This version of the form is not currently in use and is provided for reference only. Download this version of

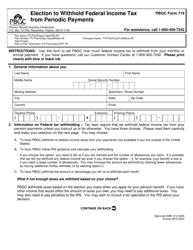

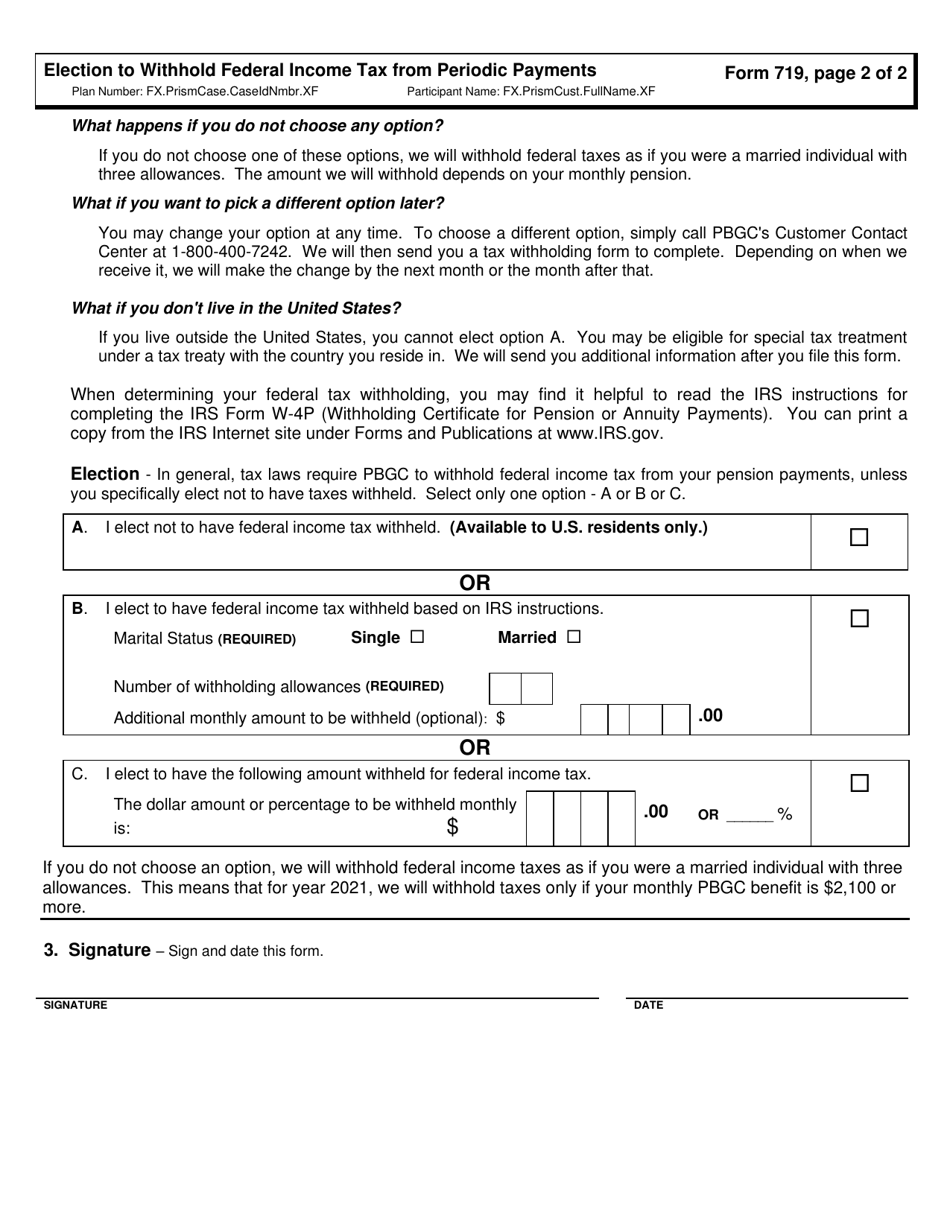

PBGC Form 719

for the current year.

