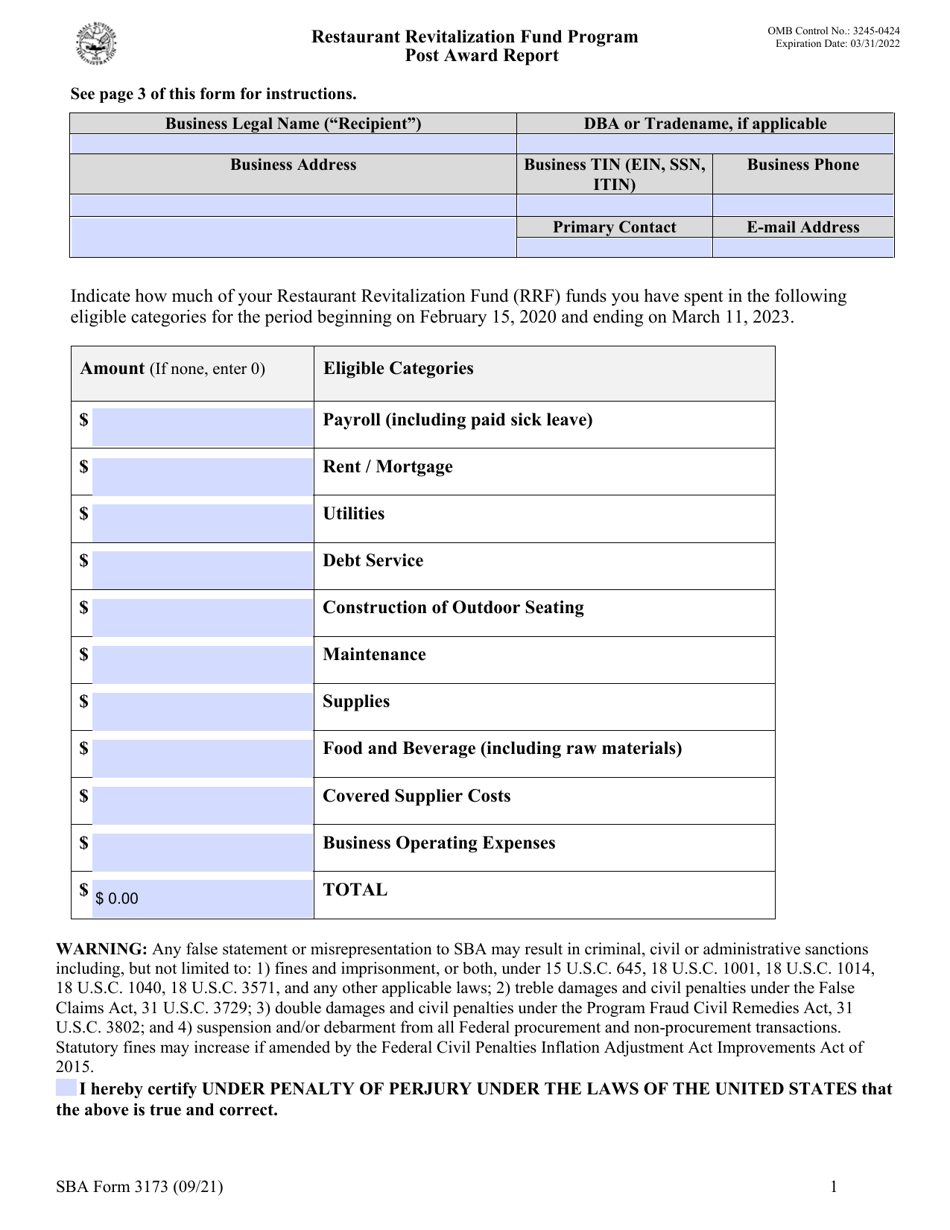

Q: When is SBA Form 3173 due?

A: The deadline for submitting SBA Form 3173 is 120 days after the grant award date.

Q: Are there any fees associated with submitting SBA Form 3173?

A: No, there are no fees associated with submitting SBA Form 3173.

Q: What happens after I submit SBA Form 3173?

A: After submitting SBA Form 3173, the SBA will review the information provided and may conduct additional audits or examinations to ensure compliance with program requirements.

Q: What if I need assistance with filling out SBA Form 3173?

A: If you need assistance with filling out SBA Form 3173, you can contact the Small Business Administration or reach out to the Restaurant Revitalization Fund Program's support team.

Form Details:

- Released on September 1, 2021;

- The latest available edition released by the U.S. Small Business Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of SBA Form 3173 by clicking the link below or browse more documents and templates provided by the U.S. Small Business Administration.