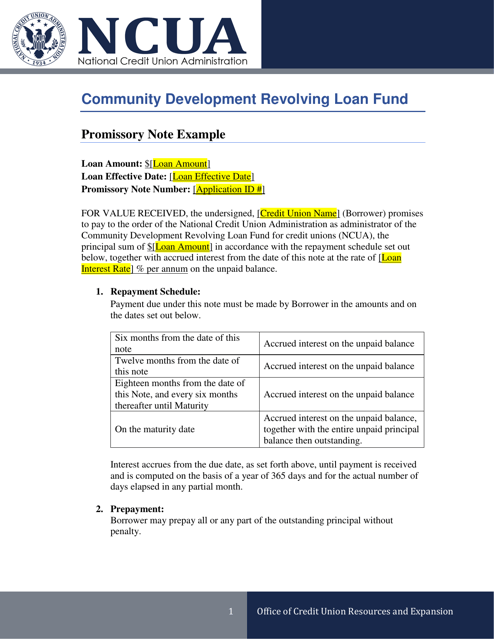

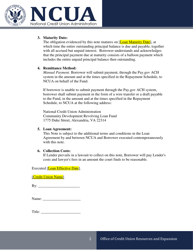

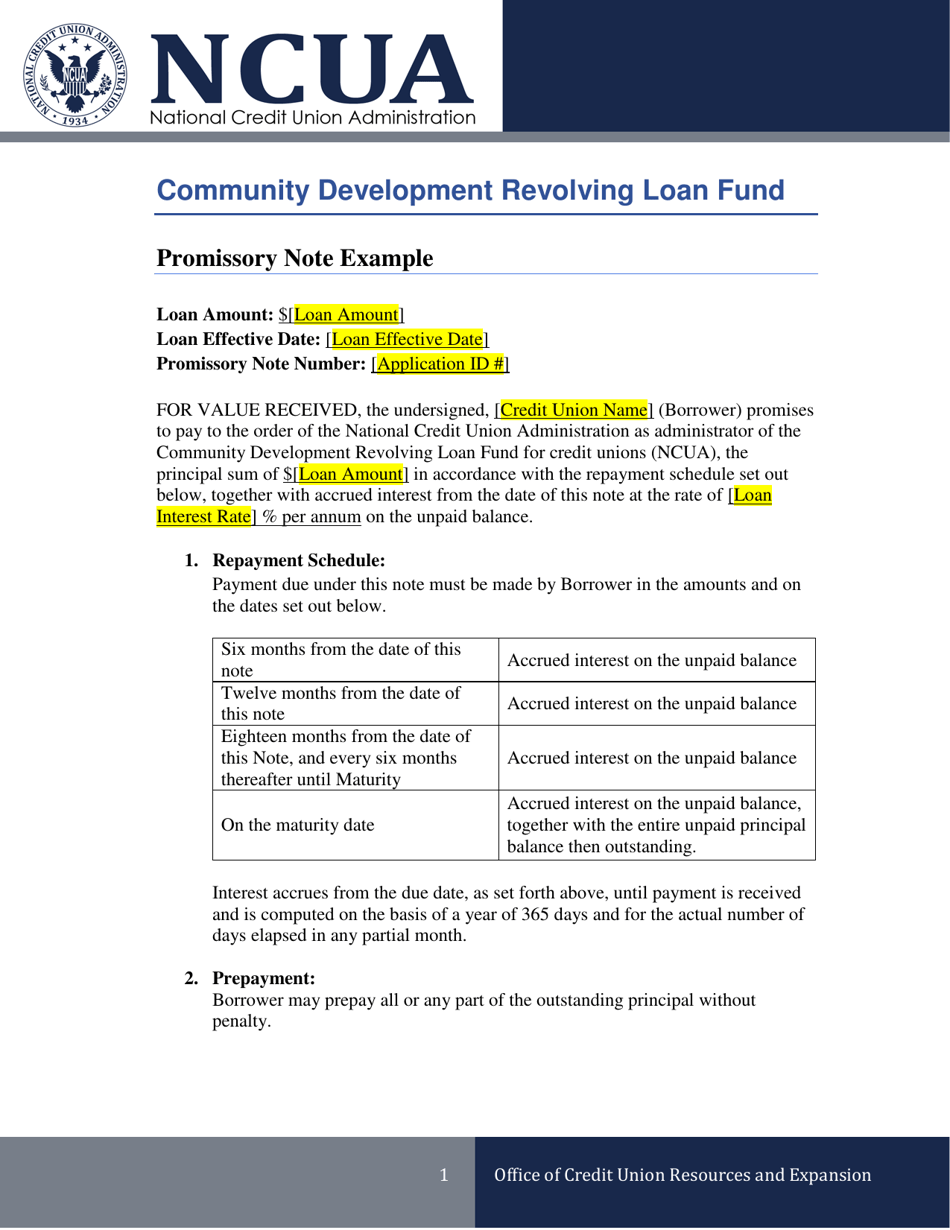

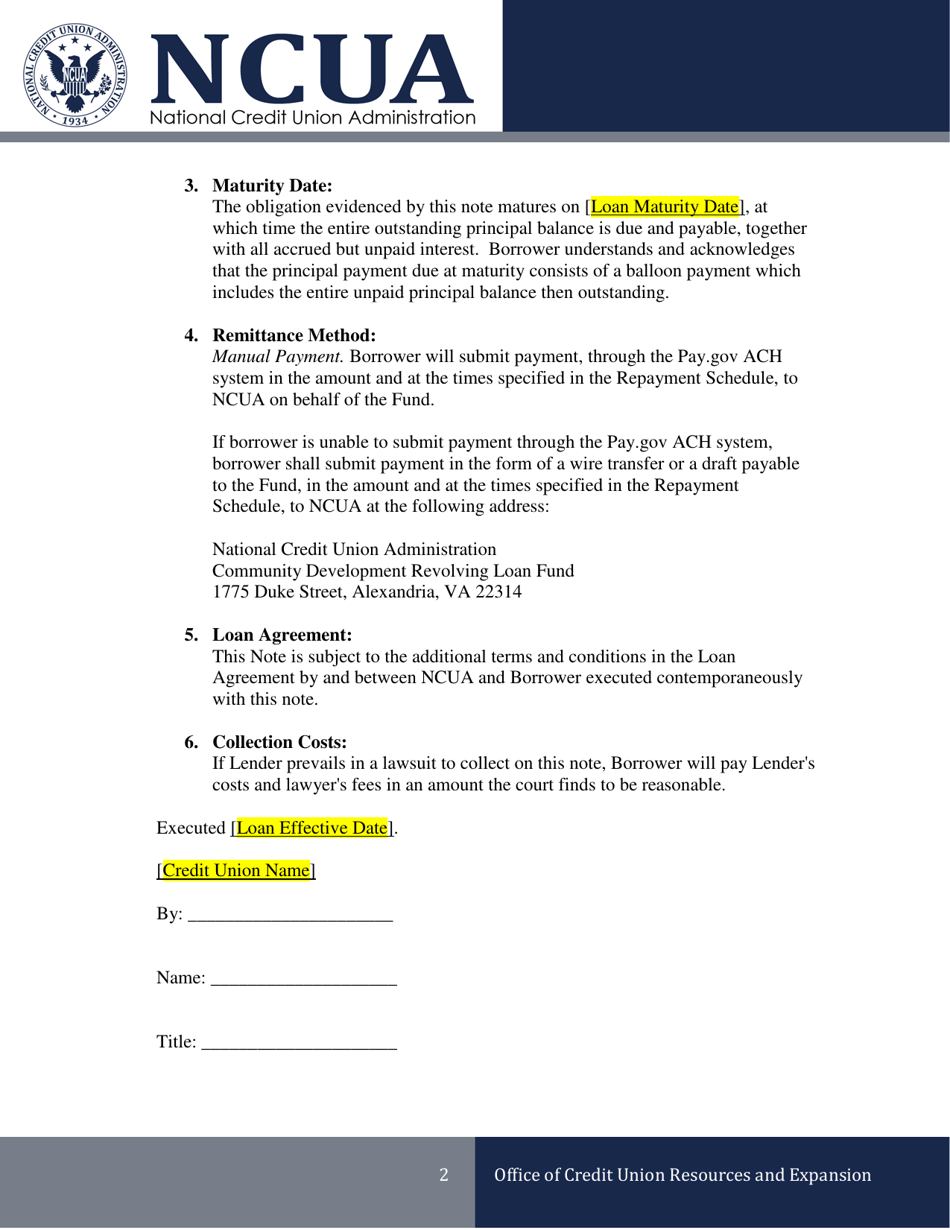

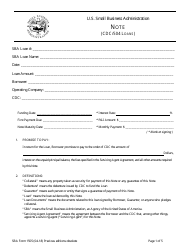

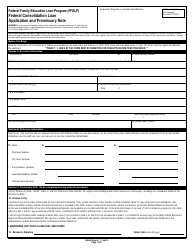

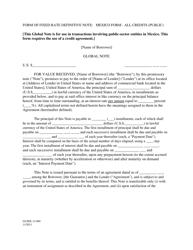

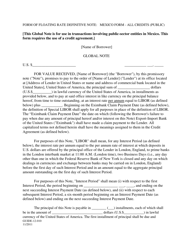

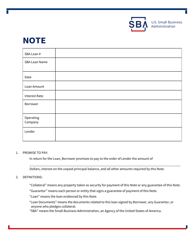

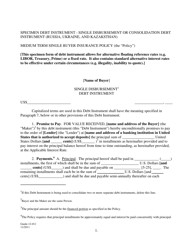

Example Loan Promissory Note

Example Loan Promissory Note is a 2-page legal document that was released by the National Credit Union Administration and used nation-wide.

FAQ

Q: What is a Loan Promissory Note?

A: A Loan Promissory Note is a legal document that outlines the details of a loan agreement between a lender and a borrower.

Q: What information is included in a Loan Promissory Note?

A: A Loan Promissory Note typically includes the names of the lender and borrower, the loan amount, interest rate, repayment terms, and any late fees or penalties.

Q: Is a Loan Promissory Note legally binding?

A: Yes, a Loan Promissory Note is a legally binding document that both the lender and borrower must adhere to.

Q: What happens if the borrower fails to repay the loan according to the terms of the Promissory Note?

A: If the borrower fails to repay the loan as agreed, the lender may take legal action to recover the outstanding amount, which may include filing a lawsuit or hiring a collection agency.

Q: Can the terms of a Loan Promissory Note be modified?

A: Yes, the terms of a Loan Promissory Note can be modified if both the lender and borrower agree to the changes in writing.

Q: Are there any consequences for prepaying a loan before the specified term?

A: Some Loan Promissory Notes may include penalties or fees for prepaying the loan before the specified term. It is important to review the terms of the Note to understand any such consequences.

Q: Can a Loan Promissory Note be used for personal loans?

A: Yes, a Loan Promissory Note can be used for personal loans, as well as business loans and other types of loans.

Form Details:

- The latest edition currently provided by the National Credit Union Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.