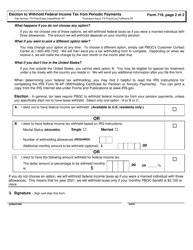

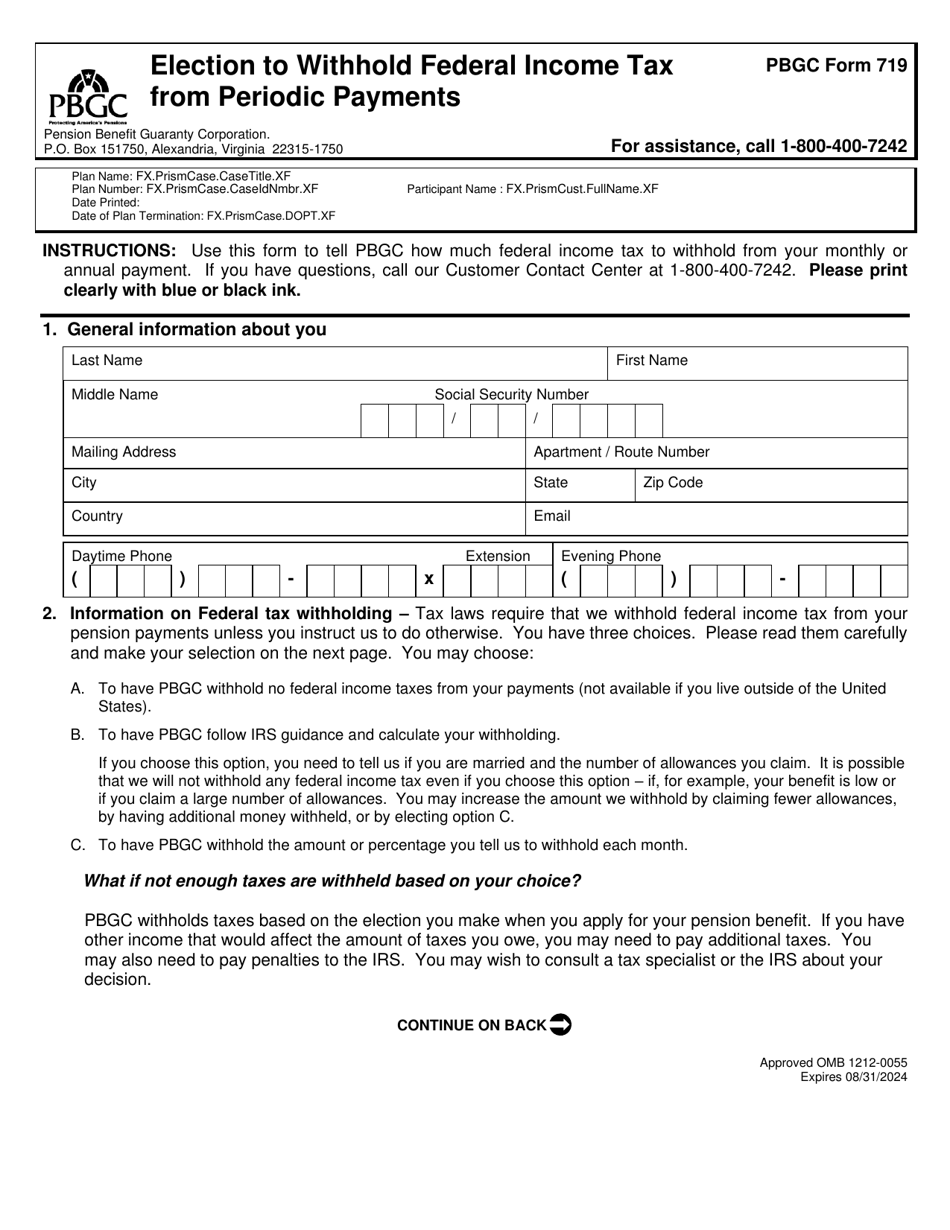

PBGC Form 719 Election to Withhold Federal Income Tax From Periodic Payments

What Is PBGC Form 719?

This is a legal form that was released by the U.S. Pension Benefit Guaranty Corporation and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PBGC Form 719?

A: PBGC Form 719 is a form used to elect to withhold federal income tax from periodic payments.

Q: Who is required to fill out PBGC Form 719?

A: Individuals receiving pension payments from the Pension Benefit Guaranty Corporation (PBGC) may be required to fill out this form.

Q: What is the purpose of withholding federal income tax from periodic payments?

A: Withholding federal income tax from periodic payments ensures that taxes are paid regularly throughout the year, rather than in a lump sum at the end of the year.

Q: Are all pension payments subject to withholding?

A: No, not all pension payments are subject to withholding. It depends on the specific circumstances and tax rules.

Form Details:

- The latest available edition released by the U.S. Pension Benefit Guaranty Corporation;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of PBGC Form 719 by clicking the link below or browse more documents and templates provided by the U.S. Pension Benefit Guaranty Corporation.