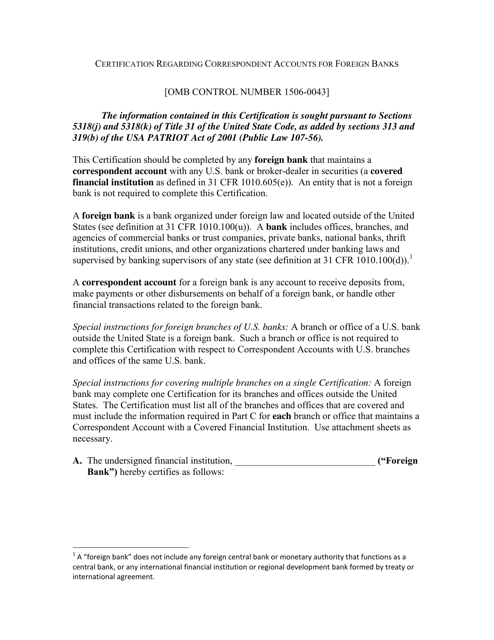

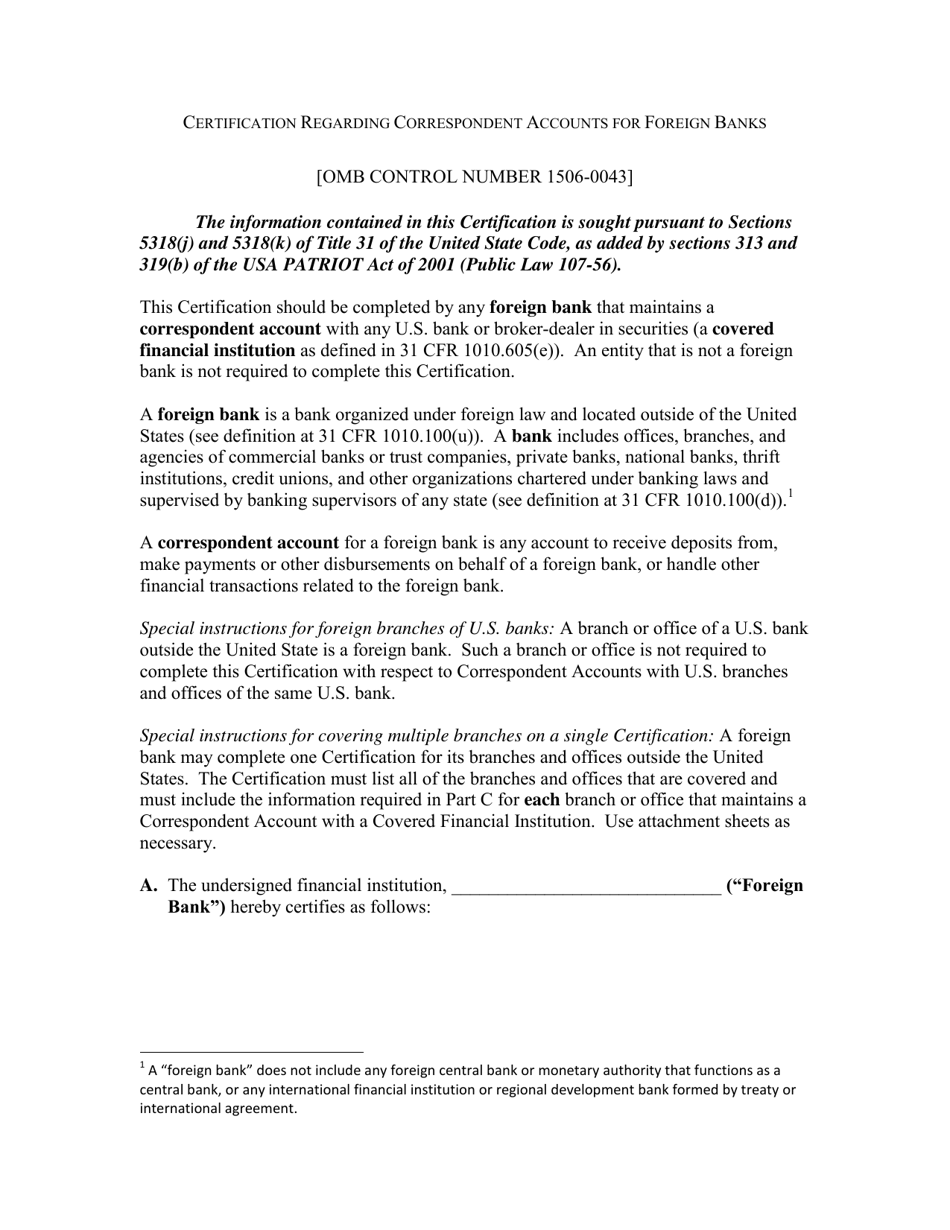

Certification Regarding Correspondent Accounts for Foreign Banks

Certification Regarding Correspondent Accounts for Foreign Banks is a 5-page legal document that was released by the U.S. Department of the Treasury - Financial Crimes Enforcement Network on September 26, 2002 and used nation-wide.

