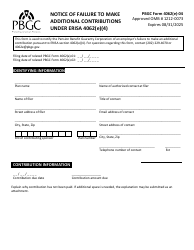

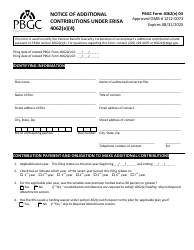

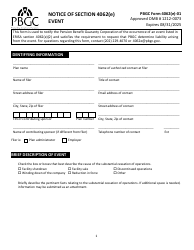

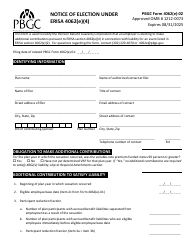

Instructions for PBGC Form 200 Notice of Failure to Make Required Contributions

This document contains official instructions for PBGC Form 200 , Notice of Failure to Make Required Contributions - a form released and collected by the U.S. Pension Benefit Guaranty Corporation. An up-to-date fillable PBGC Form 200 is available for download through this link.

FAQ

Q: What is PBGC?

A: PBGC stands for Pension Benefit Guaranty Corporation. It is a federal agency that protects the pensions of employees in private sectordefined benefit plans.

Q: What is Form 200?

A: Form 200 is the Notice of Failure to Make Required Contributions. It is a form that employers must file with the PBGC to report a failure to make required contributions to their pension plans.

Q: Who needs to file Form 200?

A: Employers with defined benefit pension plans who have failed to make required contributions need to file Form 200.

Q: What happens if an employer fails to file Form 200?

A: If an employer fails to file Form 200, they may be subject to penalties and other enforcement actions by the PBGC.

Q: Is there a deadline for filing Form 200?

A: Yes, there is a deadline for filing Form 200. The form must be filed within 30 days after the missed contribution deadline.

Q: Are there any fees associated with filing Form 200?

A: No, there are no fees associated with filing Form 200.

Q: Can I submit Form 200 electronically?

A: Yes, you can submit Form 200 electronically through the PBGC's e-filing system.

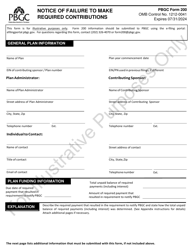

Q: What information do I need to include in Form 200?

A: You need to include information about the missed contributions, the amounts involved, and the efforts made to correct the failure.

Q: What should I do if I need help with filling out Form 200?

A: If you need help with filling out Form 200, you can contact the PBGC's Employer Customer Service at 1-800-736-2444.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Pension Benefit Guaranty Corporation.