FAQ

Q: What is a Certification Regarding Correspondent Accounts for Foreign Banks?

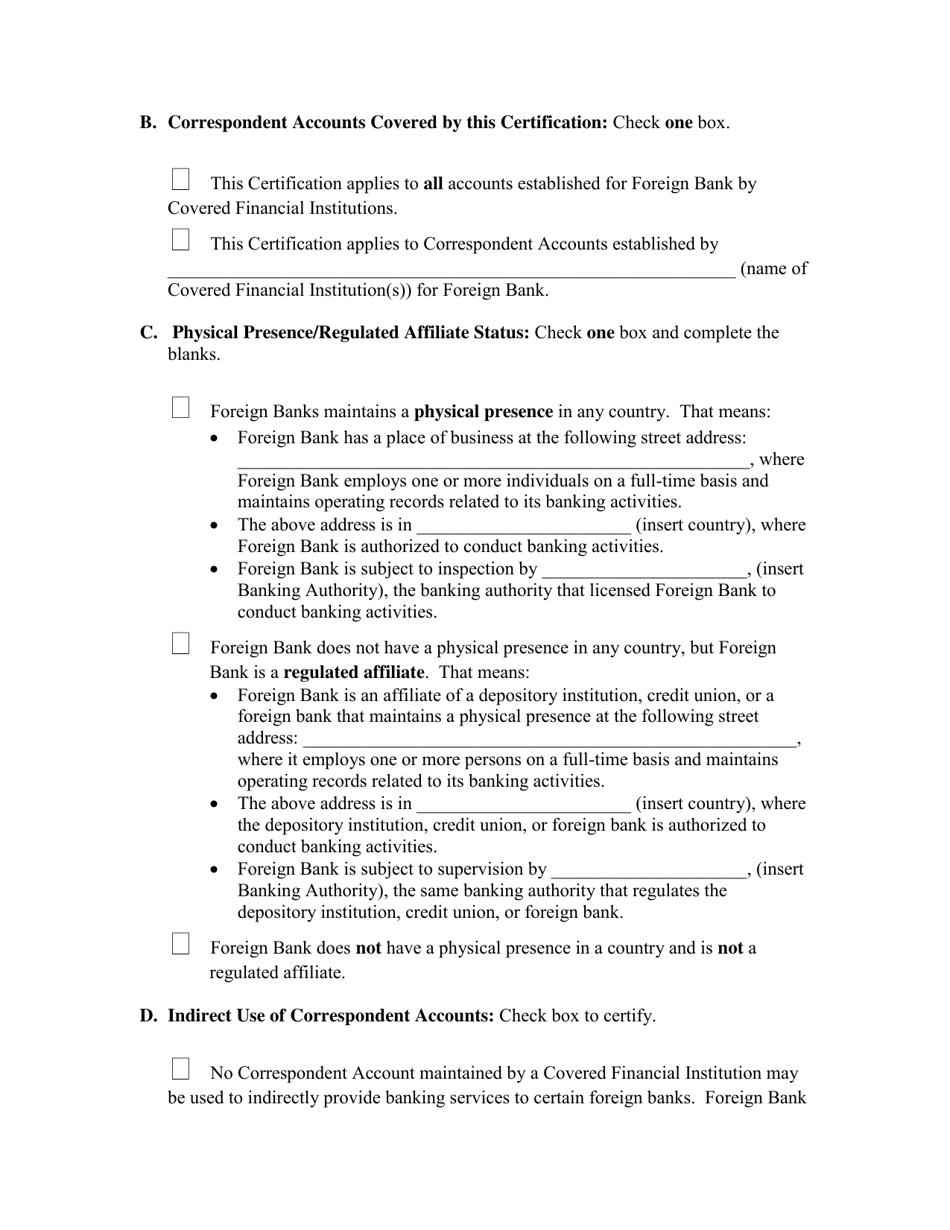

A: A Certification Regarding Correspondent Accounts for Foreign Banks is a document that requires foreign banks to certify certain information regarding their correspondent accounts in the United States.

Q: Why is the Certification Regarding Correspondent Accounts for Foreign Banks important?

A: The certification is important because it helps prevent money laundering and terrorist financing by foreign banks.

Q: Who is required to submit the Certification Regarding Correspondent Accounts for Foreign Banks?

A: Foreign banks that maintain correspondent accounts in the United States are required to submit the certification.

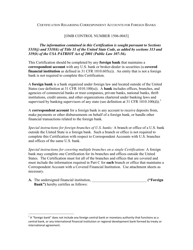

Q: What information does the certification require?

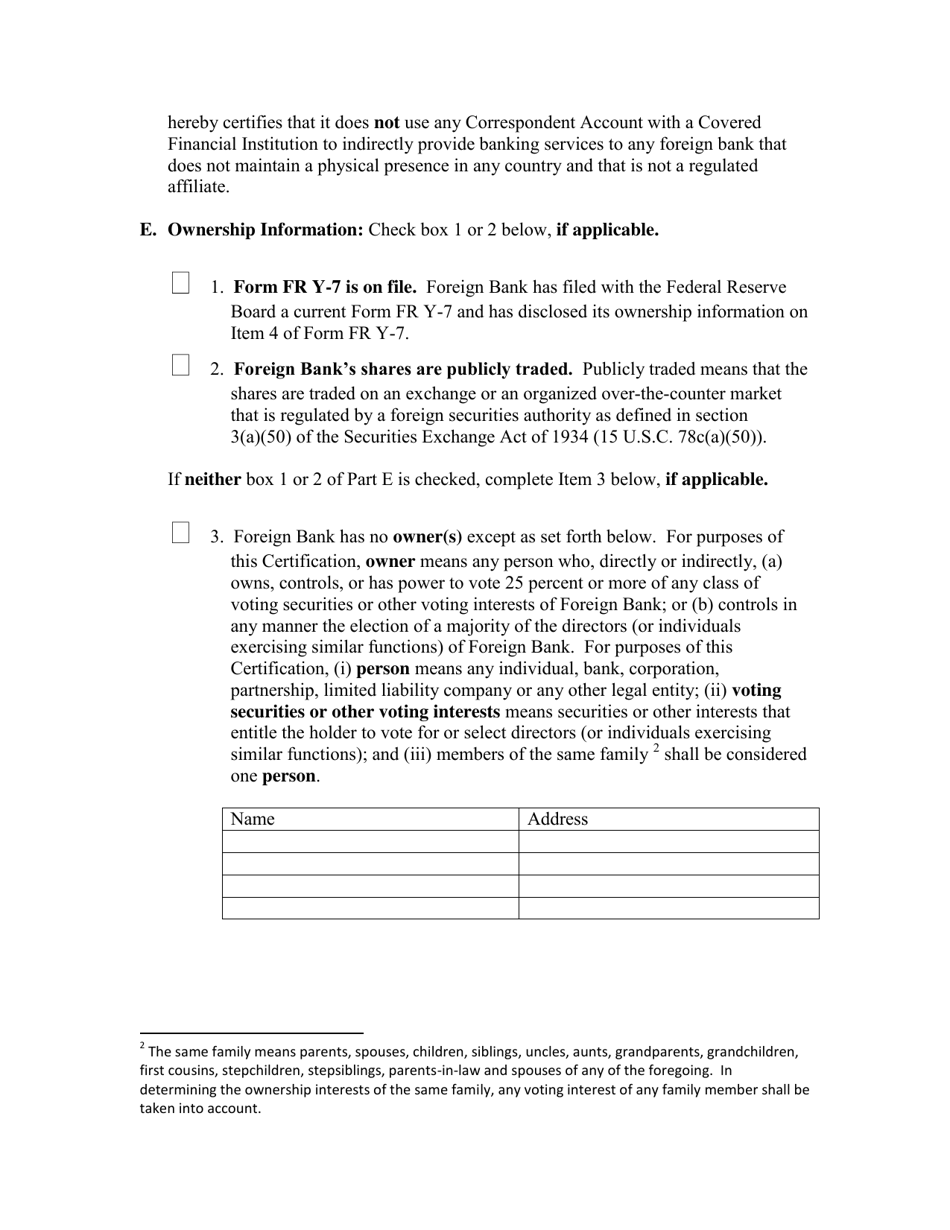

A: The certification requires foreign banks to provide information about their ownership structure, regulatory status, and the identity of certain of their customers.

Q: What are correspondent accounts?

A: Correspondent accounts are accounts that a foreign bank maintains at a financial institution in the United States to receive deposits from, make payments on behalf of, or handle other financial transactions for the foreign bank.

Q: What are the consequences of not submitting the certification?

A: Foreign banks that fail to submit the certification may be subject to penalties, including the potential loss of access to the U.S. financial system.

Form Details:

- The latest edition currently provided by the U.S. Department of the Treasury - Financial Crimes Enforcement Network;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.